GBP/USD Forecast: Pound Sterling needs to hold above 1.2360 for extended recovery

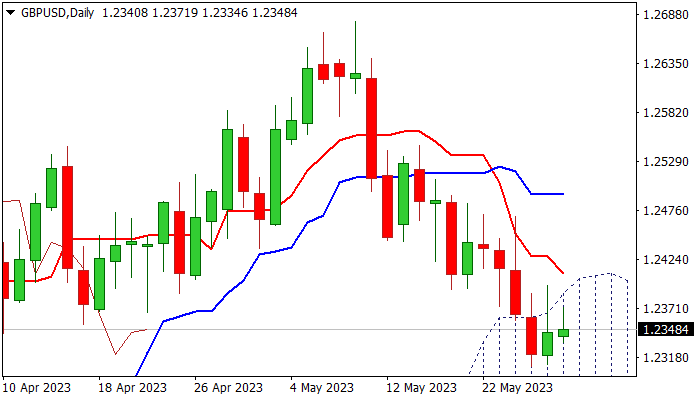

GBP/USD has started the new week in a quiet manner with the Spring Bank Holiday in the UK and the Memorial Day holiday in the US causing trading volumes to remain thin. The pair's near-term technical outlook shows that buyers remain on the sidelines but an extended correction could be observed once Pound Sterling stabilizes above 1.2360.

Hawkish Federal Reserve (Fed) bets provided a boost to the US Dollar (USD) last week and caused GBP/USD to lose nearly 100 pips. Ahead of the weekend, the US Bureau of Economic Analysis reported that the Core Personal Consumption Expenditures (PCE) Price Index, the Fed's favourite measure of inflation, inched higher to 4.7% on a yearly basis in April, compared to the market expectation of 4.6%. Read more ...

GBP/USD Price Analysis: Cable buyers approach 1.2400 resistance confluence

GBP/USD pares monthly losses, the first in three, around 1.2360 during early Monday as markets in the UK and the US are off for the Memorial Day holiday. In doing so, the Cable pair extends the previous day’s recovery from the last levels since early April as the US Dollar retreats from a multi-day high despite the Biden-McCarthy deal on debt ceiling extension.

That said, the below 50 levels of the RSI line, placed at 14, joins the 100-Exopnential Moving Average (EMA) to put a floor under the Pound Sterling pair around the 1.2300 round figure. Even so, the bearish MACD signals and the 1.2400 resistance confluence, including the 50-EMA and a two-week-old descending trend line, restrict immediate upside moves of the GBP/USD pair. Read more ...

GBP/USD outlook: Near-term action looks for clearer direction signal as daily studies are mixed

Cable is standing at the front foot at the start of the week, though recovery attempts were so far limited. Near-term action remains capped by the top of rising daily cloud for the third consecutive day, with strong upside rejection on Friday, signaling lack of strength for more significant recovery for now.

Signals on daily chart are mixed, as daily cloud top and formation of 10/55DMA bear cross (1.2404) weigh, while fading negative momentum and north-heading stochastic about break out of oversold zone, underpins. Read more ...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.