GBP/JPY bears on the prowell and testing weekly support

GBP/JPY bears in town and eye lower lows ahead. The cross is on the brink of breaking below critical weekly support. GBP has collapsed in classic risk-off fashion with the US dollar rallying to fresh cycle highs in the pursuit of blue skies on the DXY chart. At the time of writing, cable is trading 1.3640 and down close to 1% while the GBP/JPY cross is lower by the same percentage with USD/JPY flat on the day. Read more...

GBP/USD Forecast: Poised to test July low at 1.3571

The British Pound was among the worst performers against the greenback, with GBP/USD falling to 1.3639, its lowest for this August, holding nearby ahead of the Asian opening. The pound came under renewed selling pressure amid a dismal market’s mood pushing investors into safer bets. The UK macroeconomic calendar was empty, which made it easier to sell the sterling. Read more...

GBP/USD Forecast: Sterling suffers, and a dollar breather may fail to lift it

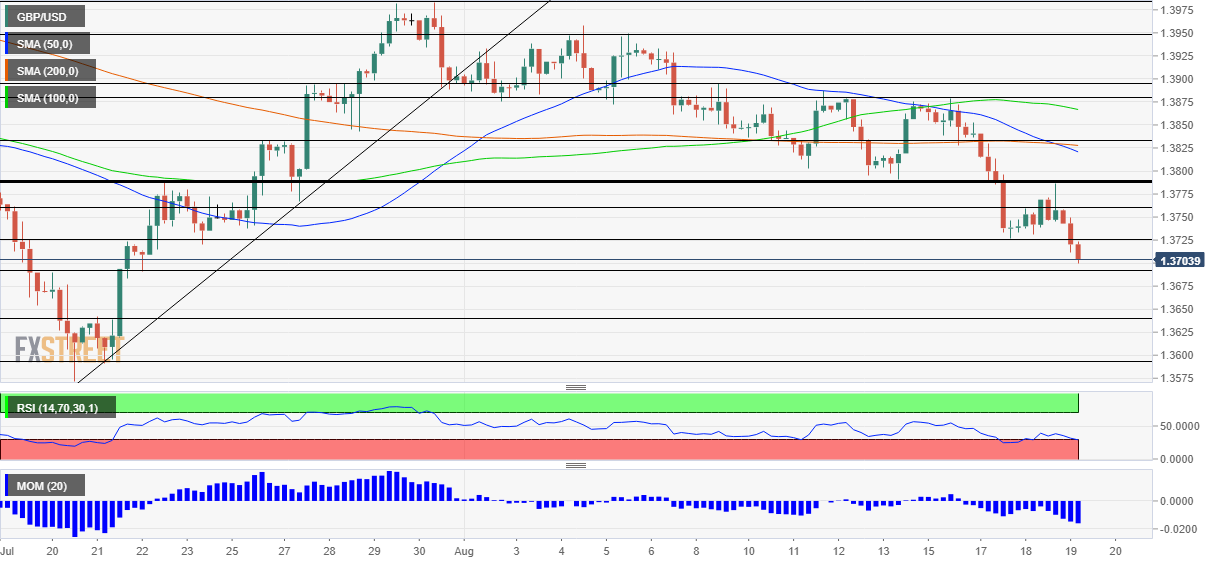

GBP/USD has tumbled to around 1.37 following the Fed's meeting minutes. Rising UK covid cases could hamper a recovery attempt. Thursday's four-hour chart is pointing to further pain for the pound. Blame it on Biden or on Boris? The chaos in Kabul has prompted a lively debate in the British parliament that will likely continue for long days. In currency markets, the most recent downfall of GBP/USD can be easily attributed to America's central bank – but it would be hard for the pound to recover. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

GBP/USD climbs above 1.2500 after UK GDP data

GBP/USD gathers bullish momentum and trades above 1.2500 in the European session on Thursday. Pound Sterling benefits from the improving risk mood and the upbeat UK data, which showed that the economy expanded at an annual rate of 1.4% in Q4, surpassing the market expectation of 1.1%.

EUR/USD stays strongly bid toward 1.0450 ahead of EU data

EUR/USD continues its upward momentum for the third straight session, eyeing 1.0450 in the European session on Thursday. The pair draws support from the unabated US Dollar selling in anticipation of an end to the Russia-Ukraine war. EU and US data also remain in focus.

Gold price struggles to capitalize on intraday gains amid receding Fed rate cut bets

Gold price attracts buyers for the second straight day amid a combination of supportive factors. Concerns about Trump’s trade tariff and a modest USD weakness underpin the XAU/USD pair.

Ripple's XRP eyes a recovery as investors switch toward accumulation

Ripple's XRP is up 2% in the early Asian session on Thursday following rising accumulation among investors and a potential bottom signal in the MVRV Ratio.

How the European Union could counter US tariffs

With Trump ordering a 25% import tax on all steel and aluminium entering the US, trade tensions are inching closer to Europe. We take a closer look at how European policymakers could react. Spoiler alert: it's complicated.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.