GBP/USD recovers balance post-US Retail Sales

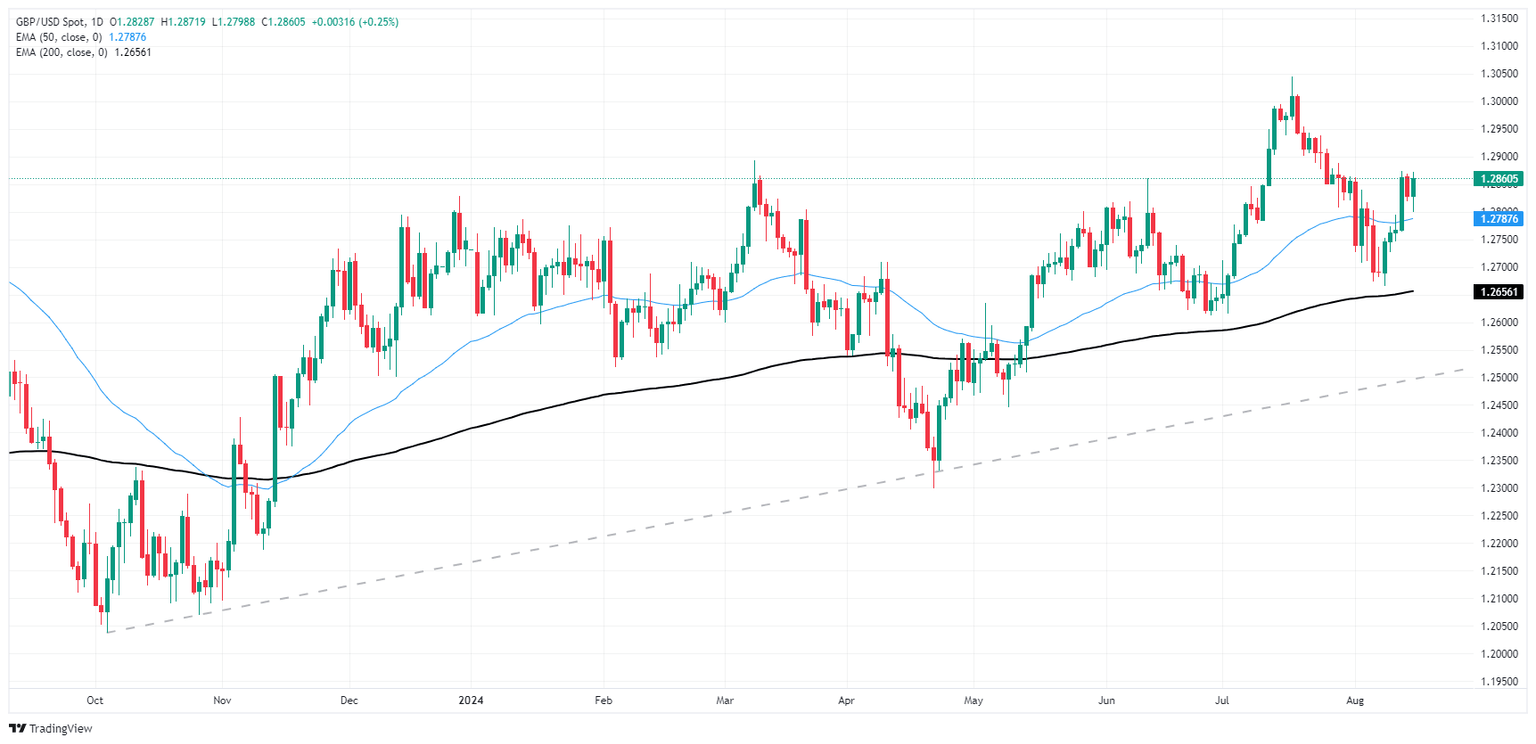

GBP/USD recovered back into the high side on Thursday after a bullish tilt in UK data prints coupled with better-than-expected US

Retail Sales figures helped to improve overall market sentiment and keep the Greenback pinned on the low side.

Read More...

Pound Sterling cools down on upbeat US Retail Sales and lower jobless claims

The Pound Sterling (GBP) gives up the majority of its intraday gains against the US Dollar (USD) in Thursday’s North American trading hours. The GBP/USD pair surrenders its entire intraday gains and drops to near the round-level support of 1.2800. The Cable faces selling pressure after the release of the strong United States (US) monthly Retail Sales data for July and lower Initial Jobless Claims for the week ending August 9.

Read More...

GBP/USD edges higher amid subdued USD demand, remains below mid-1.2700s ahead of UK GDP

The

GBP/USD pair attracts some dip-buying during the Asian session on Thursday and reverses a part of the previous day's post-US CPI retracement slide from the vicinity of the monthly peak. Spot prices currently trade around the 1.2735-1.2740 region, up less than 0.10% for the day as traders now look to the release of the preliminary UK Q3 GDP print for a fresh impetus.

Read More...