GBP/USD outlook: Cable regained traction and attacks pivotal barriers ahead of UK PMI data

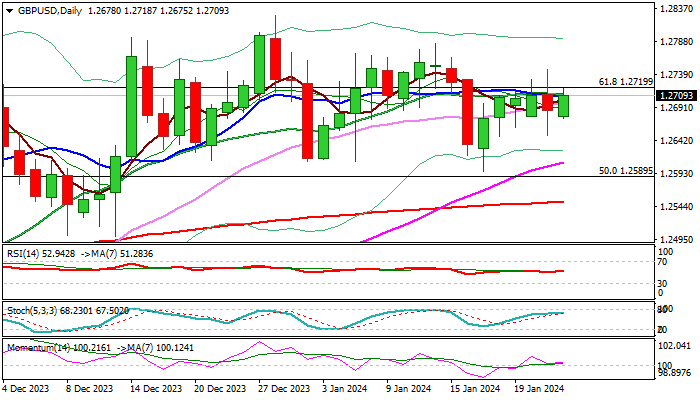

Cable bounced above 1.2700 mark on Wednesday morning, keeping bullish bias after Tuesday’s close in red and indecision signal from strong rejection on both sides.

Fresh strength cracks again pivotal barriers at 1.2710/20 (converged 10/20DMA’s/Fibo 61.8% of 1.3141/1.2037) which so far resisted several attacks. Read more...

GBP/USD Forecast: Pound Sterling trades near key level as markets await PMIs

After rising toward 1.2750 early Tuesday, GBP/USD made a sharp U-turn and lost nearly 100 pips during the American trading hours. The improving risk mood toward the end of the day, however, helped the pair erase a large portion of its daily losses. Early Wednesday, GBP/USD holds steady at around 1.2700. Read more...

GBP/USD surges to near 1.2760 on the upbeat UK PMI data, focus shifts to US PMI

GBP/USD rises to near 1.2760 during the European session on Wednesday. The positive Purchasing Managers Index (PMI) data from the United Kingdom (UK) contribute to a rise in the Pound Sterling (GBP) against the US Dollar (USD). The preliminary S&P Global/CIPS Services PMI for January demonstrated growth, reaching 53.8 compared to the previous figure of 53.4. Additionally, the Manufacturing PMI increased to 47.3 from the earlier reading of 46.2. Concurrently, the Composite PMI showed appreciation, reporting a figure of 52.5 as compared to the previous reading of 52.1. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds near 1.0300 as traders await US NFP

EUR/USD trades in a tight channel at around 1.0300 in the European session on Friday. However, concerns over US President-elect Trump's policies and hawkish Fed expectations keep the US Dollar afloat ahead of the Nonfarm Payrolls data, capping the pair's upside.

GBP/USD struggles to stay above 1.2300, eyes on US jobs report

GBP/USD finds it difficult to gather recovery momentum after rising above 1.2300 earlier in the day. The pair remains vulnerable amid persistent US Dollar strength and the UK bond market turmoil. The focus now shifts to the US labor market data for fresh directives.

Gold climbs to fresh multi-week high above $2,680 ahead of US NFP

Gold price (XAU/USD) gains some follow-through positive traction for the fourth consecutive day and trades at its highest level in nearly a month above $2,680. Market focus shifts to US labor market data, which will feature Nonfarm Payrolls and wage inflation figures.

Nonfarm Payrolls forecast: US December job gains set to decline sharply from November

US Nonfarm Payrolls are expected to rise by 160K in December after jumping by 227K in November. US jobs data is set to rock the US Dollar after hawkish Fed Minutes published on Wednesday.

How to trade NFP, one of the most volatile events Premium

NFP is the acronym for Nonfarm Payrolls, arguably the most important economic data release in the world. The indicator, which provides a comprehensive snapshot of the health of the US labor market, is typically published on the first Friday of each month.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.