Pound Sterling Price News and Forecast: GBP/USD slumps as Trump tariffs prompt global economic risks

Pound Sterling slumps as Trump tariffs prompt global economic risks

The Pound Sterling (GBP) tumbles against its major peers on Wednesday. The British currency faces a sharp selling pressure as the Bank of England's (BoE) Financial Policy Committee (FPC) has warned that a major shift in global trading arrangements could harm "financial stability by depressing growth". Read More...

GBP/USD appreciates to near 1.2850 due to easing trade tensions after Trump's comments

The GBP/USD pair advances for a second straight session, trading near 1.2820 during Asian hours on Wednesday. The pair’s uptick is supported by easing trade tensions after US President Donald Trump signaled openness to negotiations with global partners, fueling hopes of a potential de-escalation in trade conflicts. Read More...

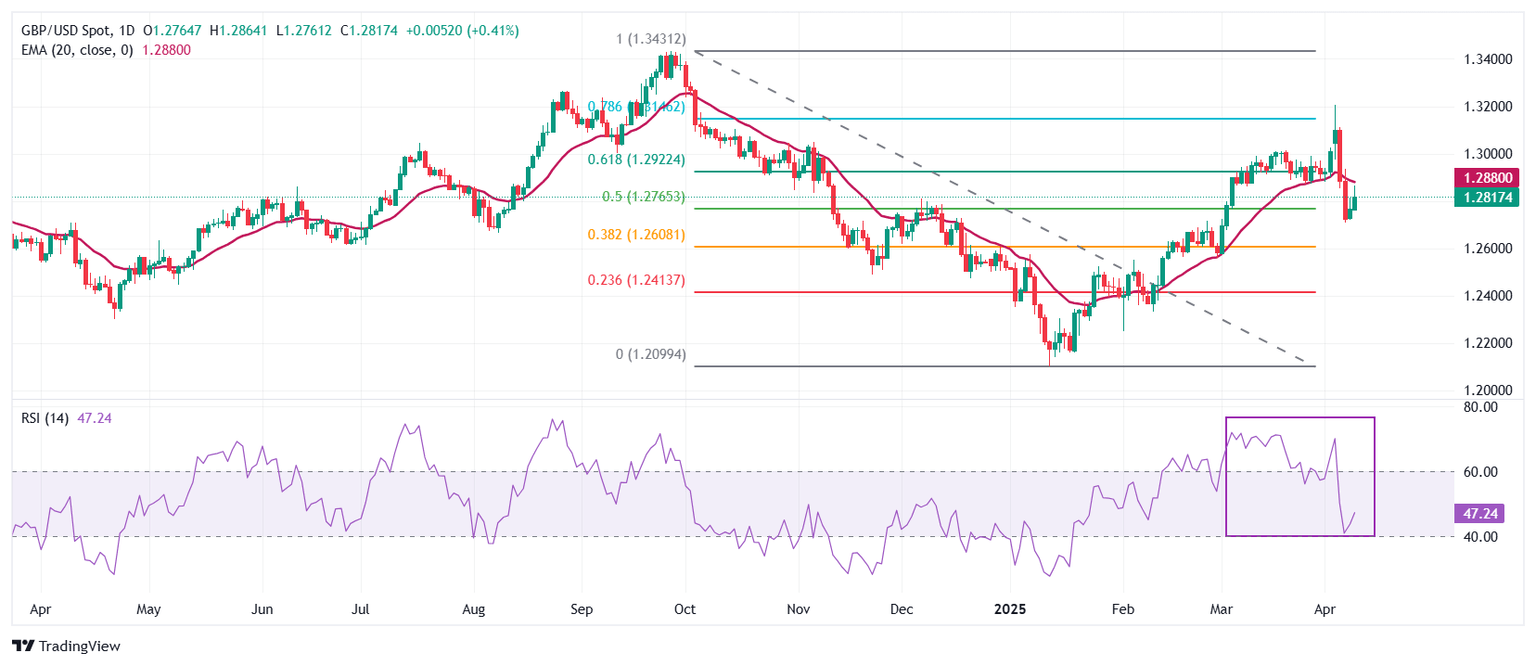

GBP/USD catches much-needed bounce from key moving average as tariffs loom

GBP/USD snapped a harsh two-day losing streak on Tuesday, finding a technical bounce from the 200-day Exponential Moving Average (EMA) just north of the 1.2700 handle. Price action remains strung out in no man’s land ahead of the US’s planned tariff implementation, and investors are hunkering down with key US inflation and sentiment figures due later this week. Read More...

Author

FXStreet Team

FXStreet