Pound Sterling declines toward 1.2600 as weak UK PMI weighs on economic outlook

- The Pound Sterling drops as dismal market mood and poor UK PMI weaken the impact of upbeat Retail Sales.

- Strong UK Retail Sales could weigh on BoE rate-cut hopes for August.

- Preliminary US S&P PMI surprisingly outperforms expectations.

The Pound Sterling (GBP) remains on the back foot in Friday’s American session against the majority of currencies except for the Euro, in the aftermath of strong United Kingdom (UK) Retail Sales data for May and weak preliminary S&P Global/CIPS data for June. The UK Office for National Statistics (ONS) reported stronger-than-expected Retail Sales data for May. The report showed that monthly Retail Sales rebounded, growing at a robust 2.9%, more than the 1.5% expected. On year, Retail Sales surprisingly rose by 1.3% while investors expected them to have declined by 0.9%.

Retail Sales are an indicator measuring consumer spending, which accounts for a major part of economic growth. A significant improvement in sales at retail stores despite the Bank of England's (BoE) maintaining higher interest rates indicates strong demand but also increasing price pressures in the pipeline. This, if sustained, could be a headache for the BoE, which is focusing on achieving price stability.

On Thursday, the BoE kept interest rates steady at 5.25% in a 7-2 vote split, as expected. BoE policymakers acknowledged the return of headline inflation to the bank’s target of 2% in three years but said that won’t be enough as price pressures in the service sector are still too high. Currently, financial markets expect that the BoE will start reducing interest rates in August, which means there will be no rate cuts before the parliamentary elections. Pre-election polls show the Conservative Party of Prime Minister Rishi Sunak is behind the opposition Labour Party by around 20 points, Reuters reports.

Meanwhile, the S&P Global/CIPS PMI report showed that the Composite PMI surprisingly dropped to 51.7 but holds the 50.0 threshold. Economists forecasted the overall PMI to deliver a slight improvement to 53.1 from the prior release of 53.0. The PMIs were down due to slower growth in the Services PMI. However, the Manufacturing PMI expanded at a better pace than estimates and the former release. The agency reported, "The slowdown in part reflects uncertainty around the business environment in the lead-up to the general election, with many firms seeing a hiatus in decision-making pending clarity on various policies."

Daily digest market movers: Pound Sterling faces more pressure on upbeat US PMI report

- The Pound Sterling weakens against the US Dollar (USD). The GBP/USD pair falls as the upbeat US Dollar (USD) has dampened market sentiment. The US Dollar strengthens as the S&P Global has reported a strong preliminary US PMI report for June. The report showed that the Composite PMI surprisingly jumped to 51.7. Investors expected the PMI data to decline to 51.0 from the prior release of 51.3.

- The report said, "The PMI is running at a level broadly consistent with the economy growing at an annualized rate of just under 2.5%. The upturn is broad-based, as rising demand continues to filter through the economy. Although led by the service sector, reflecting strong domestic spending, the expansion is being supported by an ongoing recovery in manufacturing, which so far this year is enjoying its best growth spell for two years."

- The US Dollar was already exhibiting a strong performance as Federal Reserve (Fed) policymakers continue to argue in favor of one rate cut this year. Officials say they want to see inflation declining for months before lowering interest rates.

- Contrary to policymakers' projections, investors see the Fed reducing interest rates twice this year. Also, expectations for the Fed to begin lowering its key borrowing rates from September have increased due to the recent decline in the United States (US) inflation and Retail Sales data for May. According to the CME FedWatch tool, 30-day Fed Fund Futures pricing data shows a 64% chance for rate cuts in September.

Pound Sterling Price Today:

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.09% | 0.00% | -0.06% | -0.01% | -0.04% | -0.14% | 0.05% | |

| EUR | -0.09% | -0.09% | -0.15% | -0.09% | -0.11% | -0.22% | -0.05% | |

| GBP | -0.00% | 0.09% | -0.08% | -0.02% | -0.03% | -0.15% | 0.06% | |

| JPY | 0.06% | 0.15% | 0.08% | 0.05% | 0.03% | -0.08% | 0.15% | |

| CAD | 0.01% | 0.09% | 0.02% | -0.05% | -0.04% | -0.15% | 0.07% | |

| AUD | 0.04% | 0.11% | 0.03% | -0.03% | 0.04% | -0.13% | 0.09% | |

| NZD | 0.14% | 0.22% | 0.15% | 0.08% | 0.15% | 0.13% | 0.21% | |

| CHF | -0.05% | 0.05% | -0.06% | -0.15% | -0.07% | -0.09% | -0.21% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

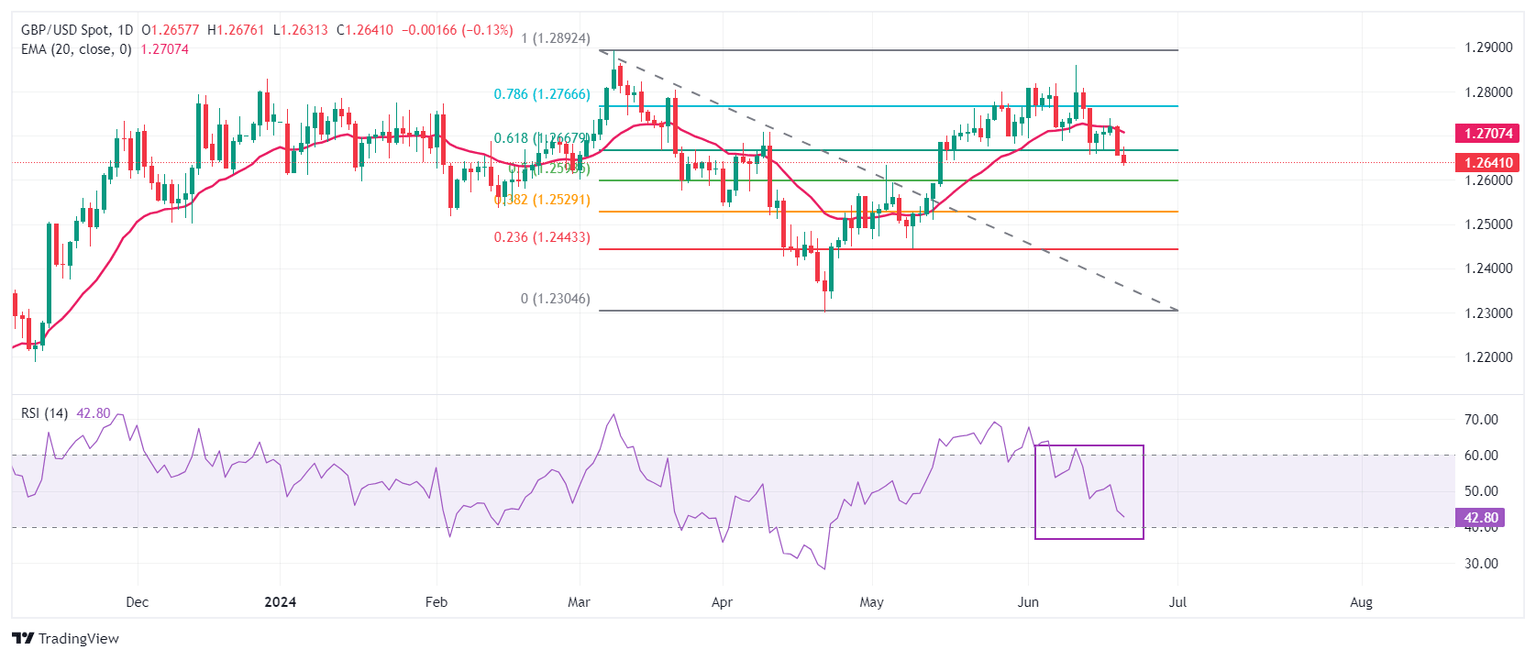

Technical Analysis: Pound Sterling falls below 61.8% Fibo retracement support

The Pound Sterling slips to near 1.2630 after the release of the upbeat UK Retail Sales data for May and preliminary weak S&P Global/CIPS data for June. However, the near-term appeal is uncertain as the GBP/USD pair is below the 20-day and 50-day Exponential Moving Averages (EMAs), which trade around 1.2700 and 1.2670, respectively.

The Cable struggles to hold the 61.8% Fibonacci retracement support at 1.2667, plotted from the March 8 high of 1.2900 to the April 22 low at 1.2300.

The 14-period Relative Strength Index (RSI) falls back into the 40.00-60.00 range, indicating that the upside momentum has faded.

Economic Indicator

S&P Global Composite PMI

The S&P Global Composite Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging US private-business activity in the manufacturing and services sector. The data is derived from surveys to senior executives. Each response is weighted according to the size of the company and its contribution to total manufacturing or services output accounted for by the sub-sector to which that company belongs. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. The index varies between 0 and 100, with levels of 50.0 signaling no change over the previous month. A reading above 50 indicates that the private economy is generally expanding, a bullish sign for the US Dollar (USD). Meanwhile, a reading below 50 signals that activity is generally declining, which is seen as bearish for USD.

Read more.Last release: Fri Jun 21, 2024 13:45 (Prel)

Frequency: Monthly

Actual: 54.6

Consensus: -

Previous: 54.5

Source: S&P Global

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.