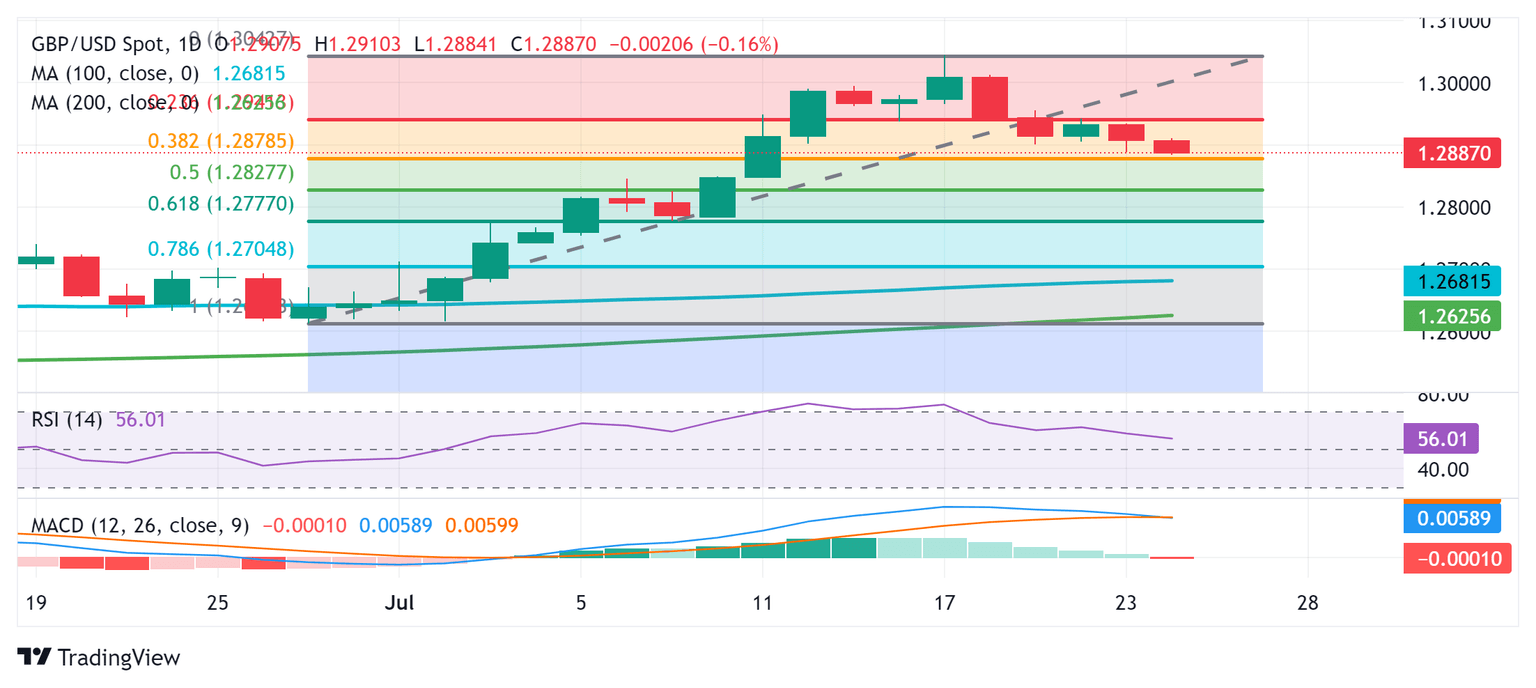

GBP/USD Price Analysis: Stuck in range, clings to 1.2900

The Pound Sterling clings to minimal gains, though it remains stuck within the 1.2880-1.2940 range against the Greenback, unable to crack immediate resistance to push the GBP/USD pair toward the 1.3000 mark. At the time of writing, the major trades at 1.2926 after bouncing off daily lows of 1.2877.

Read More...

Pound Sterling capitalizes on strong UK flash PMI

The Pound Sterling (GBP) bounces back against its major peers in Wednesday’s New York session after upbeat preliminary S&P Global/CIPS Purchasing Managers’ Index (PMI) data for July. The Composite PMI came in higher at 52.7 than estimates of 52.6 and the former release of 52.3 due to an increase in activities in the manufacturing as well as service sectors. The Manufacturing and Services PMI expanded to 51.8 and 52.4, respectively, outperforming their former releases.

Read More...

GBP/USD Price Analysis: Drops to two-week low, bears await break below 38.2% Fibo. level

The GBP/USD pair drifts lower for the second successive day – also marking the fourth day of a negative move in the previous five – and drops to a nearly two-week low during the Asian session on Wednesday. Spot prices currently trade just below the 1.2900 mark, down 0.15% for the day amid a modest US Dollar (USD), though any meaningful depreciating move seems elusive.

Read More...