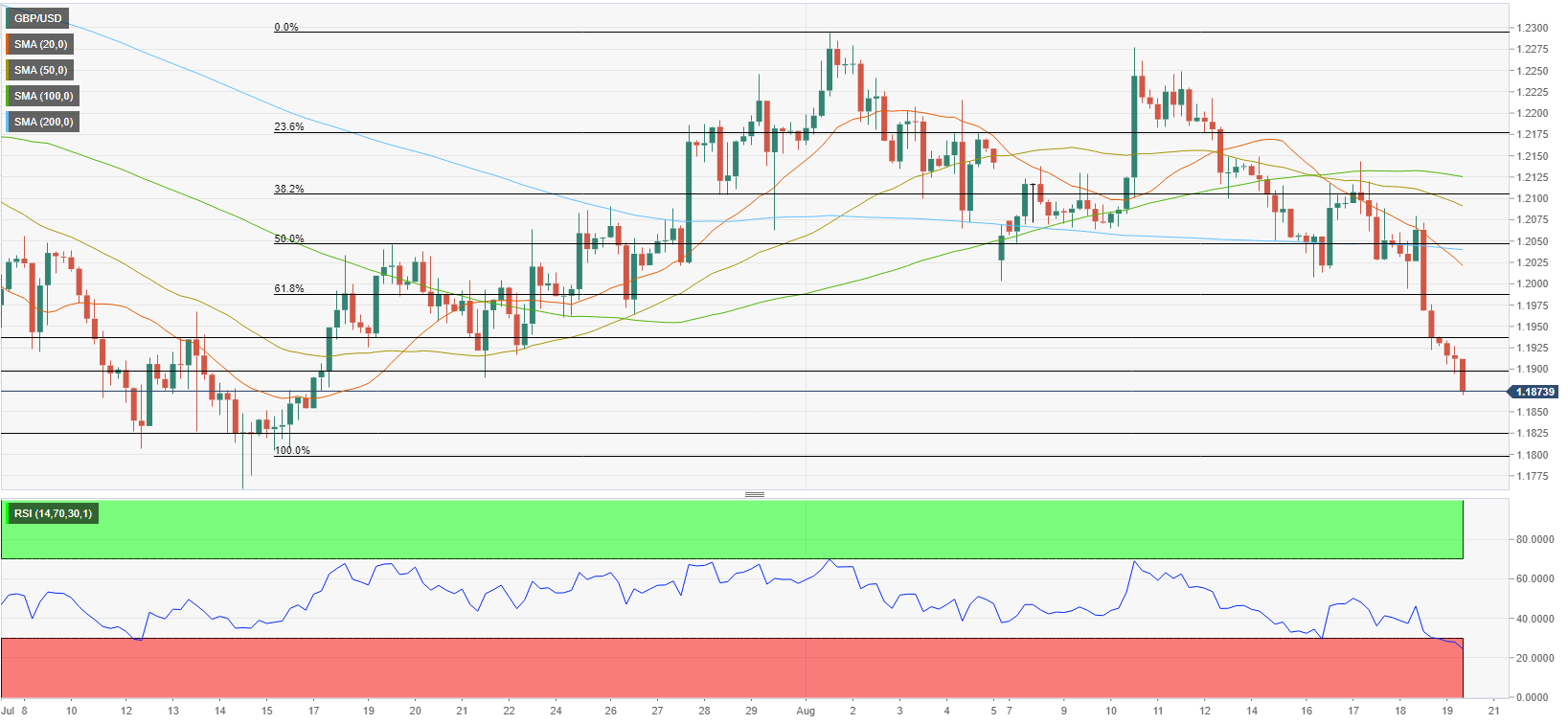

GBP/USD Forecast: Next line of defense aligns at 1.1825

Pressured by the broad-based dollar strength, GBP/USD has suffered heavy losses and dropped to its lowest level in a month below 1.1900. The pair stays on the backfoot on Friday and additional losses could be witnessed in case safe-haven flows continue to dominate the financial markets in the second half of the day. It's worth noting, however, that the near-term technical outlook suggests that the pair could make a correction before the next leg lower.

The data from the US showed on Thursday that the Philadelphia Fed Manufacturing Index improved significantly in August and the weekly Initial Jobless Claims declined to 250,0000, compared to the market expectation of 265,000. On a negative note, Existing Home Sales fell by 5.9% in July. The dollar struggled to make a decisive move in either direction with the initial reaction but hawkish comments from officials triggered an impressive rally in the US Dollar Index (DXY). Read more...

GBP/USD slides below 1.1900 mark, hits one-month low amid broad-based USD strength

The GBP/USD pair prolongs a one-and-half-week-old bearish trend and continues losing ground for the third successive day on Friday. This also marks the sixth day of a negative move in the previous seven and drags spot prices below the 1.1900 mark, or a one-month low during the first half of the European session.

US dollar buying remains unabated on the last day of the week and turns out to be a key factor that continues to exert downward pressure on the GBP/USD pair. In fact, the USD Index (DXY), which tracks the greenback against a basket of half a dozen major currencies has shot to its highest level since July 18 and remains well supported by hawkish Fed expectations. Read more...

GBP/USD to extend further to the downside over the coming weeks – MUFG

The GBP/USD rate has broken back below the 1.2000 level. In the view of economists at MUFG Bank, GBP downside risks persist despite better sales data.

“A recent build-up of long GBP positioning by Leveraged Funds could be vulnerable to liquidation propelling GBP/USD lower still.”

“Instead of the expected modest MoM declines, overall sales increased 0.3% and excluding auto fuel gained 0.4%. The data doesn’t change the overall picture of weak consumer spending. The ex-auto sales print gained 0.2% in June as well but these modest gains were preceded by seven consecutive declines and the record temperatures in the UK in July were very likely a driver of increased sales.” Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD rises above 1.0850 while remaining in overbought territory

The EUR/USD pair gains ground for the third successive session, trading around 1.0860 during the Asian hours on Tuesday. A technical examination of the daily chart indicates a bearish breakout as the pair breaks below an ascending channel pattern.

GBP/USD maintains position near 1.2900 as concerns over US economic growth persist

The GBP/USD pair recovers recent losses from the previous session, trading around 1.2890 during Asian hours on Tuesday. The pair edges higher as the US Dollar struggles amid concerns that tariff policy uncertainty could push the US economy into recession.

Gold price sticks to modest intraday gains amid weaker risk tone; remains below $2,900

Gold price rebounds from a one-week low and draws support from a combination of factors. Global trade war fears and geopolitical risks continue to underpin the safe-haven commodity. Fed rate cut bets keep the USD depressed and further benefit the non-yielding XAU/USD pair.

The crypto market cap dips to $2.44 trillion while Mt. Gox moves 11,833 BTC worth $932 million

The crypto market continued its ongoing downleg as the week started, as its market cap capitalization reached a low of $2.44 trillion on Tuesday, levels not seen since early November.

Gold price sticks to modest intraday gains amid weaker risk tone; remains below $2,900

Gold price rebounds from a one-week low and draws support from a combination of factors. Global trade war fears and geopolitical risks continue to underpin the safe-haven commodity. Fed rate cut bets keep the USD depressed and further benefit the non-yielding XAU/USD pair.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.