GBP/USD bulls need the BoE to throw a hawkish lifeline

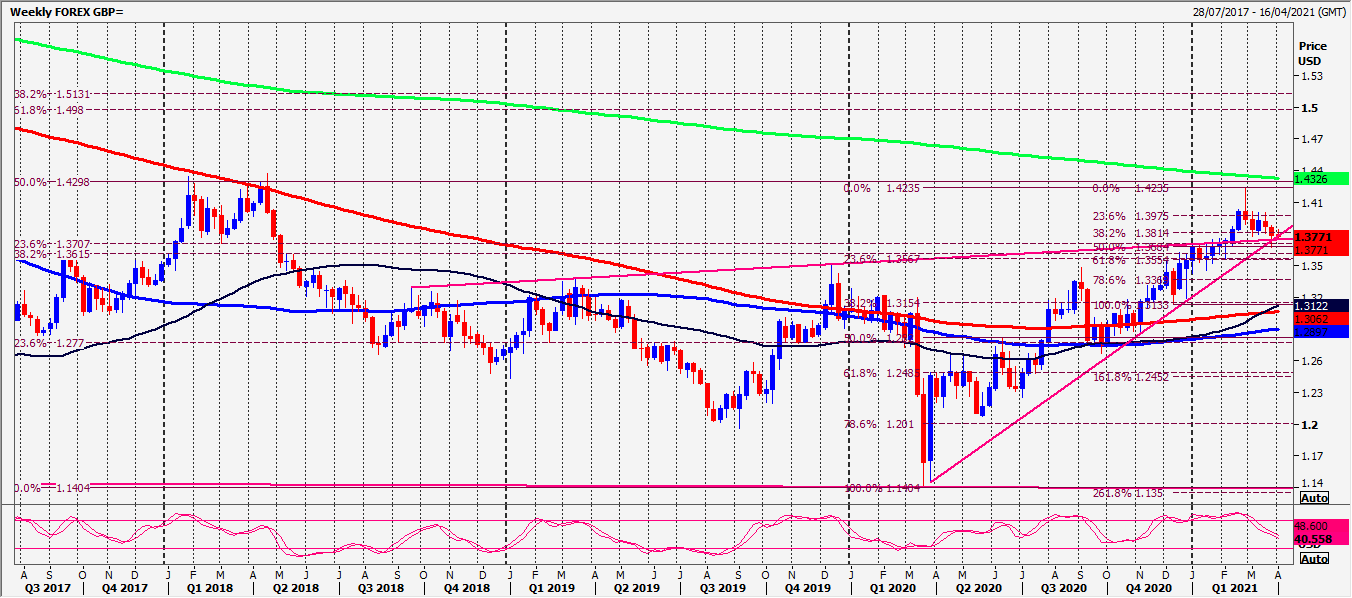

GBP/USD bears seeking a break of the 1.3890 for 1.36 area targets. US dollar is not letting up on hawkish Fed hold. All eyes will turn to the BOE next week following the UK CPI print this week. GBP/USD is currently trading at 1.3924 and down around 0.4% in the afternoon New York session attempting to correct the steep bearish decline. Cable has traded between a high of 1.4008 and a low of 1.3895 on the day so far, reeling in the wake of US dollar strength. Read more...

GBP/USD Forecast: Pressure mounts amid fundamental jitters weighing on pound

The GBP/USD pair traded as low as 1.3895 in the aftermath of a hawkish US Federal Reserve, now heading into the Asian opening trading at around 1.3900. The UK did not release macroeconomic figures that could add to the pound’s behaviour. Still, tensions surrounding the Northern Ireland Protocol undermine sterling´s demand. Read more...

GBP/USD: Gains are likely to be limited

GBPUSD finally broke the 100 month moving average at 1.4080/60 for a sell signal this week targeting 1.4025/15 & 1.3970/60. We bottomed exactly here but are likely to test the 100 day moving average at 1.3940/35, perhaps today. A break below 1.3925 risks a slide to 1.3880/70 & a.3840/30. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD: The bearish outlook remains intact below 1.0900

The EUR/USD pair remains firmer near 1.0880 during the early European session on Tuesday. The uncertainty surrounding the US presidential election outcome weighs on the Greenback and provides some support to the pair.

GBP/USD holds steady near 1.2950 as traders await US presidential election result

The GBP/USD pair trades flat near 1.2950 during the early Tuesday. Traders will closely monitor the outcome of the US presidential election. On Thursday, the attention will shift to the Bank of England and the US Federal Reserve monetary policy decisions.

Gold price recovers early lost ground to over one-week low amid US election concerns

Gold price slides to a one-week low amid some repositioning trades ahead of the US election. Fed rate cut bets, falling US bond yields and subdued USD demand help limit the downside. Middle East tensions also offer support to the XAU/USD and contribute to the modest bounce.

Trump-inspired memecoin MAGA shows bullish on-chain metrics ahead of US elections

MAGA trades slightly down to around $3.4 on Tuesday after rallying more than 20% since Sunday. The former President Donald Trump-based memecoin is poised for further gains as daily active addresses and network growth metrics rise, signaling increased network usage and adoption.

US presidential election outcome: What could it mean for the US Dollar? Premium

The US Dollar has regained lost momentum against its six major rivals at the beginning of the final quarter of 2024, as tensions mount ahead of the highly anticipated United States Presidential election due on November 5.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.