Pound Sterling Price News and Forecast GBP/USD: Range bound with an eye on the BOE

GBP/USD Weekly Forecast: Range bound with an eye on the BOE

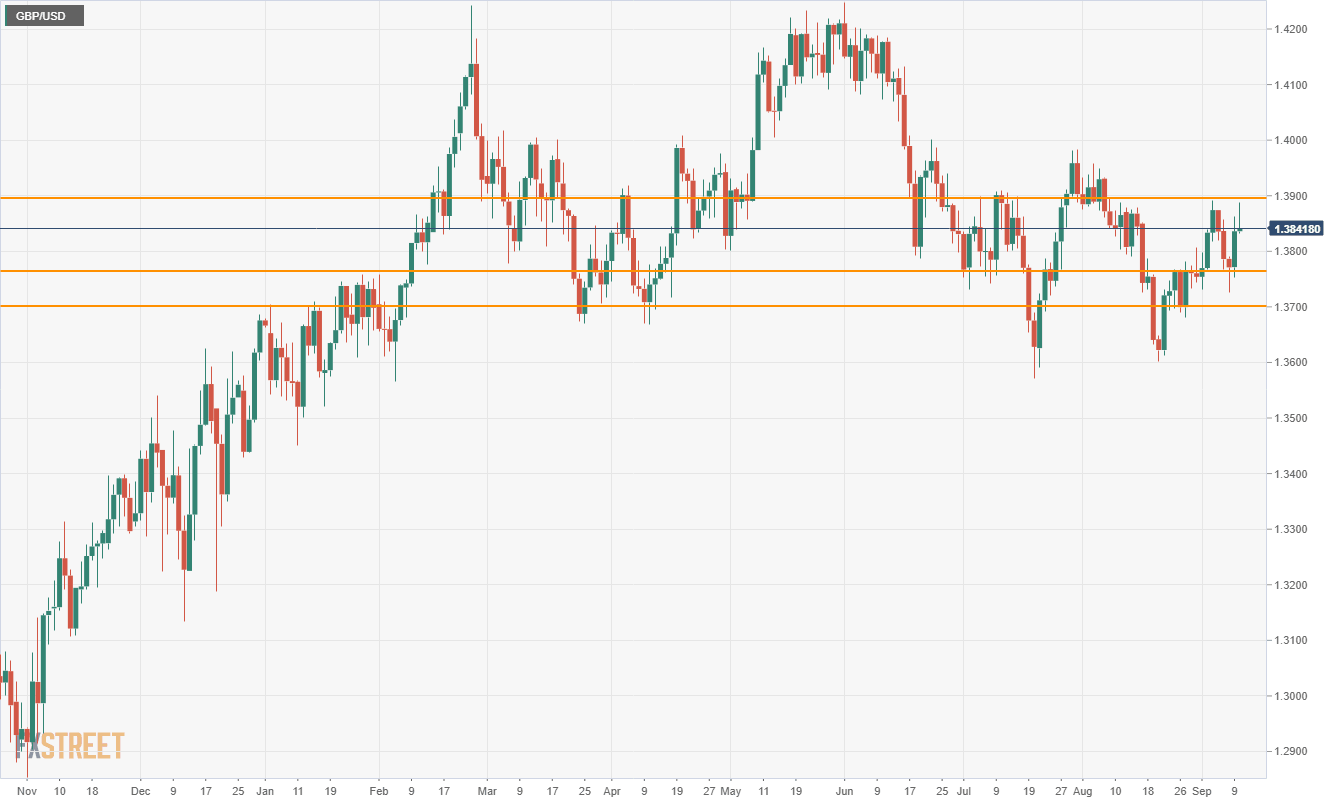

Weak July GDP data restrains sterling and rate hike expectations. GBP/USD finishes the week on par and at the middle of three-month range. Sterling’s recovery on Thursday and Friday ended, temporarily, the threat of the GBP/USD breaking below 1.3765 support and entering the lowest part of its seven-month range. Read more...

GBP/USD fails gains near 1.3900, erases weekly gains

US dollar gains momentum near the end of the week on higher US yields. GBP/USD unable to break key resistance again; upside remains limited. The GBP/USD peaked on Friday at 1.3887, the highest level in a week, and then lost momentum. Near the end of the week, it is trading at 1.3840, around the same level it had a week ago, after erasing daily gains. Read more...

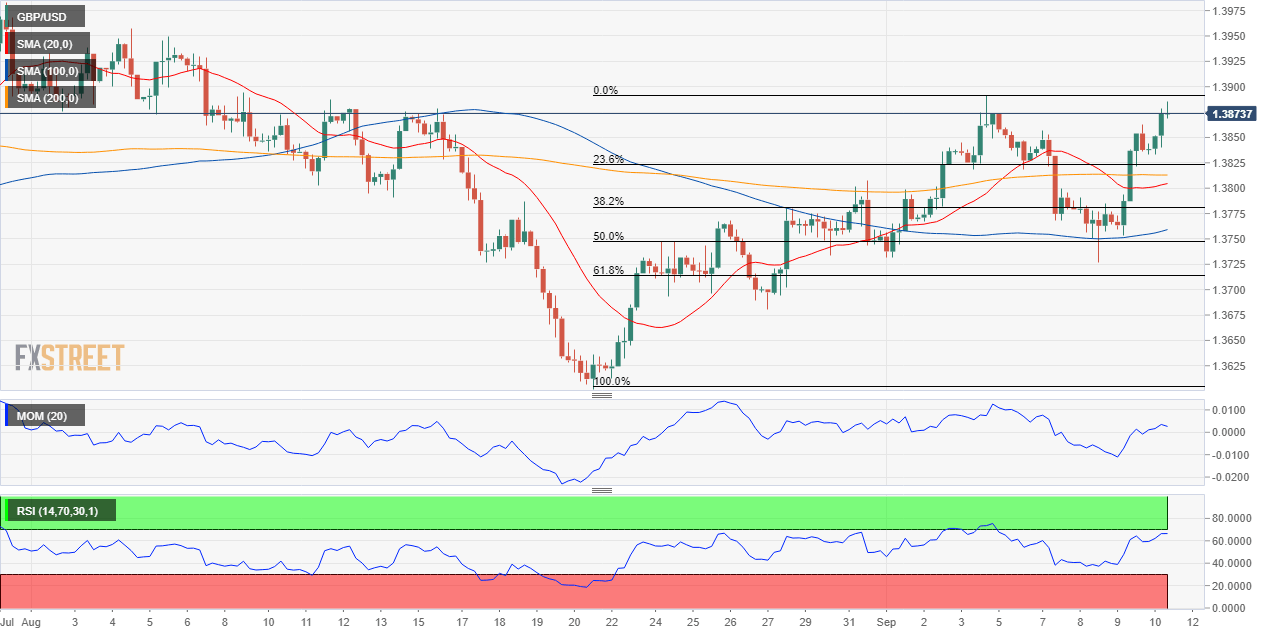

GBP/USD Forecast: Consolidating gains ahead of 1.3900

The GBP/USD pair retains its latest gains and trades near a weekly high of 1.3884 set on Friday. The American dollar remains pressured, despite US government bond yields have recovered from Thursday’s plunge, with that on the 10-year Treasury note currently around 1.32%. The better performance of equities provides additional support to the pair. Read more...

Author

FXStreet Team

FXStreet