Pound Sterling Price News and Forecast: GBP/USD remains in an ascending channel pattern

GBP/USD Price Forecast: Holds gains above 1.2600 support near nine-day EMA

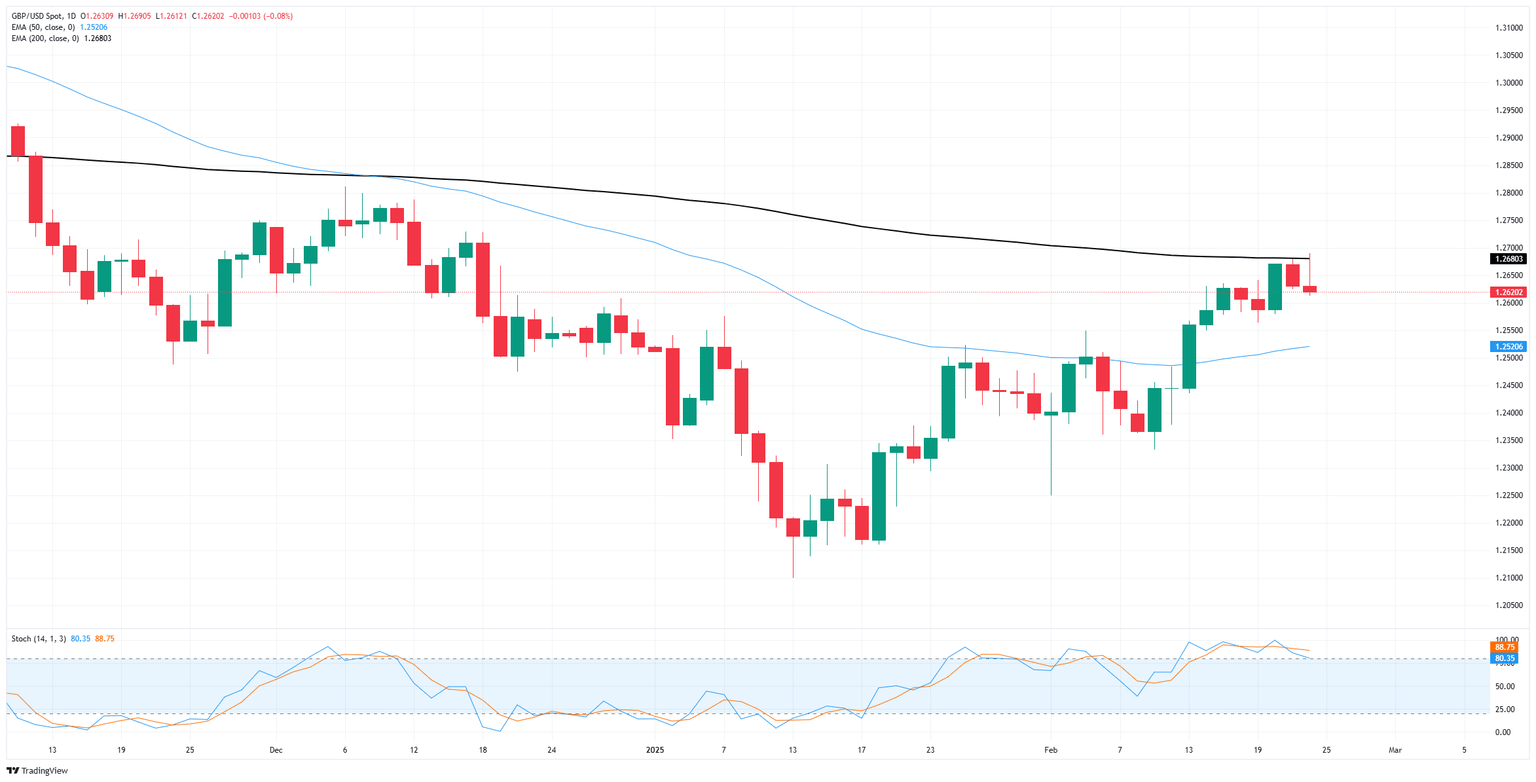

The GBP/USD pair gains ground after registering losses in the previous two successive sessions, trading around 1.2630 during the Asian session on Tuesday. However, technical analysis of the daily chart suggests a persistent bullish bias, with the pair continuing to move within an ascending channel pattern.

The 14-day Relative Strength Index (RSI) sits just above the 50 level, indicating increased bullish momentum. Moreover, the pair remains above the nine- and 14-day Exponential Moving Averages (EMAs), signaling strong short-term price dynamics and reinforcing the upward trend. Read more...

GBP/USD corkscrews near key averages as central bank speeches gather

GBP/USD churned on Monday, jumping to a fresh 10-week high before slumping back to the day’s opening bids near 1.2630. Cable failed to recapture the 1.270 handle, and price action has fallen back beneath the 200-day Exponential Moving Average (EMA) near 1.2660.

A resurgence in US inflation figures late last week kicked off a fresh round of risk aversion. Investors will be focused squarely on upcoming US Personal Consumption Expenditure (PCE) inflation data due later this week. Traders hope that an early-year uptick in headline inflation data from the US will recede quickly and not solidify into another drawn-out battle with “transitory” inflation that runs too hot for the Federal Reserve (Fed) to deliver rate cuts. Read more...

GBP/USD holds firm after hitting 9-week high

The Pound Sterling (GBP) remains firm against the US Dollar (USD) during the Monday North American session, yet retraced earlier gains after hitting a nine-week high of 1.2690 amid some USD weakness. GBP/USD trades at 1.2632, almost flat.

The market mood remains uneasy as traders digest the news that companies are reducing expenses. This indicates cautiousness as United States (US) President Donald Trump continues to use trade policies to negotiate favorable deals for the US. Read more...

Author

FXStreet Team

FXStreet