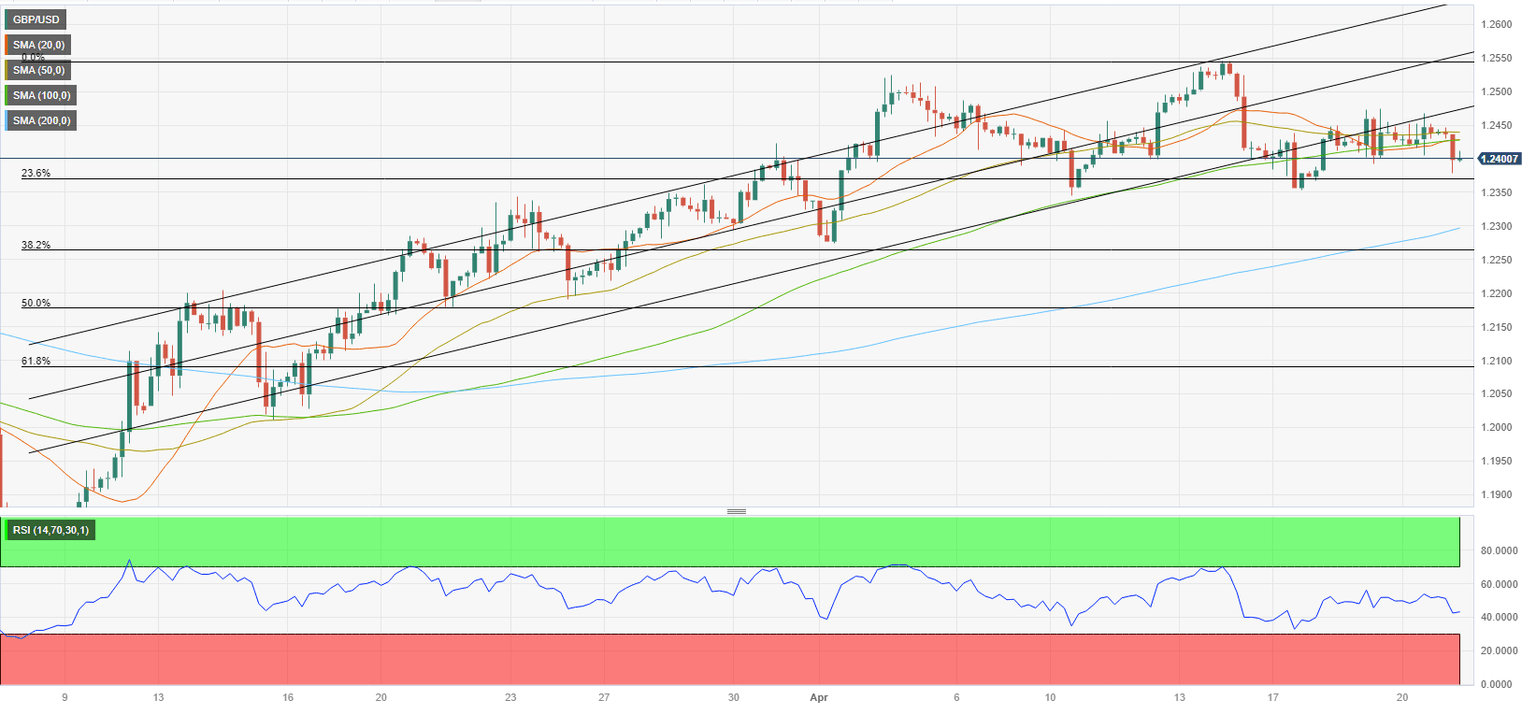

Pound Sterling Price News and Forecast: GBP/USD seen trading within 1.2345-1.2510

GBP/USD Forecast: Sellers could take action if 1.2370 support fails

GBP/USD has started the last trading day of the week on the back foot and declined toward 1.2400. The pair's technical outlook points to a buildup of bearish momentum. 1.2370 aligns as key support and sellers could take action if that level fails.

The UK's Office for National Statistics reported early Friday that Retail Sales in March declined by 0.9% following February's growth of 1.1%. This reading came in weaker than the market expectation for a decrease of 0.5% and caused GBP/USD to edge lower in the European morning. Read more...

GBP/USD seen trading within 1.2345-1.2510 – UOB

In the opinion of UOB Group’s Markets Strategist Quek Ser Leang and Senior FX Strategist Peter Chia, GBP/USD is expected to trade within the 1.2345-1.2510 range in the next few weeks.

24-hour view: “We highlighted yesterday that ‘the outlook for GBP is mixed’ and we expected it to ‘trade in a range between 1.2375 and 1.2475’. GBP subsequently traded in a relatively choppy manner between 1.2405 and 1.2468. The price actions are likely part of a consolidation and we expect GBP to trade in a range of 1.2400/1.2475 today.” Read more...

GBP/USD remains depressed post-UK Retail Sales, holds above 1.2400 ahead of PMIs

The GBP/USD pair comes under some selling pressure on the last day of the week and maintains its offered tone through the early European session. The pair currently trades around the 1.2425-1.2420 region, down over 0.15% for the day, and reacts little to the latest UK macro data.

The UK Office for National Statistics reported this Friday that domestic Retail Sales contracted more-than-expected, by 0.9% in March and reversed a major part of the rise recorded in the previous month. Furthermore, sales excluding fuel also missed consensus estimates and dropped by 1% during the reported month as compared to the 1.4% rise reported in February. This, in turn, undermines the British Pound, which, along with a modest US Dollar (USD) uptick, acts as a headwind for the GBP/USD pair. Read more...

Author

FXStreet Team

FXStreet