Pound Sterling tumbles as BoE cuts interest rates by 25 bps to 5%

The Pound Sterling (GBP) faces a sharp selling pressure against its major peers in Thursday’s London session. The British currency weakens as the Bank of England (BoE) has cut its key borrowing rates by 25 basis points (bps) to 5%, as expected. The rate-cut move came with a 5-4 majority in the Monetary Policy Committee (MPC) vote, which was also in line with market expectations. Policymakers who voted for a rate cut were BoE Governor Andrew Bailey, Sarah Breeden, Swati Dhingra, Dave Ramsden, and Clare Lombardelli.

BoE's latest forecast report for the year-end shows that the bank rate will be at 4.9%, higher from May's forecast of 4.8%. This suggests that there will be no more rate cuts this year. The bank sees wage growth momentum at 5%, which is similar to prior projections. Read more...

GBP/USD under pressure as market anticipates Bank of England rate decision

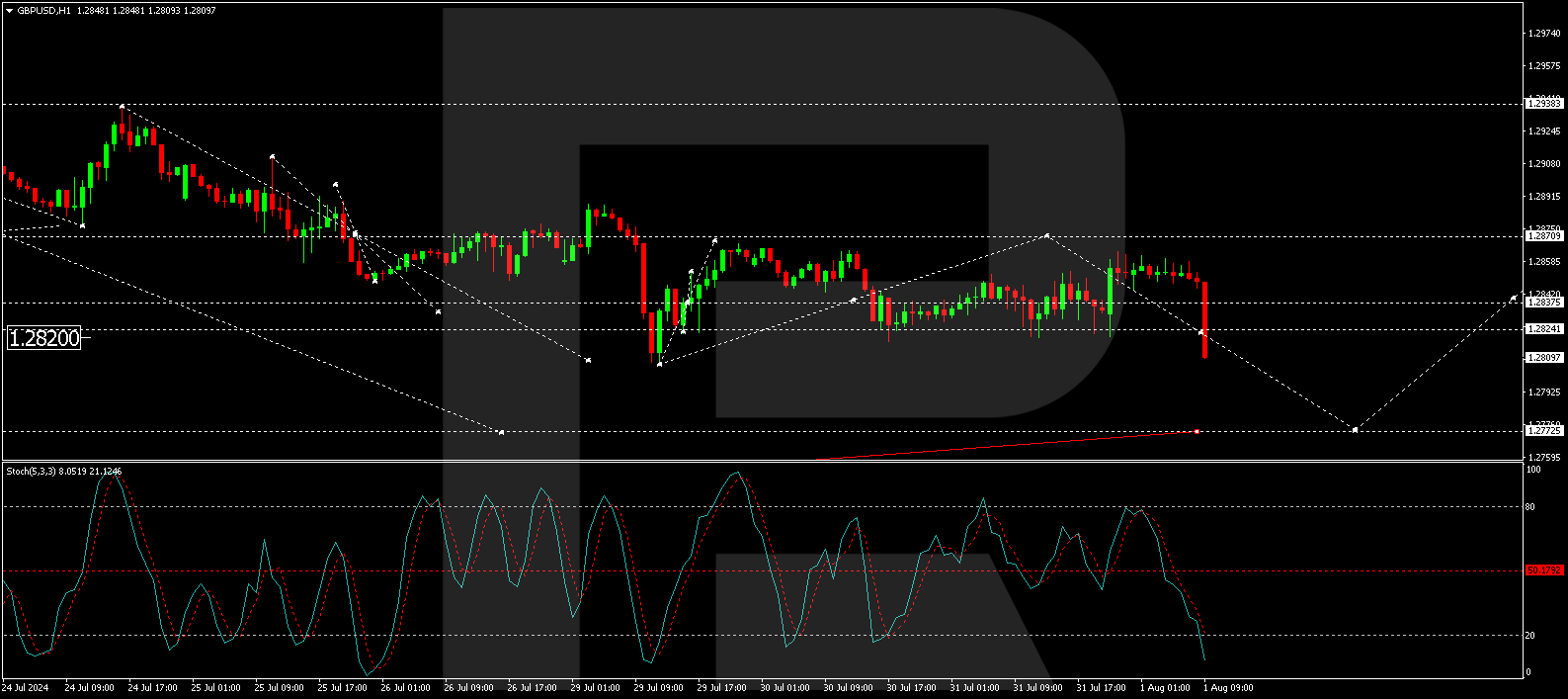

The British Pound Sterling continues to decline steadily against the US dollar. The GBP/USD pair is trending towards 1.2848. On the one hand, the pressure from the USD rate is evident. On the other hand, investors are awaiting the outcome of today's Bank of England meeting and its decision on interest rates.

There is speculation that the BoE will lower the interest rate from 5.25% to 5.00% today. The inflationary environment, coupled with the state of the employment market in the UK, supports this adjustment. The probability of a rate cut is currently estimated at 65%. Read more...

GBP/USD Forecast: Pound Sterling could rally with a BoE hold

After posting small gains on Wednesday, GBP/USD came under renewed bearish pressure and fell to its weakest level in three weeks below 1.2800 in the European morning on Thursday.

The US Dollar (USD) struggled to find demand in the American session on Wednesday and helped GBP/USD edge higher. The Federal Reserve (Fed) left its monetary policy settings unchanged as expected after the July meeting. In the post-meeting press conference, Fed Chairman Jerome Powell noted that there was a "real discussion" about the case for reducing rates at the meeting, adding that a rate cut could be on the table in September. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

GBP/USD recovers to 1.2800 area as markets assess BoE policy decisions

After falling to a multi-week low at 1.2750 on Bank of England's (BoE) decision to cut policy rate by 25 basis points, GBP/USD recovers toward 1.2800 on Thursday. BoE Governor Bailey's cautious comments on additional policy easing seem to be helping Pound Sterling find support.

EUR/USD stays near 1.0800, eyes on US PMI data

EUR/USD stays in negative territory at around 1.0800 in the second half of the day on Thursday. The data from the US showed that weekly Initial Jobless Claims rose to 249K from 235K, limiting the USD's gains and allowing the pair to find support ahead of US PMI data.

Gold holds near $2,450 as focus shifts to US data

After climbing to a two-week high near $2,460, Gold lost its bullish momentum and retreated to the $2,450 area. Following Wednesday's sharp decline, the 10-year US Treasury bond yield holds steady above 4%, not allowing XAU/USD to gather bullish momentum.

Crypto Today: Bitcoin holders accumulate without fear, Ethereum struggles while XRP holds gains steady

Bitcoin long-term holders have continued to accumulate BTC consistently in the last two months. Ethereum hovers around $3,100, struggles to make a comeback to resistance at $3,500.

Bank of England cuts rates and there are more to come this year

The Bank of England is staying tight-lipped on when it expects to cut rates again. But we think better news on services inflation and wage growth can unlock one, or more likely two rate cuts by year-end.