Pound Sterling edges lower after mixed start to the week

- The Pound Sterling edges lower in its key pairs on Monday.

- From a technical perspective, GBP/USD is pulling back within an established short-term uptrend.

The Pound Sterling (GBP) trades marginally lower in its most heavily traded pairs on Monday after a mixed start and despite the run of positive economic data out of the UK of late.

Pound Sterling mixed but resilient after string of positive data

The Pound Sterling is trading lower at the start of the new week. Recent assessments of the UK economy have been mostly positive, with some economists describing it as striking a “Goldilocks” balance between “not too cold” and “not too hot”.

Headline Inflation is hovering around the Bank of England’s (BoE) 2.0% target, and Services inflation – which thus far has remained particularly high – fell to 5.2% in July from 5.7% previously, working its way back to a long-run average of around 3.5%.

UK Retail Sales data last week showed a rebound in July of 0.5% from a negative 0.9% in June. The Unemployment Rate fell to 4.2% in Q2 from 4.4% in Q1, and Gross Domestic Product (GDP) rose 0.9% from 0.3% over the same period.

Lower headline inflation and easing in stubbornly high Services inflation led the BoE to cut interest rates at its August meeting to 5.00% from 5.25%. Lower interest rates tend to depress GBP’s value by reducing foreign capital inflows. Market-based gauges of whether interest rates will fall any further are giving a slightly lower than 50% probability of a further 0.25% cut in September. Economists at Capital Economics expect a total of two more 0.25% cuts before the end of the year.

Sterling higher versus the USD but falls against JPY

Against the US Dollar, GBP is flat, trading in the 1.2940s on Monday after a strong start. GBP/USD traded higher due to broad-based USD weakness, following comments from the President of the Federal Reserve (Fed) Bank of Chicago Austan Goolsbee on Friday, who said that the US labor market and some other leading economic indicators were “flashing warning signs” including rising levels of credit card delinquencies. His words reawakened recession concerns, weighing on the US currency.

EUR/GBP is seesawing between tepid gains and losses with little new information or data to drive either of the currencies in the pair.

The Pound is falling against the Japanese Yen (JPY) after data out of Japan late Sunday evening showed Machinery Orders in Japan rebounding by a stronger-than-expected 2.1% MoM in June after registering a 3.2% decline in the previous month.

Japanese 10-year Government Bond yields rose to 0.9% following the data, helping to support the Yen to which they are highly correlated. The JPY had already been rallying after Japanese GDP data out last week surprised to the upside, showing the economy expanded 0.8% QoQ in Q2, reversing the 0.6% contraction in Q1 and beating expectations of 0.5%.

The Bank of Japan (BoJ) also surprised markets in July after deciding to raise interest rates from a 0.0% -0.10% band to 0.25% due to increasing inflationary pressures. This comes after successful spring wage negotiations gave workers more disposable income. The expectation is that the BoJ will raise rates even higher before the end of the year.

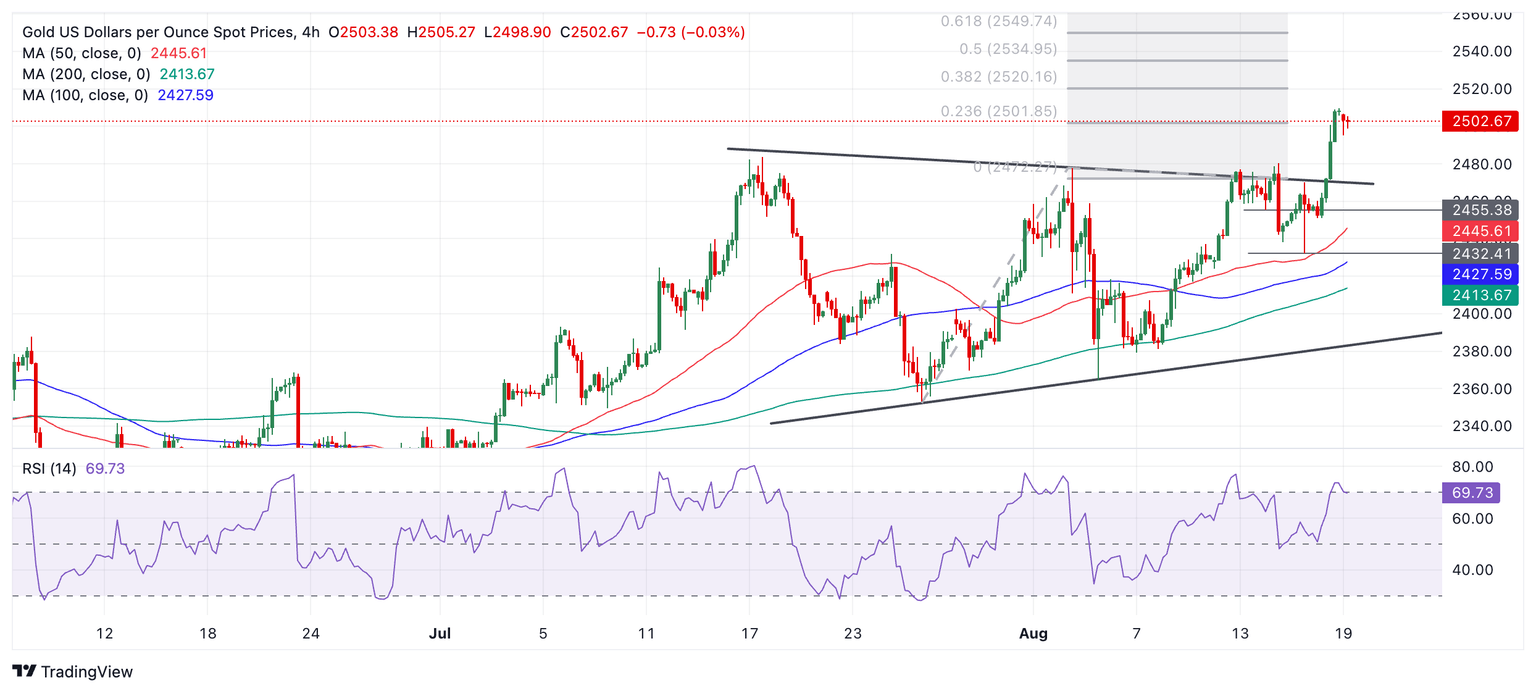

Technical Analysis: GBP/USD continues short-term rally

GBP/USD pulls back within a short-term uptrend, however, given “the trend is your friend” it is biased to resume its uptrend eventually.

GBP/USD 4-hour Chart

GBP/USD will probably eventually extend higher to the next target at 1.3042 (July 17 high).

The Relative Strength Index (RSI) has risen into the overbought zone, indicating an increasing risk the pair could pull back. Former highs at 1.2940 could provide a support level for any pull back that materializes. The round number of 1.2900 is another level the pair might fall to in the event of a correction.

The medium and longer-term trends remain opaque and more “sideways” than directional, with price action trapped in the range between 1.2300 and 1.3042 since November 2023.

Economic Indicator

Gross Domestic Product (QoQ)

The Gross Domestic Product (GDP), released by the Office for National Statistics on a monthly and quarterly basis, is a measure of the total value of all goods and services produced in the UK during a given period. The GDP is considered as the main measure of UK economic activity. The QoQ reading compares economic activity in the reference quarter to the previous quarter. Generally, a rise in this indicator is bullish for the Pound Sterling (GBP), while a low reading is seen as bearish.

Read more.Last release: Thu Aug 15, 2024 06:00 (Prel)

Frequency: Quarterly

Actual: 0.6%

Consensus: 0.6%

Previous: 0.7%

Source: Office for National Statistics

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.