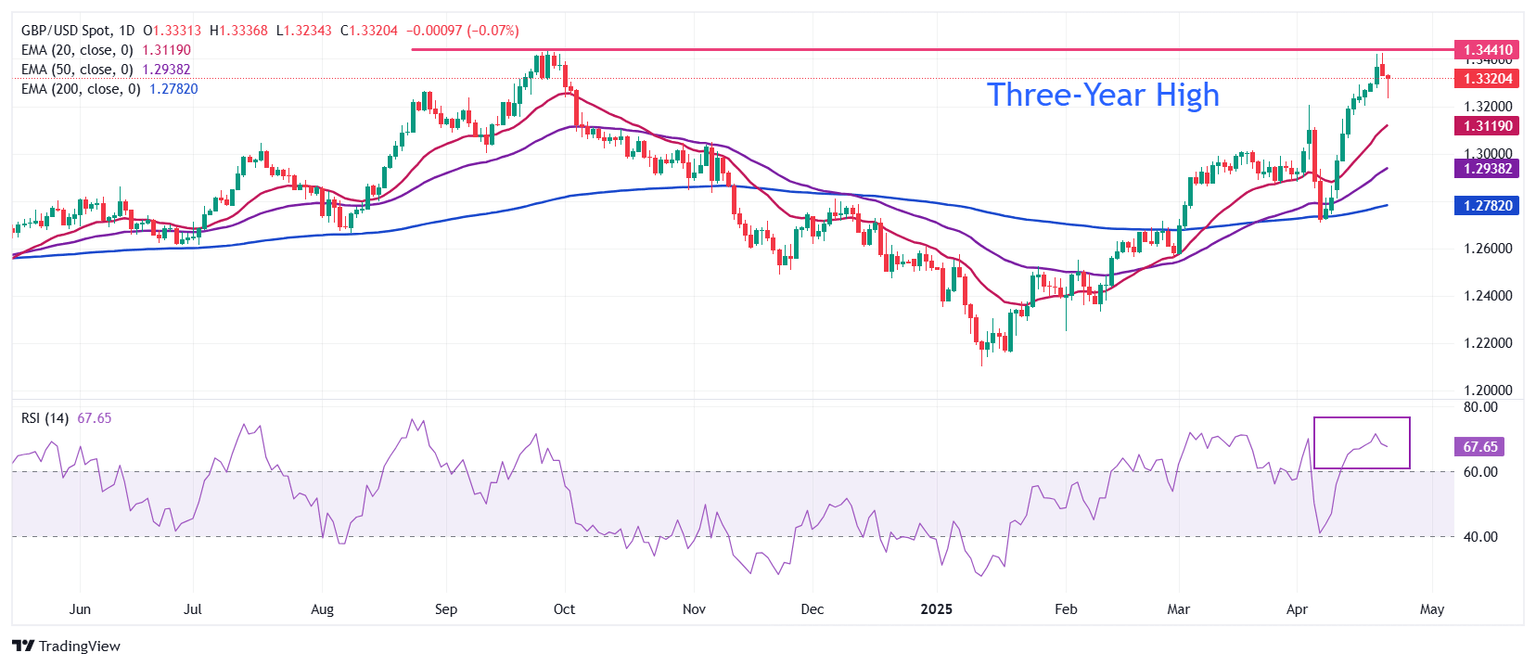

Pound Sterling Price News and Forecast:GBP/USD slips beneath 1.3300 as USD gains on Powell relief

GBP/USD slips beneath 1.3300 as USD gains on Powell relief and trade optimism

The Pound Sterling (GBP) depreciates against the Greenback on Wednesday, yet slightly recovered after diving to four-day lows of 1.3230. Traders seemed relieved that US President Donald Trump, although angry with Federal Reserve (Fed) Chair Powell, is not looking to sack him. At the time of writing, GBP/USD trades were at 1.3289, down 0.28%. Read More...

Pound Sterling weakens against US Dollar after flash UK/US PMI data for April

The Pound Sterling (GBP) trades lower against the US Dollar (USD) around 1.3280 in Wednesday’s North American session. The GBP/USD pair weakens as the US Dollar (USD) attracts bids despite the release of the weaker-than-expected United States (US) S&P Global Purchasing Managers’ Index (PMI) data for April. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, recovers sharply to near 99.60. During European trading hours, the USD Index gave up initial gains and fell back to near 99.00. Read More...

UK Preliminary Services PMI contracts to 48.9 in April vs. 51.3 expected

The seasonally adjusted S&P Global/CIPS UK Manufacturing Purchasing Managers’ Index (PMI) eased to 44 in April from 44.9 in March. The data matched the market consensus of 44 in the reported period.Read More...

Author

FXStreet Team

FXStreet