Pound Sterling recovers some losses as BoE refrains from aggressive easing cycle

- The Pound Sterling falls to near 1.2770 against the US Dollar after BoE's dovish policy decision.

- The BoE cut interest rates by 25 bps to 5%, with a 5-4 vote split, as expected.

- The US Dollar struggles to hold recovery due to weak US ISM Manufacturing PMI in July.

The Pound Sterling (GBP) recovers some of its losses but still remains negative against its major peers in Thursday’s New York session. The British currency bounces gradually as the Bank of England (BoE) avoids endorsing an aggressive policy-easing stance on interest rates ahead. BoE Governor Andrew Bailey said in the press conference, "We need to make sure inflation stays low, and be careful not to cut interest rates too quickly or by too much." On the United Kingdom's (UK) service inflation outlook, Bailey commented, "Services price inflation may rise slightly in August before easing in the rest of the year."

Earlier, the BoE has cut its key borrowing rates by 25 basis points (bps) to 5%, with a 5-4 majority in the Monetary Policy Committee (MPC) vote, which was also in line with market expectations. Policymakers who voted for a rate cut were Andrew Bailey, Sarah Breeden, Swati Dhingra, Dave Ramsden, and Clare Lombardelli.

BoE's latest forecast report for the year-end shows that the bank rate will be at 4.9%, higher from May's forecast of 4.8%. This suggests that there will be no more rate cuts this year. The bank sees wage growth momentum at 5%, which is similar to prior projections.

Meanwhile, investors await Andrew Bailey's speech to get more cues about the interest rate guidance and the impact of Labor's fiscal policies on inflation and the economy.

Daily digest market movers: Pound Sterling weakens while US Dollar struggles to hold gains

- The Pound Sterling slides further and posts a fresh three-week low to near 1.2770 against the US Dollar (USD) in Thursday’s American session. The GBP/USD pair weakened after breaking below the three-day consolidation range as the US Dollar (USD) rises even though the Federal Reserve (Fed) has delivered dovish guidance on interest rates in its monetary policy announcement on Wednesday.

- The Fed left interest rates unchanged in the range of 5.25%-5.50% for the eighth consecutive meeting and acknowledged that moderation in inflationary pressures in the second quarter had increased their confidence that rate cuts could be on the table in the September meeting. The Fed admitted that risks are now widened to both aspects of dual mandate.

- Fed’s Chair Jerome Powell said, "If we were to see inflation moving down more or less in line with expectations, growth remains reasonably strong, and the labor market remains consistent with current conditions, then I think a rate cut could be on the table at the September meeting”, Reuters reported.

- The US Dollar has bounced back strongly after a Fed policy-inspired sell-off but struggles to hold gains due to weak United States (US) ISM Manufacturing Purchasing Managers’ Index (PMI) report for July. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, moves higher to near 104.20 from its intraday low of 103.86.

- The PMI report showed that activities in the manufacturing sector contracted to 46.8. The Manufacturing PMI was expected to contract but at a slower pace to 48.8 from the former reading of 48.5.

Pound Sterling Price Today:

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.25% | 0.37% | 0.21% | 0.13% | 0.02% | -0.28% | -0.39% | |

| EUR | -0.25% | 0.12% | -0.06% | -0.14% | -0.23% | -0.53% | -0.64% | |

| GBP | -0.37% | -0.12% | -0.17% | -0.25% | -0.35% | -0.65% | -0.76% | |

| JPY | -0.21% | 0.06% | 0.17% | -0.10% | -0.20% | -0.55% | -0.64% | |

| CAD | -0.13% | 0.14% | 0.25% | 0.10% | -0.10% | -0.40% | -0.51% | |

| AUD | -0.02% | 0.23% | 0.35% | 0.20% | 0.10% | -0.29% | -0.41% | |

| NZD | 0.28% | 0.53% | 0.65% | 0.55% | 0.40% | 0.29% | -0.11% | |

| CHF | 0.39% | 0.64% | 0.76% | 0.64% | 0.51% | 0.41% | 0.11% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

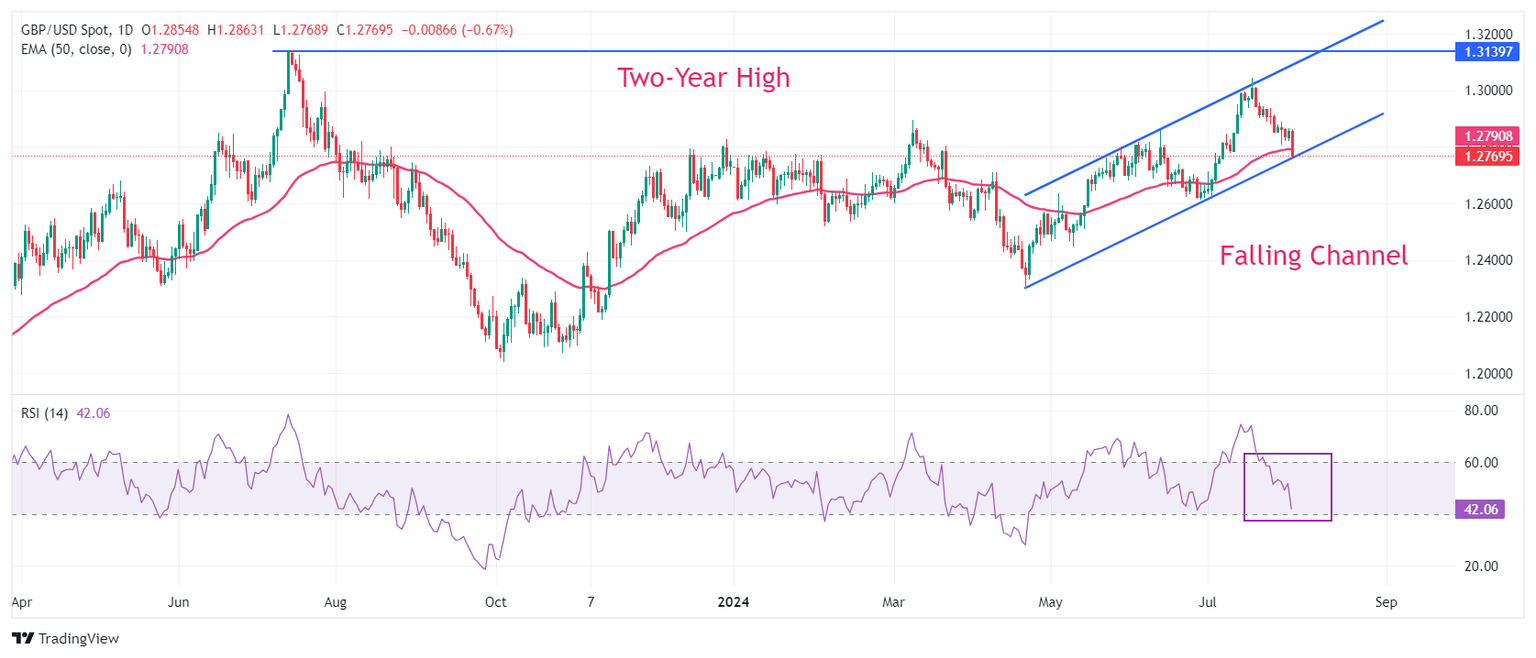

Technical Analysis: Pound Sterling declines to lower boundary of Rising Channel

The Pound Sterling declines to near the lower boundary of a Rising Channel chart pattern on a daily timeframe. The GBP/USD pair fell on the backfoot after breaking below the crucial support of 1.2900. The Cable dives below the 50-day Exponential Moving Average (EMA) near 1.2790, suggesting that the near-term trend has become bearish.

The 14-day Relative Strength Index (RSI) declines toward 40.00, which would a be cushion for the momentum oscillator.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.