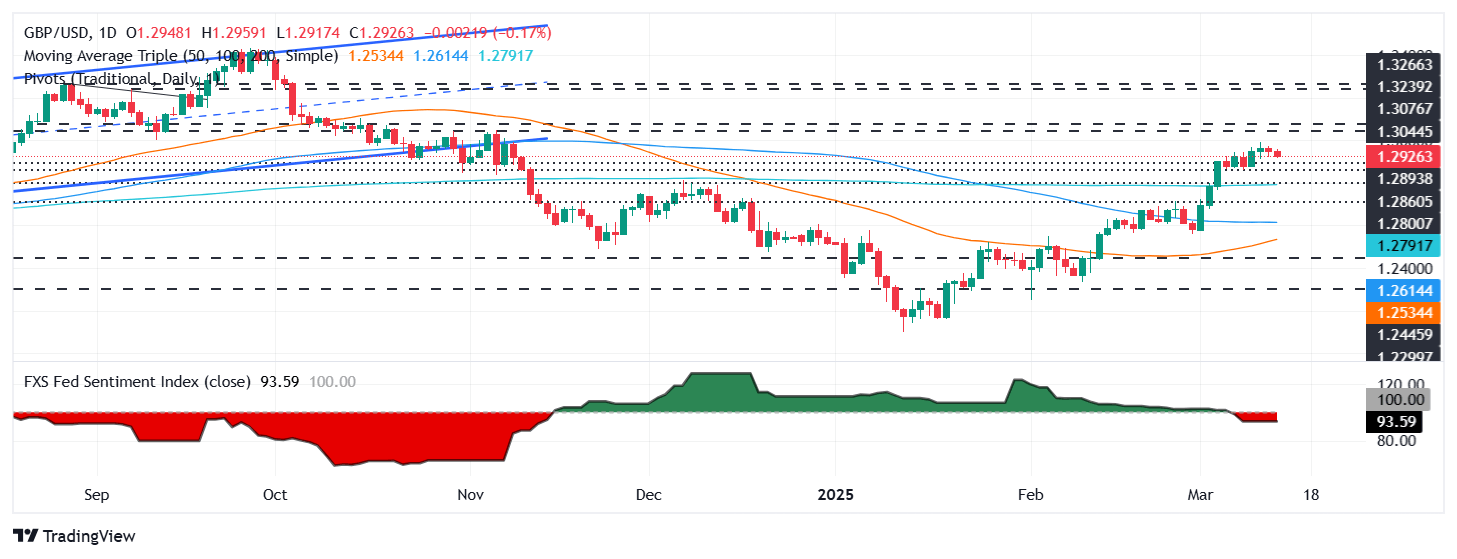

Pound Sterling Price News and Forecast: GBP/USD slides as UK economy falters ahead of central bank bonanza

GBP/USD slides as UK economy falters ahead of central bank bonanza

The Pound Sterling registers back-to-back bearish days, dropping some 0.14% on Friday against the Greenback after economic data from the UK revealed that the Gross Domestic Product (GDP) contracted. Despite this, the GBP/USD trades above the 1.2900 figure, poised to finish the day near that level. Read More...

GBP/USD loses momentum below 1.2950 on downbeat UK GDP data

GBP/USD hovers around 1.2950, four-month highs ahead of UK GDP, factory data

GBP/USD continues its decline for the second straight session, trading near 1.2940 during Friday’s Asian session. The pair faces challenges as the Pound Sterling (GBP) struggles amid weakened risk sentiment, exacerbated by concerns over global trade after US President Donald Trump threatened a 200% tariff on European wines and champagne, unsettling markets. Read More...

Author

FXStreet Team

FXStreet