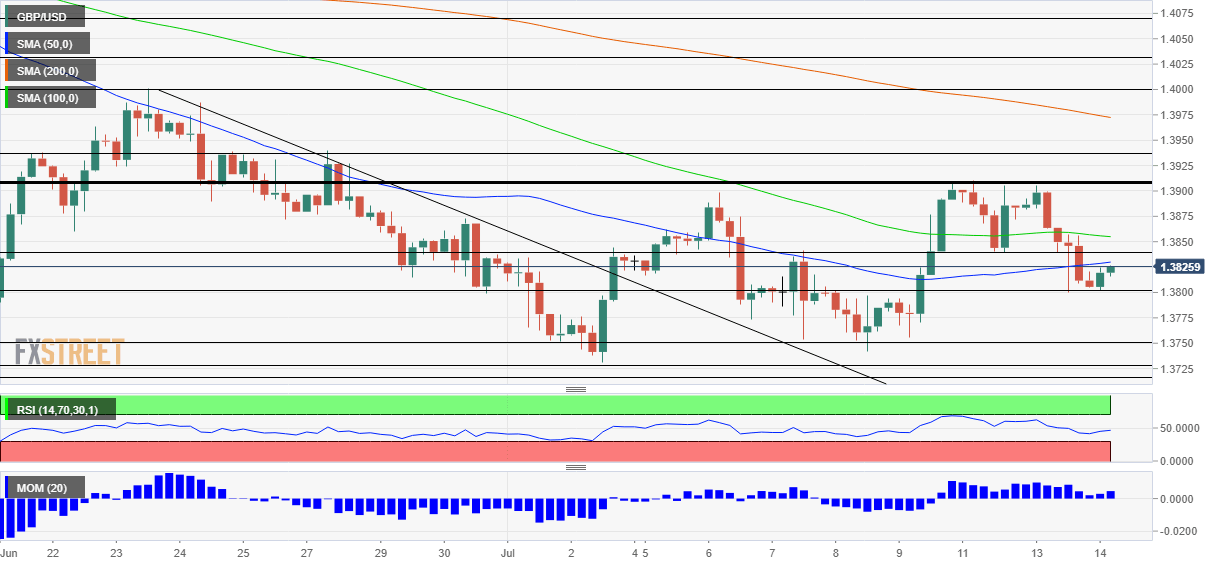

Pound Sterling Price News and Forecast: GBP/USD returns to 1.3900

GBP/USD Forecast: Dead-cat bounce? Pound at the mercy of Powell

Inflation is everywhere – that is the notion after both the US and the UK have reported higher-than-expected price rises. However, the increases are boosted by transitory factors on both sides of the pond, and what matters is what policymakers think about it.

The latest GBP/USD move is to the upside, stemming from Britain's report of a 2.5% increase in the Consumer Price Index, higher than expected. However, these were boosted by second-hand cars, footwear, clothing and restaurant prices – all related to the reopening. Core CPI is up 2.3% YoY in June, also above estimates. Read more...

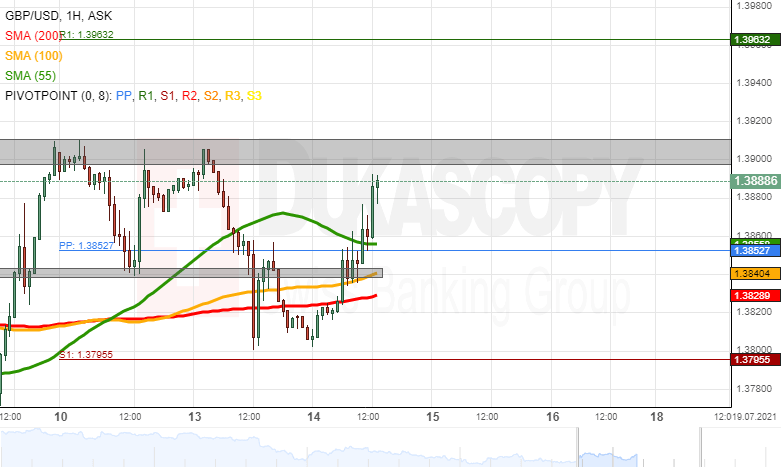

GBP/USD analysis: Returns to 1.3900

The GBP/USD traded with high volatility due to the US CPI release on Tuesday. However, on Wednesday, the rate had recovered and appeared to be set for another test of the resistance zone above the 1.3900 mark.

In the case that the rate passes the resistance of the 1.3900 mark, the GBP/USD would find resistance in the 1.3950 mark and afterwards the weekly R1 simple pivot point at 1.3963. Read more...

GBP/USD spikes to 1.3900 neighbourhood amid notable USD weakness

The intraday USD selling picked up pace during the early North American session and pushed the GBP/USD pair to fresh daily tops, closer to the 1.3900 mark in the last hour.

The pair caught some aggressive bids near the 1.3800 level on Wednesday and has now recovered its weekly losses recorded over the past two trading sessions. The British pound found some support following the release of hotter-than-expected UK consumer inflation figures. This, along with the emergence of some heavy selling around the US dollar, contributed to the GBP/USD pair's strong intraday positive move. Read more...

Author

FXStreet Team

FXStreet