Pound Sterling Price News and Forecast: GBP/USD rebounds back above 1.3000

GBP/USD Weekly Forecast: Downside risks remain intact ahead of a big week

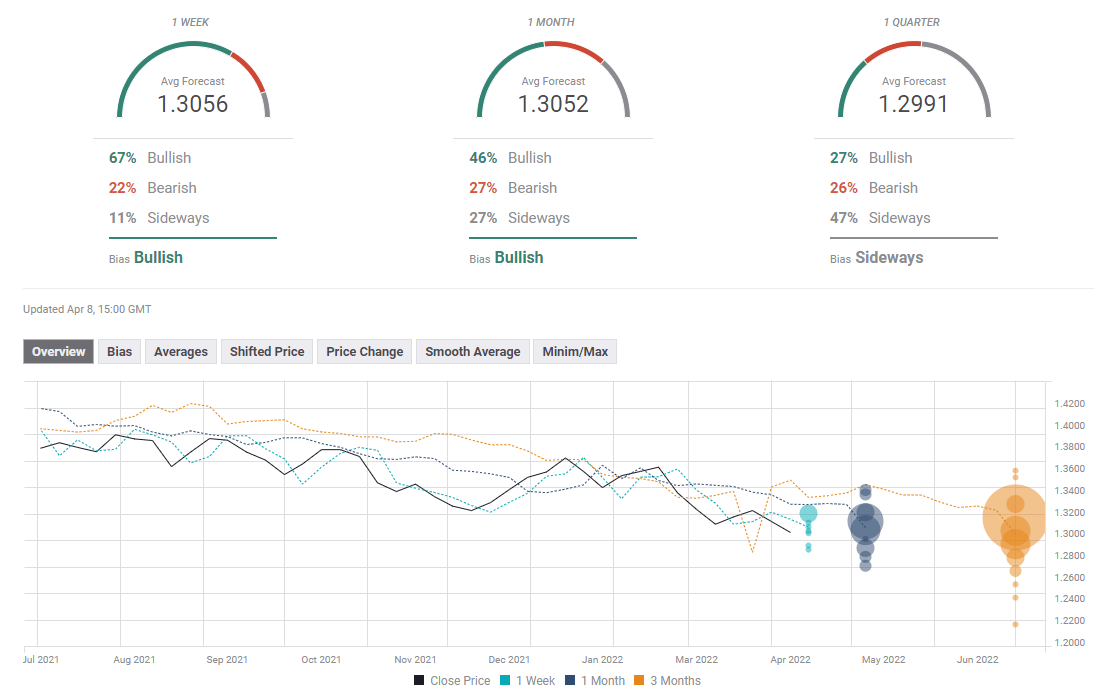

GBP/USD booked the second straight week of losses, as bears refused to give in amid hawkish Fed-driven sentiment and risk-aversion. Cable touched its lowest level since November below 1.3000, as King dollar reigned supreme, partly buoyed by the US bond market rout. With UK and US inflation dropping next week, the downside risks for the currency pair remain intact. Read more...

GBP/USD rebounds back above 1.3000 after hitting lowest levels since November 2020

GBP/USD hit its lowest level since November 2020 at 1.29817 in earlier Friday trade, weighed at the time by a broad strengthening of the US dollar that say the DXY momentarily eclipse 100 for the first time in nearly two years. But the currency pair has since rebounded to around the 1.3030 level, erasing the day’s losses to about 0.3% versus around 0.7% at worst levels. Read more...

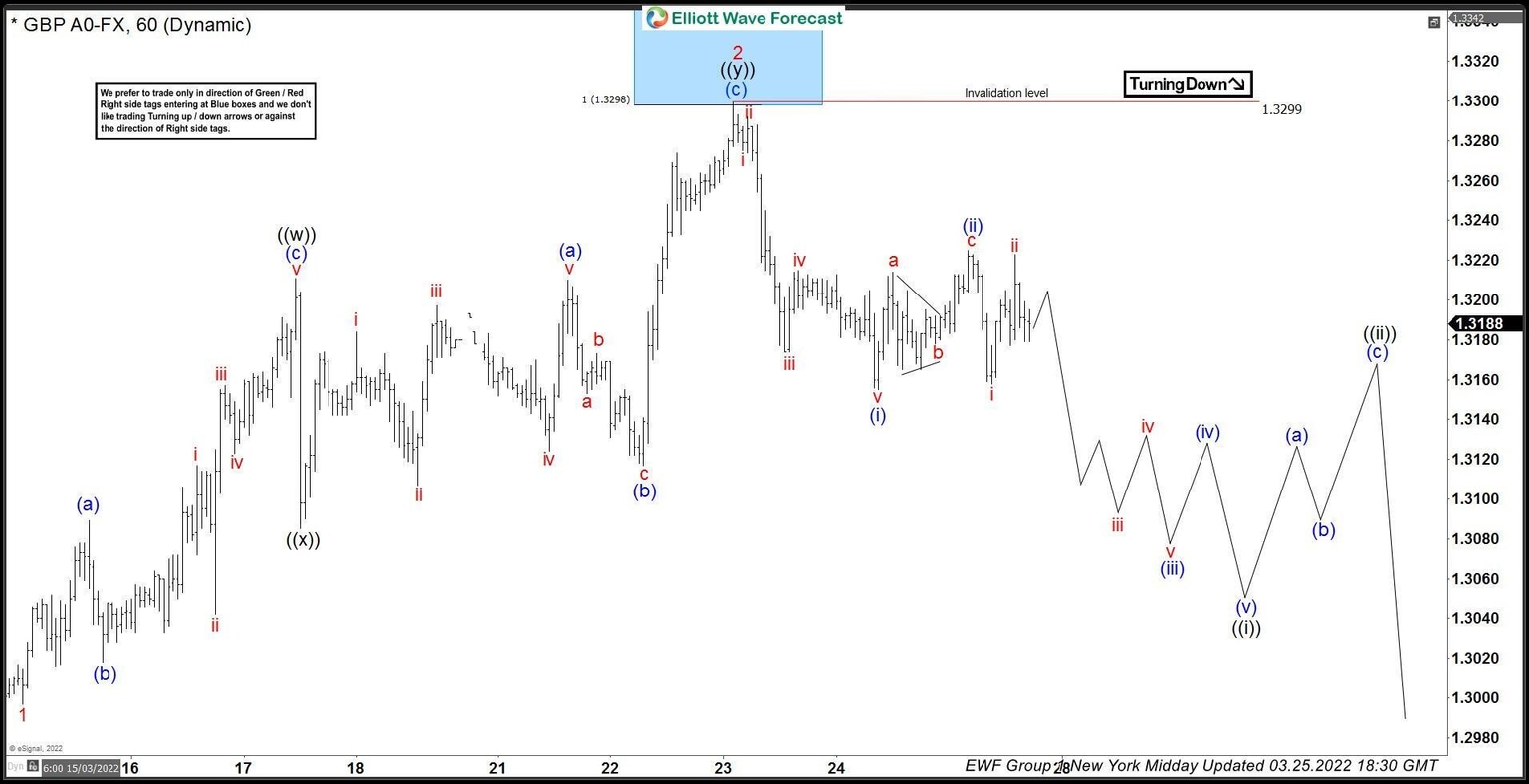

GBP/USD Elliott Wave: Forecasting the short term path

In this technical blog we’re going to take a quick look at the Elliott Wave charts of GBPUSD. The pair has given us nice trading opportunity recently. We have been selling the rallies at 1.3298-1.3348 area as explained in previous article on GBPUSD . Reasons for calling further weakness in pair are bearish sequences in the cycle from the June 1st 2021 peak. We recommended members to avoid buying and keep selling rallies in 3,7,11 swings when get a chance. In further text we are going to explain the Elliott Wave Forecast. Read more...

Author

FXStreet Team

FXStreet