GBP/USD Forecast: Variant fears may end holiday calm and send sterling down

Enjoying the spring? The haze in London may keep British traders at home on a bank holiday, and that is not necessarily pound-positive. At the moment, markets are calm amid the long weekend in both the US and the UK, and after Friday's choppy trading, triggered by end-of-month adjustment.

Now that money managers have finished adjusting the portfolios, it is time to reexamine the fundamentals. People residing in the UK may enjoy the long weekend at home and in several European countries – but not in France nor Germany, where they are required to quarantine. These restrictions serve as a reminder of the B.1.167.2 variant. Sterling is on the back foot due to these fears. Read more...

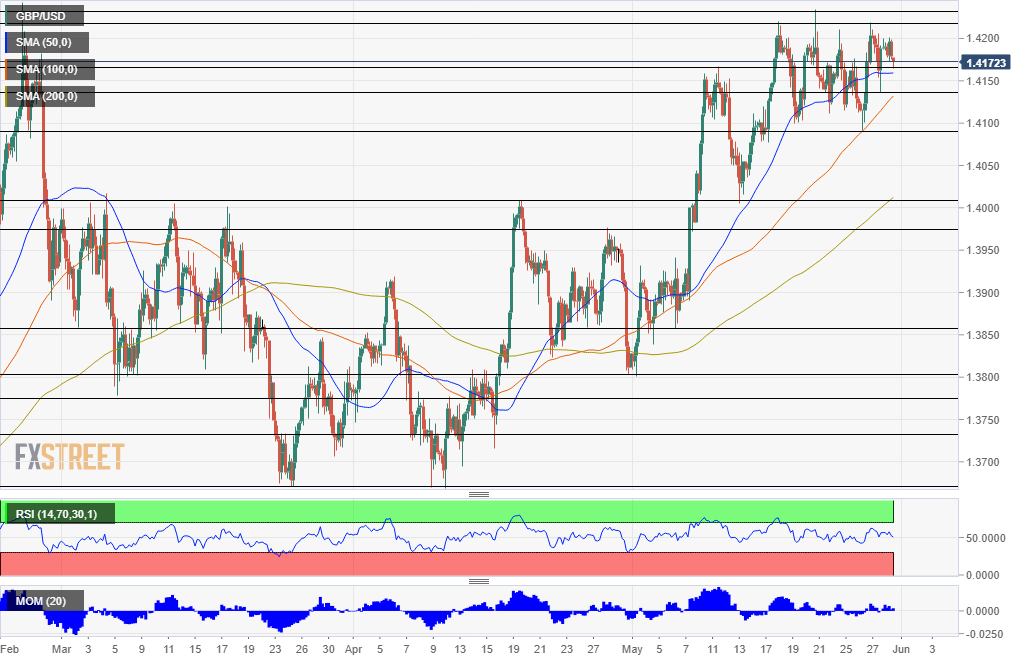

GBP/USD: Trading recommendations

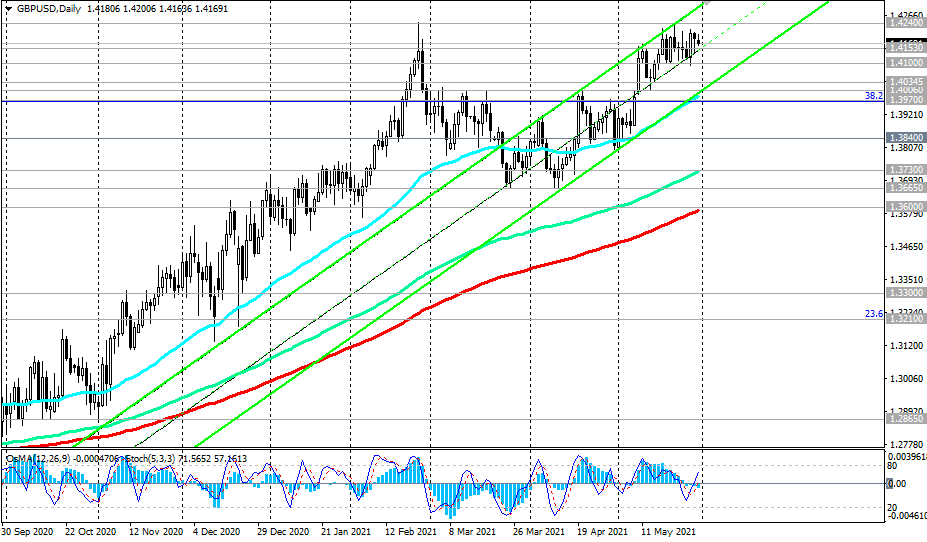

GBP/USD maintains positive long-term dynamics, moving within the upward channel on the daily chart. Its upper border passes through the level of 1.4300 and after the breakdown of the local resistance level of 1.4240, this mark will become the closest target of the GBP/USD growth.

More distant growth targets for the pair are resistance levels at 1.4580 (Fibonacci level of 50% correction to the decline of the GBP/USD pair in the wave that began in July 2014 near the level of 1.7200), 1.4800, 1.4830. Read more...

GBP/USD: Fears of COVID-19 variants and robust US data to push cable lower

At the moment, markets are calm amid the long weekend in both the US and the UK, and after Friday's choppy trading, triggered by end-of-month adjustment. But fears of COVID-19 variants may end holiday calm and send sterling down, FXStreet’s Analyst Yohay Elam briefs.

“People residing in the UK may enjoy the long weekend at home and in several European countries – but not in France nor Germany, where they are required to quarantine. These restrictions serve as a reminder of the B.1.167.2 variant. Sterling is on the back foot due to these fears.” Read more ...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD ticks lower toward 0.6200 after Australian Nov inflation data

AUD/USD remains pressured toward 0.6200 following the release of Australian consumer inflation figures, which showed a slowing in the trimmed mean annual CPI , boosting the odds for an April RBA rate cut. Meanwhile, US-China trade war fears and a softer risk tone add to the weight on the pair.

USD/JPY steadies at around 158.00, Fed Minutes awaited

USD/JPY holds steady at atound the 158.00 mark early Wednesday amid uncertainty over further BoJ rate hikes. Further, the Fed's hawkish shift, the recent surge in the US bond yields and a bullish US Dollar support the currency pair, though Trump trade risks cap gains. US ADP data and Fed Minutes eyed.

Gold consolidates near $2,650 amid mixed cues; looks to Fed Minutes

Gold price stabilizes near $2,650 after the pullback from the $2,665 barrier as concerns about Trump's tariff plans and geopolitical risks support the safe-haven bullion. That said, diminishing odds for further Fed rate cuts and elevated US Treasury bond yields-led US Dollar strength weigh on Gold price ahead of Fed Minutes.

Crypto market surged to $3.9 trillion record market cap as Solana's revenue plunged in December: Binance

In a report on Monday, Binance Research stated that the crypto market reached a market capitalization milestone of $3.9 trillion in December. The researchers suggest anticipation surrounding Donald Trump's upcoming pro-crypto administration could stretch the bullish momentum in the coming weeks.

Five fundamentals for the week: Nonfarm Payrolls to keep traders on edge in first full week of 2025 Premium

Did the US economy enjoy a strong finish to 2024? That is the question in the first full week of trading in 2025. The all-important NFP stand out, but a look at the Federal Reserve and the Chinese economy is also of interest.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.