GBP/USD drops to one-week lows under 1.3875 amid a rally of USD

US dollar extends gains during the American session as US yields soar. Cable fails to hold to weekly gains, drops below 1.3900. The GBP/USD extended the decline to 1.3860, the lowest level in a week, on the back of a stronger US dollar across the board. The greenback started a rally after the release of the US official employment report that continues. NFP numbers came in above expectations and triggered a sell-off in Treasuries. Read more...

GBP/USD Weekly Forecast: Why Sterling is set to break higher after weathering negative factors

GBP/USD has rocked and rolled in response to the BOE and Nonfarm Payrolls. UK GDP, US inflation and covid headlines are set to shake cable in the upcoming week. Early August´s daily chart is painting a mixed picture. The FX Poll is showing a bullish trend on all timeframes. Resisting gravity and set to skyrocket? GBP/USD has weathered hawkish tunes from the Fed, strong US jobs and BOE caution. Can it move higher now? The next moves hinge on critical US inflation figures, Britain's covid advantage and UK growth data. Read more...

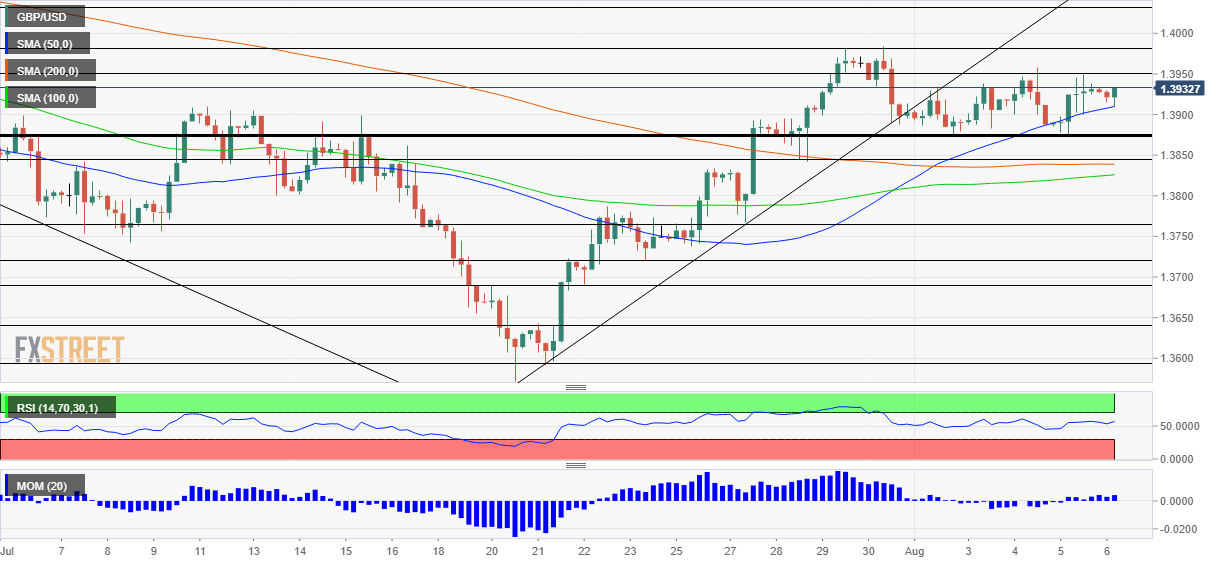

GBP/USD Forecast: Bailey bails sterling out, Nonfarm Payrolls may test critical support

GBP/USD has weathered dollar strength after the BOE took a hawkish step. US Nonfarm Payrolls are left, right and center for markets. Friday's four-hour chart is showing bulls are in control, and where critical support awaits. Tip-toeing toward tightening – the Bank of England has indicated it is ready to "modestly" change its monetary policy, and that has eventually proved to be positive for the pound. A bigger test is due now. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD gathers strength above 1.1350, bullish bias remains

The EUR/USD pair strengthens to around 1.1370 during the early European trading hours on Friday. Hopes for a trade deal between the United States and the European Union provide some support to the Euro. Trading volume is likely to be lightened on Good Friday.

GBP/USD hovers near six-month highs, 1.3300, eyes on US-UK trade discussions

GBP/USD continues its upward momentum from April 8, trading near 1.3280 during Friday's Asian session. The pair is buoyed by a weakening US Dollar, as concerns grow over the economic impact of tariffs on the United States.

Gold price loses momentum on profit-taking

Gold price holds steady on Friday after retreating from an all-time high of $3,358 as investors book profits during a long Easter weekend. Significant uncertainty over US President Donald Trump's tariffs on imports into the US and ongoing geopolitical tensions could underpin the Gold price.

How SEC-Ripple case and ETF prospects could shape XRP’s future

Ripple consolidated above the pivotal $2.00 level while trading at $2.05 at the time of writing on Friday, reflecting neutral sentiment across the crypto market.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.