GBP/USD Weekly Forecast: Pound recovery at the mercy of BoE rate hike bets

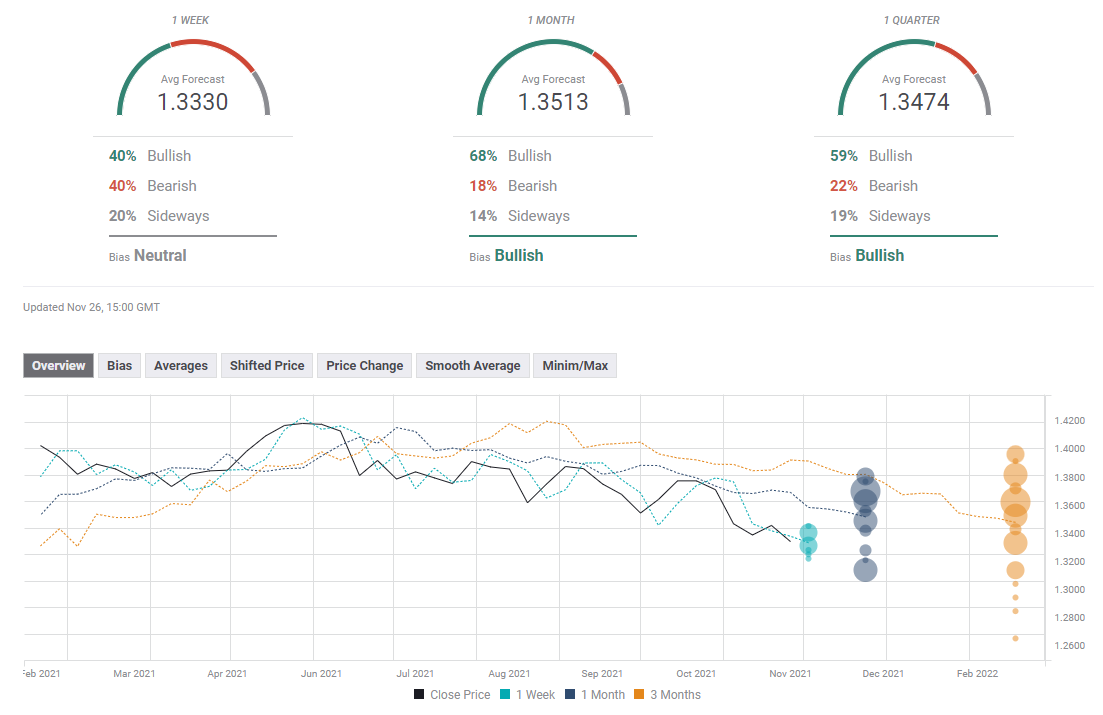

The GBP/USD pair started the week under bearish pressure after failing to reclaim 1.3500 in the previous week. With the greenback continuing to gather strength against its major rivals on the back of rising US Treasury bond yields, the pair extended its slide below 1.3300 and touched its lowest level since December 2020. Ahead of the weekend, the intense flight to safety triggered a sharp drop in yields and allowed GBP/USD to erase a small portion of its weekly losses. Read more...

GBP/USD Forecast: Decreasing BoE rate hike bets limit pound's upside

After dipping below 1.3300 earlier in the day, GBP/USD has managed to gain traction in the early European session and started to push higher toward mid-1.3300s on heavy selling pressure surrounding the dollar. However, the British pound could have a difficult time preserving its strength with investors reassessing the impact of the new coronavirus variant on the Bank of England's (BoE) policy outlook. Read more...

Breaking: GBP/USD refreshes yearly low around 1.3300 on coronavirus, Brexit woes

GBP/USD extends the five-day downtrend towards refreshing 2021 low near 1.3300 heading into Friday’s London open. The cable’s latest weakness could be linked to the broad market fears over the coronavirus variant and the Brexit woes. However, bears seem to wait for the outcome of European Commission's Brexit point person Maroš Šefčovič’s UK visit on Friday, not to forget the UK Health Security Agency (UKHSA) technical briefing to discuss the variant covid variant. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD side-lines near 0.6200 as traders await US NFP report

AUD/USD consolidates near 0.6200 early Friday, just above its lowest level since October 2022 as traders move to the sidelines ahead of Friday's closely-watched US NFP data releae. Meanwhile, rising bets for an early RBA rate cut, China's economic woes and US-Sino trade war fears act as a headwind for the Aussie.

USD/JPY bulls take a breather above 158.00 ahead of US NFP

USD/JPY takes a breather above 158.00 following the release of household spending data from Japan, slightly off the multi-month top amid wavering BoJ rate hike expectations. However, the widening of the US-Japan yield differential keeps the pair supported amid a bullish US Dollar. US NFP data awaited.

Gold needs a US NFP miss to sustain the upside

Gold price consolidates the weekly gains just below the one-month high of $2,678 set on Thursday as traders eagerly await the US Nonfarm Payrolls data for placing fresh bets.

Lack of Bitcoin allocation could be risky for nations in 2025: Fidelity

Fidelity Digital Assets' Look Ahead report for the crypto market in 2025 highlights key trends expected for the year, including increased Bitcoin adoption by governments worldwide, broader use cases for stablecoins and more app blockchain launches.

How to trade NFP, one of the most volatile events Premium

NFP is the acronym for Nonfarm Payrolls, arguably the most important economic data release in the world. The indicator, which provides a comprehensive snapshot of the health of the US labor market, is typically published on the first Friday of each month.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.