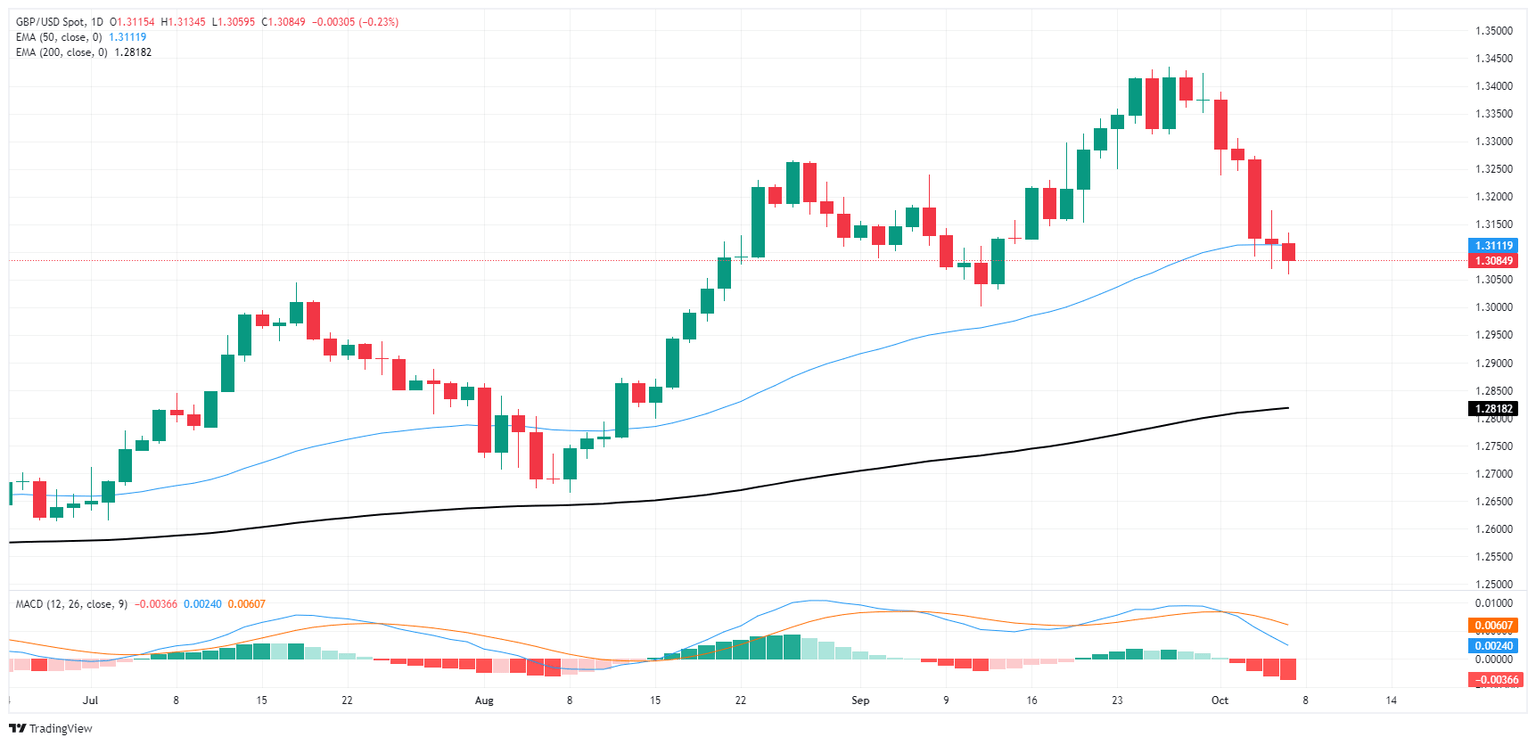

Pound Sterling Price News and Forecast: GBP/USD snaps a five-day losing streak to a multi-week low

GBP/USD struggles to capitalize on modest intraday gains beyond 1.3100 mark

The GBP/USD pair attracts some buyers during the Asian session on Tuesday and for now, seems to have snapped a five-day losing streak to a nearly four-week low, around the 1.3560 area touched the previous day. Spot prices, however, struggle to build on the uptick beyond the 1.3100 mark, warranting some caution for bullish traders.

The US Dollar (USD) remains depressed below a seven-week high touched on Friday and turns out to be a key factor lending some support to the GBP/USD pair. That said, reduced bets for another oversized interest rate cut by the Federal Reserve (Fed), amid signs of a still resilient US labor market, might hold back the USD bears from placing aggressive bets. Apart from this, a softer risk tone should act as a tailwind for the safe-haven buck and cap the upside for the currency pair. Read more...

GBP/USD finds fresh lows as Greenback climbs

GBP/USD sunk another one-quarter of one percent on Monday, easing into a fresh four-week low and closing below the 1.3100 handle for the first time since mid-September. Investors rate cut hopes are buckling under the weight of a firmer-than-expected US labor market, and geopolitical tensions have kept trader risk appetite pinned.

Investor appetite took a leg down to kick off the fresh trading week as market hopes for further outsized rate cuts continue to dwindle. Rate markets now overwhelmingly expect the Fed’s next rate move on November 7 will be a demure quarter-point cut, down from the heady 50 bps that rate markets expected just after the Fed’s opening volley of a 50 bps double cut in September. Fedspeak has steadily telegraphed to markets that a further deterioration in the US economy, and specifically the US labor market, will be the thing that opens the door to further extreme moves on rates. Read more...

Author

FXStreet Team

FXStreet