Pound Sterling drops against USD after hot US PPI data

- The Pound Sterling ticks lower, but the assumption that the BoE will keep interest rates steady on December 19 keeps its broader outlook firm.

- Traders expect the BoE to cut interest rates at a slower pace when compared to other central banks in Europe and North America..

- Markets fully price in that the Fed will cut interest rates by 25 bps on Wednesday.

The Pound Sterling (GBP) surrenders gains and turns negative against the US Dollar (USD) in Thursday’s North American session. The GBP/USD pair declines to near 1.2720 as the US Dollar (USD) recovers losses, with the US Dollar Index (DXY) rising to near 106.70.

The Greenback gains after the release of the United States (US) Producer Price Index (PPI) data for November, which showed producer inflation rose faster-than-expected. The report showed that the headline PPI accelerated to 3%, faster than estimates and the prior release of 2.6%. The core PPI – which excludes volatile food and energy prices – rose by 3.4%, faster than estimates of 3.2% and the prior release of 3.1%. A sharp growth in producer inflation is unlikely to weigh on market expectations that the Federal Reserve (Fed) will cut interest rates in the monetary policy announcement on Wednesday.

Traders fully priced in an interest rate reduction of 25 basis points (bps) to 4.25%-4.50% by the Fed for next week’s policy meeting, according to the CME FedWatch tool. Fed dovish bets strengthened after the release of the US Consumer Price Index (CPI) report for November on Wednesday, which showed that inflationary pressures grew in line with estimates.

Meanwhile, Initial Jobless Claims data for the week ending December 6 have come in surprisingly higher-than-expected. Individuals claiming jobless benefits for the first time were 242K, higher than estimates of 220K and the prior release of 225K.

Daily digest market movers: Pound Sterling drops while its broader outlook remains firm

- The Pound Sterling ticks lower against its major peers on Thursday ahead of the United Kingdom's (UK) monthly Gross Domestic Product (GDP) and the factory data for October, which will be released on Friday. The data will indicate the current status of the nation's economic health.

- The British currency remains broadly firm against its major counterparts due to expectations that the Bank of England (BoE) will follow a more gradual policy-easing cycle compared with other central banks in Europe and North America.

- Inflation in the United Kingdom (UK) services sector remains high, allowing the BoE to remain in a slow lane towards interest rate cuts. BoE Monetary Policy Committee (MPC) external member Megan Greene warned in her latest commentary that she suspects the BoE’s inflation target “by the end of our forecast period, which is three years.”

- Signs of more government expenditure and higher employer costs in Labour’s first budget have also escalated uncertainty over the inflation outlook. UK employers are expected to pass on the impact of higher employers’ contribution to National Insurance to consumers.

- Market expectations that the BoE will cut interest rates at a moderate pace have also kept the Pound Sterling strong against the US Dollar this year, unlike other European currencies such as the Euro (EUR) and the Swiss Franc (CHF), which are down 4.9% and 5.5%, respectively.

- For the BoE policy meeting announcement on December 19, traders see the central bank leaving interest rates unchanged at 4.75%, but price in three interest rate cuts in 2025.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.10% | 0.06% | -0.24% | -0.05% | -0.50% | -0.16% | 0.29% | |

| EUR | 0.10% | 0.15% | -0.14% | 0.04% | -0.40% | -0.07% | 0.40% | |

| GBP | -0.06% | -0.15% | -0.29% | -0.11% | -0.55% | -0.22% | 0.23% | |

| JPY | 0.24% | 0.14% | 0.29% | 0.19% | -0.26% | 0.05% | 0.53% | |

| CAD | 0.05% | -0.04% | 0.11% | -0.19% | -0.44% | -0.11% | 0.34% | |

| AUD | 0.50% | 0.40% | 0.55% | 0.26% | 0.44% | 0.34% | 0.79% | |

| NZD | 0.16% | 0.07% | 0.22% | -0.05% | 0.11% | -0.34% | 0.45% | |

| CHF | -0.29% | -0.40% | -0.23% | -0.53% | -0.34% | -0.79% | -0.45% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

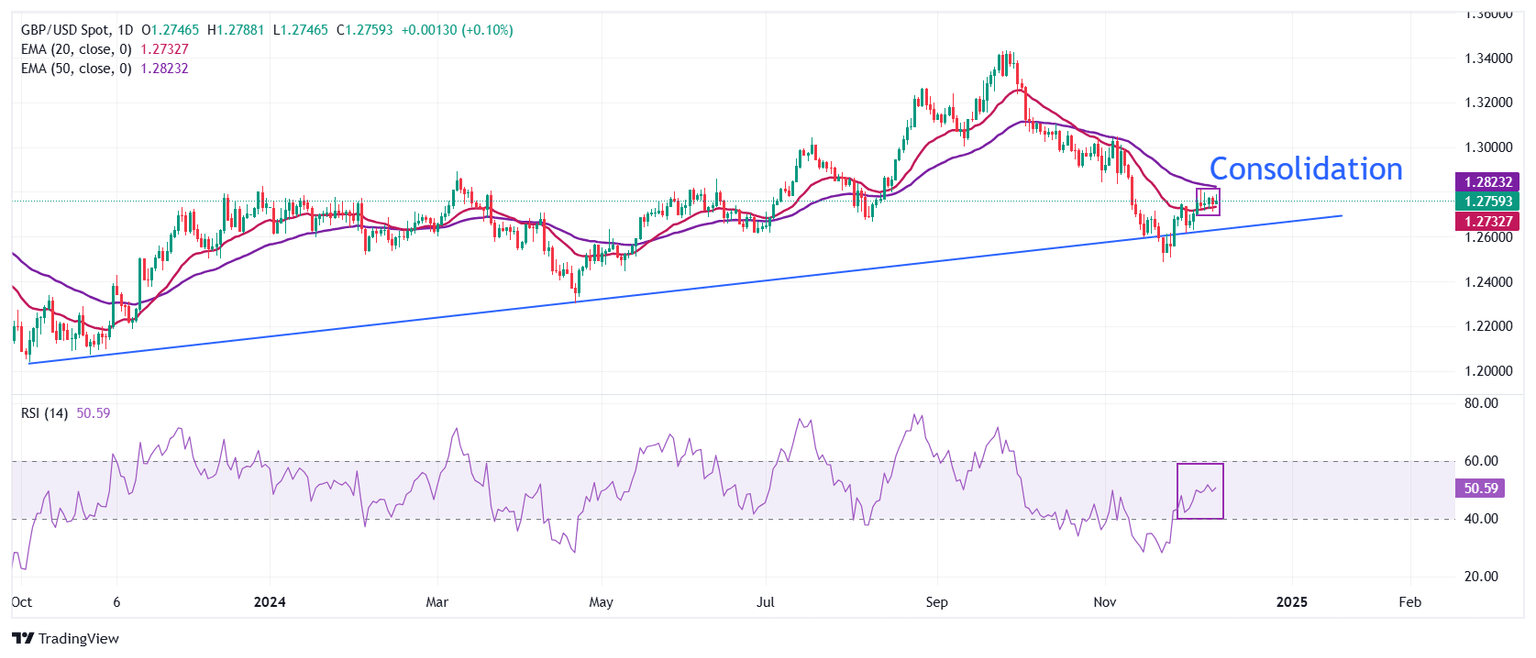

Technical Analysis: Pound Sterling wobbles around 20-day EMA

The Pound Sterling consolidates in a tight range around 1.2750 against the US Dollar for almost a week. The GBP/USD pair holds slightly above the 20-day Exponential Moving Average (EMA) around 1.2720.

The 14-day Relative Strength Index (RSI) oscillates in the 40.00-60.00 range, suggesting a sideways trend.

Looking down, the pair is expected to find a cushion near the upward-sloping trendline around 1.2500, which is plotted from the October 2023 low near 1.2035. On the upside, the 200-day EMA around 1.2830 will act as key resistance.

Economic Indicator

Gross Domestic Product (MoM)

The Gross Domestic Product (GDP), released by the Office for National Statistics on a monthly and quarterly basis, is a measure of the total value of all goods and services produced in the UK during a given period. The GDP is considered as the main measure of UK economic activity. The MoM reading compares economic activity in the reference month to the previous month. Generally, a rise in this indicator is bullish for the Pound Sterling (GBP), while a low reading is seen as bearish.

Read more.Next release: Fri Dec 13, 2024 07:00

Frequency: Monthly

Consensus: 0.1%

Previous: -0.1%

Source: Office for National Statistics

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.