Pound Sterling Price News and Forecast: GBP/USD: Stays range-bound near 1.3750, closer to monthly support

GBP/USD Forecast: Brexit talks to reveal next short-term direction

GBP/USD has been fluctuating in a relatively tight range. UK's Frost says EU proposals on Northern Ireland protocol are not good enough. Dollar holds its ground at the start of the week. GBP/USD has been moving up and down in a narrow band below 1.3800 since the beginning of the week as investors refrain from making large bets while waiting for fresh Brexit developments. Read more...

GBP/USD Price Analysis: Stays range-bound near 1.3750, closer to monthly support

GBP/USD keeps pullback from weekly top, grinds lower of late. Downside break of 50-SMA, sluggish Momentum keep sellers hopeful. 200-DMA adds to the upside filters, 200-SMA restricts short-term downside. GBP/USD remains on the back foot around 1.3765, keeping the weekly trading range during Wednesday’s Asian session. In doing so, the cable pair inches closer to an ascending support line from September 29. Read more...

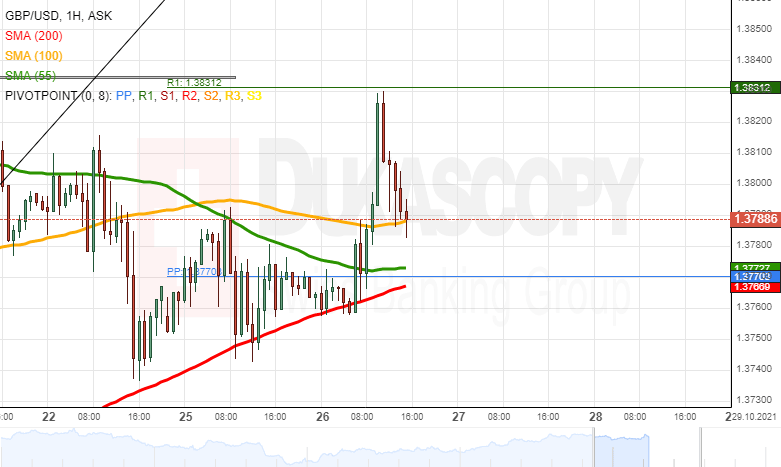

GBP/USD analysis: Surges as forecast

The GBP/USD fulfilled the first scenario described on Monday, as it broke the resistance of the 55 and 100-hour simple moving averages and jumped to the 1.3830 level and the weekly R1 simple pivot point at 1.3831. By the middle of Tuesday's trading hours, the pair had bounced off the 1.3830 mark and retreated to the 100-hour SMA at 1.3785. Read more...

Author

FXStreet Team

FXStreet