GBP/USD regains lost ground and hits one-week highs above 1.3640

Pound's rebound from 1.3414 has extended to one-week highs at 1.3640 so far. The sterling appreciates on hopes of a BoE's interest rate hike. GBP/USD's current recovery, to cap at 1.3658/75. The sterling maintains a bid tone for the fourth consecutive day on Tuesday. The pair’s recovery from year-to-date lows near 1.3400 last week has extended beyond 1.3600, reaching session highs at 1.3640 so far. Read more...

GBP/USD Forecast: Sterling weathers several storms, ISM Services PMI key to further gains

"We have reliable supply chains for Christmas" – UK Prime Minister Boris Johnson's soothing words early on Tuesday seem to echo with GBP/USD bulls sentiment that "everything will be alright." A currency pair that weathers stormy seas have room to rise when the winds calm. GBP/USD has been holding onto its impressive recovery. Cable's ability to withstand a long list of worries implies more gains are likely. Tuesday's four-hour chart is showing bulls have gained ground. Read more...

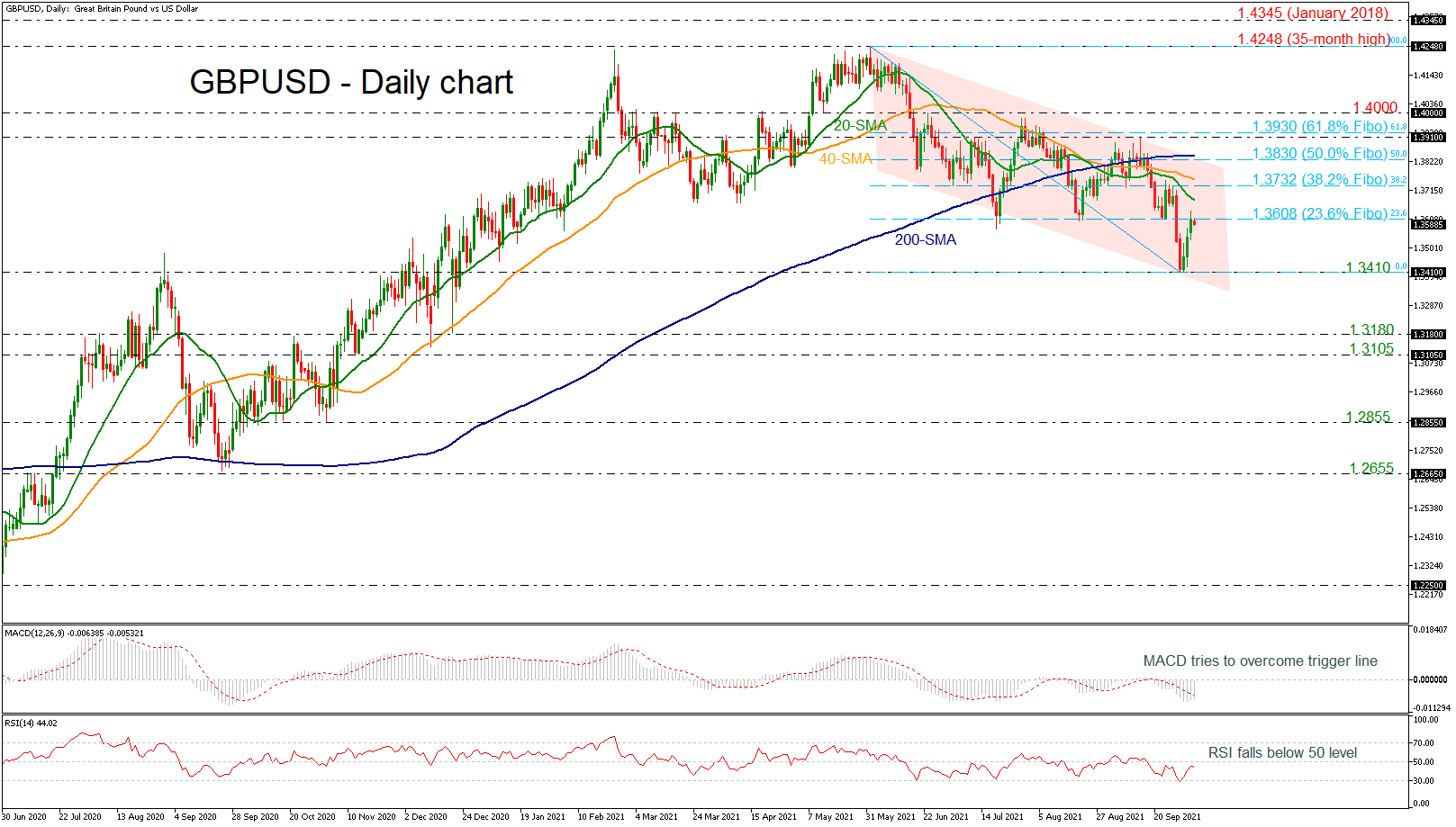

GBP/USD finds resistance at 23.6% Fibonacci in descending channel

GBPUSD has been developing in a downward sloping channel since the beginning of June, with the price recently posting another rebound at the bottom of this structure at 1.3410. The cable is currently testing the 23.6% Fibonacci retracement level of the down leg from 1.4248 to 1.3410 at 1.3608. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Australian Dollar extends gains despite mixed PMI

The Australian Dollar (AUD) continues to strengthen against the US Dollar (USD) following the release of mixed Judo Bank Purchasing Managers' Index (PMI) data from Australia on Friday. The AUD also benefits from a hawkish outlook by the Reserve Bank of Australia (RBA) regarding future interest rate decisions.

Japanese Yen fails to build on stronger CPI-led intraday uptick against USD

The Japanese Yen (JPY) attracted some follow-through buying for the second successive day following the release of slightly higher-than-expected consumer inflation figures from Japan. This comes on top of Thursday's hawkish remarks from BoJ Governor Kazuo Ueda, which keeps expectations for a December interest rate hike in play.

Gold price advances to near two-week top on geopolitical risks

Gold price touched nearly a two-week high during the Asian session as the worsening Russia-Ukraine conflict benefited traditional safe-haven assets. The weekly uptrend seems unaffected by bets for less aggressive Fed policy easing, sustained USD buying and the prevalent risk-on environment

Ethereum Price Forecast: ETH open interest surge to all-time high after recent price rally

Ethereum (ETH) is trading near $3,350, experiencing an 10% increase on Thursday. This price surge is attributed to strong bullish sentiment among derivatives traders, driving its open interest above $20 billion for the first time.

A new horizon: The economic outlook in a new leadership and policy era

The economic aftershocks of the COVID pandemic, which have dominated the economic landscape over the past few years, are steadily dissipating. These pandemic-induced economic effects are set to be largely supplanted by economic policy changes that are on the horizon in the United States.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.