GBP/USD: Bulls need above 1.3000 to really push ahead once more [Video]

As with EUR/USD there has been a mild tick higher on Cable as the strength of the dollar rally has just eased in the past 24 hours. However, this is likely to be another chance to sell as the growing medium term pressure on 1.2650 support builds. The trend lower of the past three weeks comes in around 1.2825 today and there is a near term pivot around 1.2860 which we see will likely contain a rally before downside pressure renews. Momentum indicators are far more negatively configured on a medium term outlook now, but are just beginning to tick back higher again. This near term rebound should be seen as a chance to sell. We expect this week’s low of 1.2670 to come under further pressure and how the market reacts around 1.2650 (which is a breakout support band of old highs) will determine whether this move goes much deeper towards 1.2480 and possibly 1.2250 in due course. Read More...

GBP/USD Analysis: Struggles to register any meaningful recovery, bearish bias remains

The GBP/USD pair gained some traction on Friday and climbed to three-day tops, around the 1.2805 region during the early European session. The British pound stabilized a bit after the UK Chancellor Rishi Sunak announced the new Job Support Scheme, which will replace the furlough scheme and cover two-thirds of the lost wages. Sunak said that it was part of a wider winter economy plan and aimed to support workers hit by a resurgent COVID-19 pandemic.

Apart from this, a modest recovery in the global risk sentiment undermined the US dollar's safe-haven status and remained supportive of the uptick for the second straight day. Reports indicated that Democrats in the US House of Representatives are working on a $2.2 trillion coronavirus stimulus package. Renewed hopes of additional US fiscal stimulus measures boosted investors' confidence and led to a modest recovery in the equity markets. Read More...

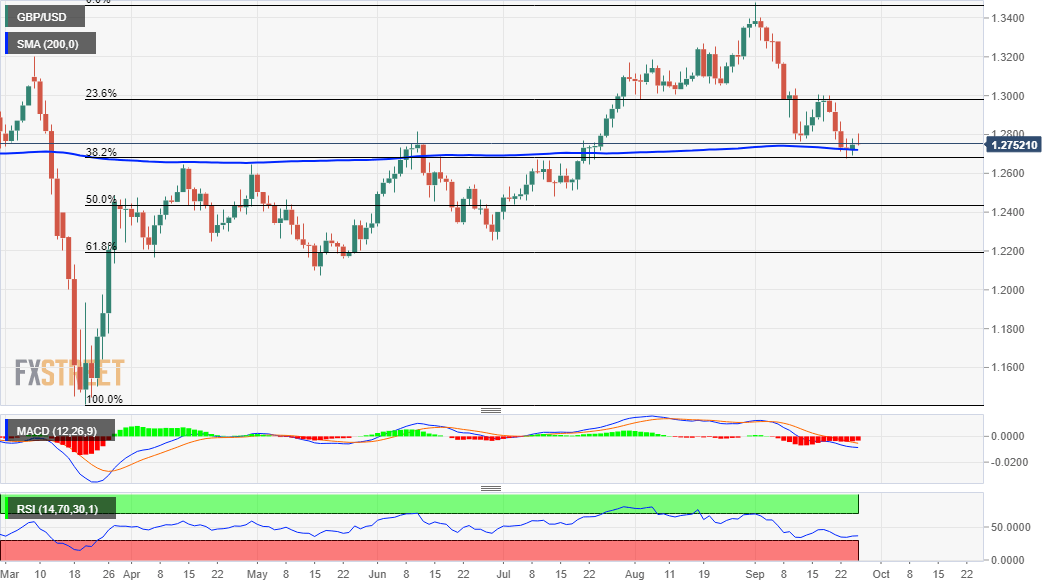

GBP/USD outlook: Recovery extension cracks pivotal Fibo barrier

Cable extends recovery from Wednesday’s two-month low (1.2675) after bears got trapped under 200DMA (1.2719) and ahead pivotal Fibo support at 1.2690 (38.2% of 1.1409/1.3482 rally).

Fresh advance also points to false break below the base of rising daily cloud (1.2759), with signal to be confirmed on weekly close within the cloud.

Rising momentum, reversal of daily stochastic from oversold zone and formation of 100/200DMA’s golden cross, support the action.

Recovery cracked initial barrier at 1.2801 (Fibo 38.2% of 1.3007/1.2675), ahead of sideways-moving 10DMA (1.2839) violation of which would open way for stronger correction. Read More...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds recovery below 1.0500 after German IFO

EUR/USD clings to recovery gains below 1.0500 in the European session on Monday. The US Dollar upswing fizzles out despite broad risk aversion, aiding the pair's renewed upside. The pair also cheers upbeat German IFO survey but ECB rate cut expectations seem to limit its rebound.

GBP/USD recovers losses above 1.2450 as US Dollar loses ground

GBP/USD trims losses to regain 1.2450 in the European session on Monday. The pair fnds fresh demand amid fading US Dollar recovery even as global stocks sell-off extends and investors remain wary of US President Trump's tariff plans.

Gold price recovers a part of intraday losses, down a little around $2,760 area

Gold price recovers a major part of its intraday losses and trades with a mild negative bias, around the $2,760 area during the first half of the European session on Monday. US President Donald Trump's decision to impose tariffs on all imports from Colombia revives trade war fears and triggers a fresh wave of the global risk-aversion trade.

Bitcoin dips below $99K, wiping nearly $860 million from market

Bitcoin edges below $100,000 support and falls nearly 4% at the time of writing on Monday after hitting a new all-time high of $109,588 the previous week. The recent price decline has triggered a wave of liquidations across the crypto market, resulting in $860.55 million in total liquidations in the last 24 hours.

ECB and US Fed not yet at finish line

Capital market participants are expecting a series of interest rate cuts this year in both the Eurozone and the US, with two interest rate cuts of 25 basis points each by the US Federal Reserve and four by the European Central Bank (ECB).

Trusted Broker Reviews for Smarter Trading

VERIFIED Discover in-depth reviews of reliable brokers. Compare features like spreads, leverage, and platforms. Find the perfect fit for your trading style, from CFDs to Forex pairs like EUR/USD and Gold.

-637366189606191924-637366354779522912.png)