GBP/USD Forecast: Pound Sterling needs a hawkish BoE to clear 1.2200

GBP/USD gathered bullish momentum and registered gains on Wednesday after dropping below 1.2100 earlier in the day. The pair continued to stretch higher toward 1.2200 on Thursday but lost its traction, with investors refraining from taking large positions ahead of the Bank of England's (BoE) monetary policy announcements.

The Federal Reserve held the policy rate steady at 5.25%-5.5% as widely expected on Wednesday. Fed Chairman Jerome Powell did not rule out another rate hike in December but failed to convince markets. The benchmark 10-year US Treasury bond yield fell nearly 4% on the day and the US Dollar (USD) weakened against its major rivals, allowing GBP/USD to turn north. Read more...

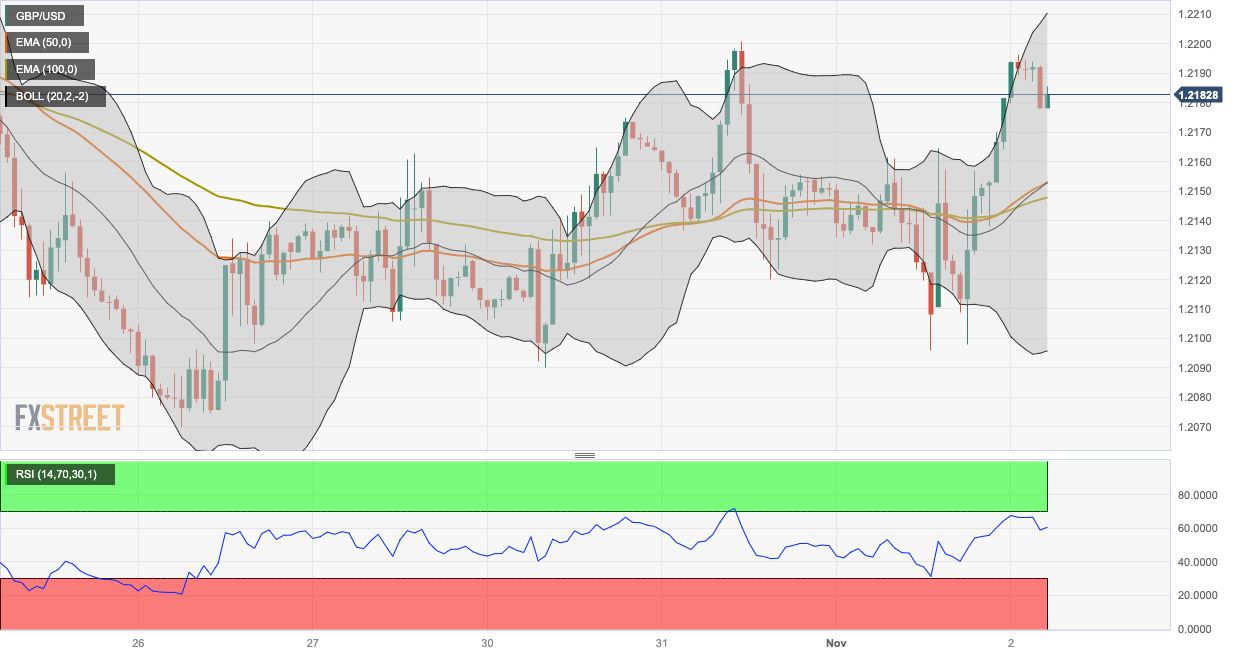

GBP/USD Price Analysis: Remains capped below the 1.2200 barrier

The GBP/USD pair edges higher during the Asian trading hours on Thursday. The uptick of the pair is supported by the weakening of the US Dollar (USD) after the Federal Reserve (Fed) maintained the interest rate steady, while odds that it may not hike rates again rose after the press conference. The major pair currently trades around 1.2184, gaining 0.28% on the day.

From the technical perspective, GBP/USD holds above the 50- and 100-hour Exponential Moving Averages (EMAs) on the one-hour chart, which means further upside looks favorable. Additionally, the Relative Strength Index (RSI) holds above 50 in bullish territory, indicating buyers retain control for the time being. Read more...

Pound Sterling soars as BoE maintains status quo

The Pound Sterling (GBP) advances strongly as the Bank of England (BoE) has kept interest rates unchanged at 5.25%, as expected. BoE policymakers: Jonathan Haskel, Megan Greene, and Katherine Mann voted for a 25 basis points (bps) rate hike while the other six policymakers including new Deputy Governor Sarah Breeden, who has replaced Jon Cunliffe, advocated for keeping interest rates unchanged. Dovish policymaker Swati Dhingra supported an unchanged interest rate decision but was expected to advocate a rate cut.

The inflation forecast report by the BoE shows that consumer inflation will soften to 4.6% by the Q4 of 2023. This indicates that UK Prime Minister Rishi Sunak would manage to fulfill his promise of halving inflation to 5.4% by the year-end. Inflation in one and two-year timeframe is seen declining to 3.1% and 1.9% respectively. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends recovery beyond 1.0800 on broad US Dollar's weakness

EUR/USD trades near 1.0830 in the mid-European session. The EUR advances despite the German IFO - Business Climate improving less than expected in March. Comments from US President Donald Trump take their toll on financial markets ahead of US Consumer Confidence data.

GBP/USD trades around 1.2950 with eyes on tariffs, geopolitics

GBP/USD trades with a firmer tone around 1.2950 in the European session on Tuesday. The pair surged as the US Dollar suffered a setback following fresh tariff-related headlines, while keeping an eye on a potential peace deal between Russia and Ukraine. US data and Fedspeak take centre stage in the upcoming American session.

Gold price trades with modest gains above $3,000; positive risk tone could cap gains

Gold price edges higher and snaps a three-day losing streak amid a softer USD. Bets that the Fed will resume its rate-cutting cycle soon also support the bullion. Traders now look to Tuesday’s US macro data and Fed speak for a fresh impetus.

Bitcoin stabilizes around $87,000 as it displays a classic beta response to traditional markets

Bitcoin stabilizes around $87,000 on Tuesday after extending a recovery over the past two days. A Crypto Finance report highlights that the crypto market followed the broader risk momentum, displaying a classic beta response to traditional markets.

Seven Fundamentals for the Week: Tariff news, fresh surveys, the Fed's preferred inflation gauge are eyed Premium

Reports and rumors ahead of Trump’s reciprocal tariffs announcement next week will continue moving markets. Business and consumer surveys will try to gauge where the US economy is heading. Core PCE, the Fed's preferred inflation gauge, is eyed late in the week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.