Pound Sterling resumed its downside against the US Dollar

GBP/USD Forecast: Pound Sterling could correct higher on improving risk mood

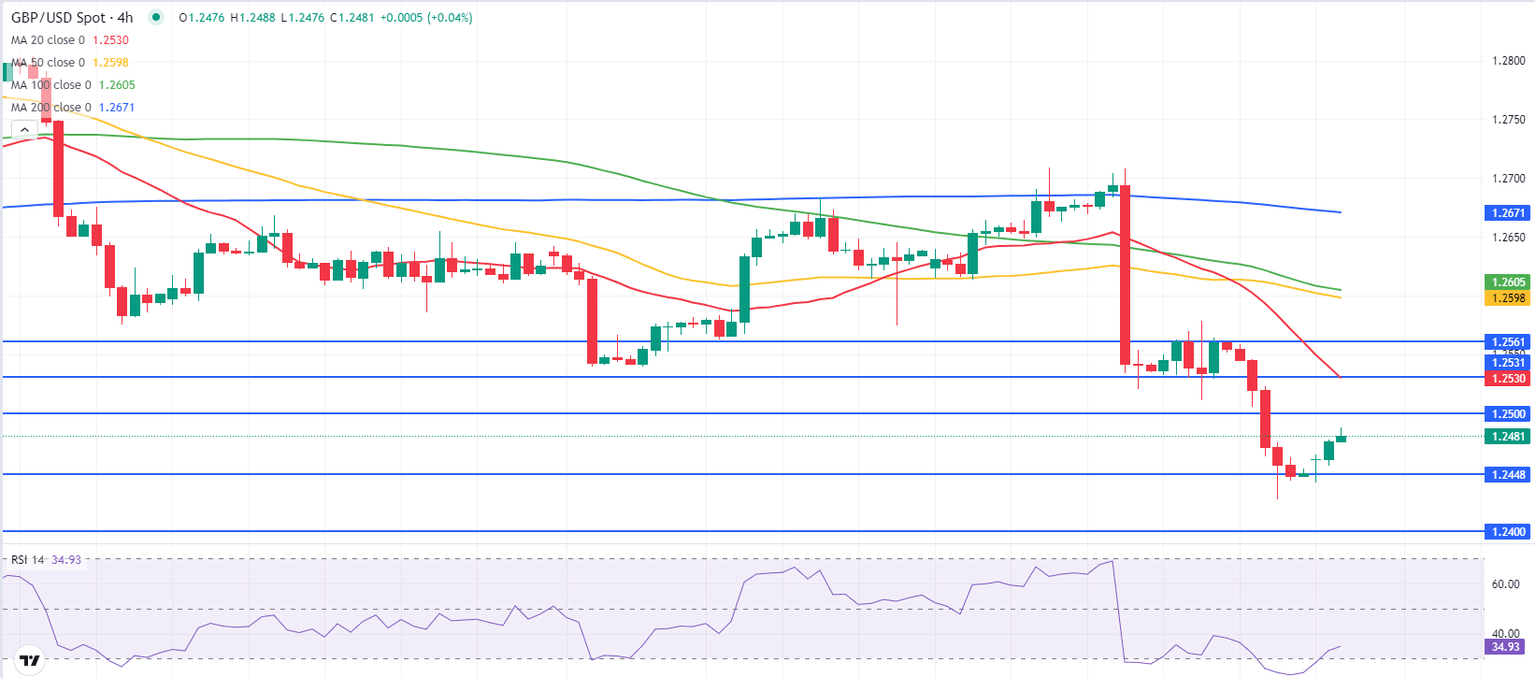

GBP/USD staged a rebound early Monday and advanced above 1.2450 after slumping to its lowest level since November at 1.2426 ahead of the weekend. The technical outlook suggests that the bearish bias remains intact but a de-escalation of geopolitical tensions could help the pair extend its recovery.

Investors sought refuge ahead of the weekend on reports of Iran preparing an attack on Israel in retaliation to the suspected Israeli attack on Iran’s consulate in Damascus on April 1. In turn, the US Dollar capitalized on safe-haven flows, triggering a sharp decline in GBP/USD in the late American session. Read more...

GBP/USD Weekly Forecast: Is Pound Sterling set for more pain in the UK inflation week?

The Pound Sterling (GBP) resumed its downside against the US Dollar (USD), sending the GBP/USD pair to the lowest level in four months below 1.2500.

After witnessing a decent comeback in the first half of the week, GBP/USD sellers returned with a bang amid a resurgent demand for the US Dollar. Expectations surrounding the US Federal Reserve (Fed) policy pivot continued to play their part alongside heightened geopolitical tensions in the Middle East, helping the Greenback reach its highest level in five months against its major counterparts above 105.00. Read more...

GBP/USD on the radar this week

Sterling ended the week considerably lower against the US dollar, recording its largest one-week decline since July 2023 (-1.5%). In light of the slew of UK economic data on the docket this week—wages, CPI inflation and retail sales—this will be a particularly key market to monitor.

Price action on the monthly chart continues to seek deeper waters south of resistance at $1.2715. While one may argue that this chart is now in the early stages of an uptrend, the high (arrow) at $1.3142, located near the next layer of resistance at $1.3111, would likely need to be breached before a long-term uptrend can be confirmed with any conviction. As things stand, the monthly support level at $1.2173 is viewed as the next logical longer-term downside target for GBP bears in the longer term., Read more...

Author

FXStreet Team

FXStreet