Pound Sterling Price News and Forecast: GBP/USD plummets as BoE cut rates unanimously

GBP/USD plummets as BoE cut rates unanimously

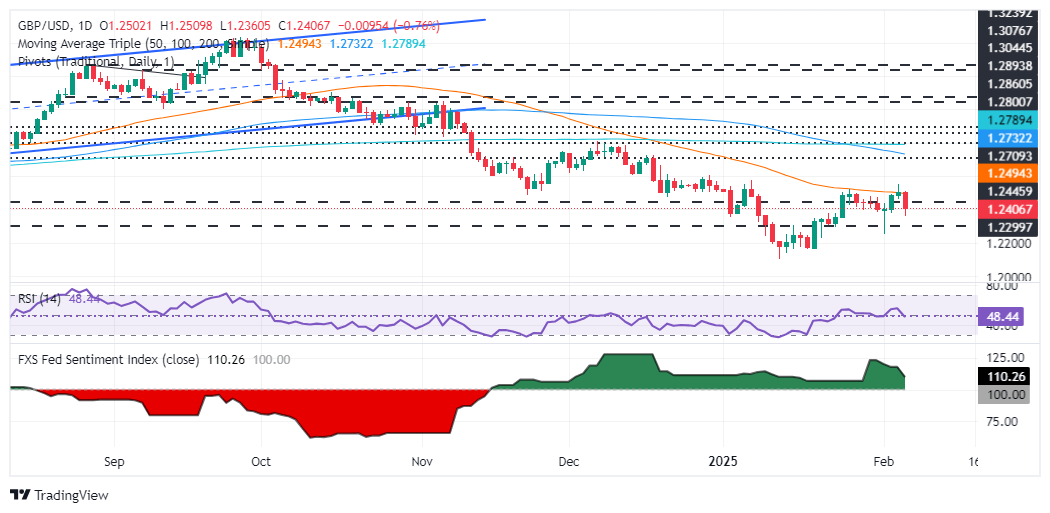

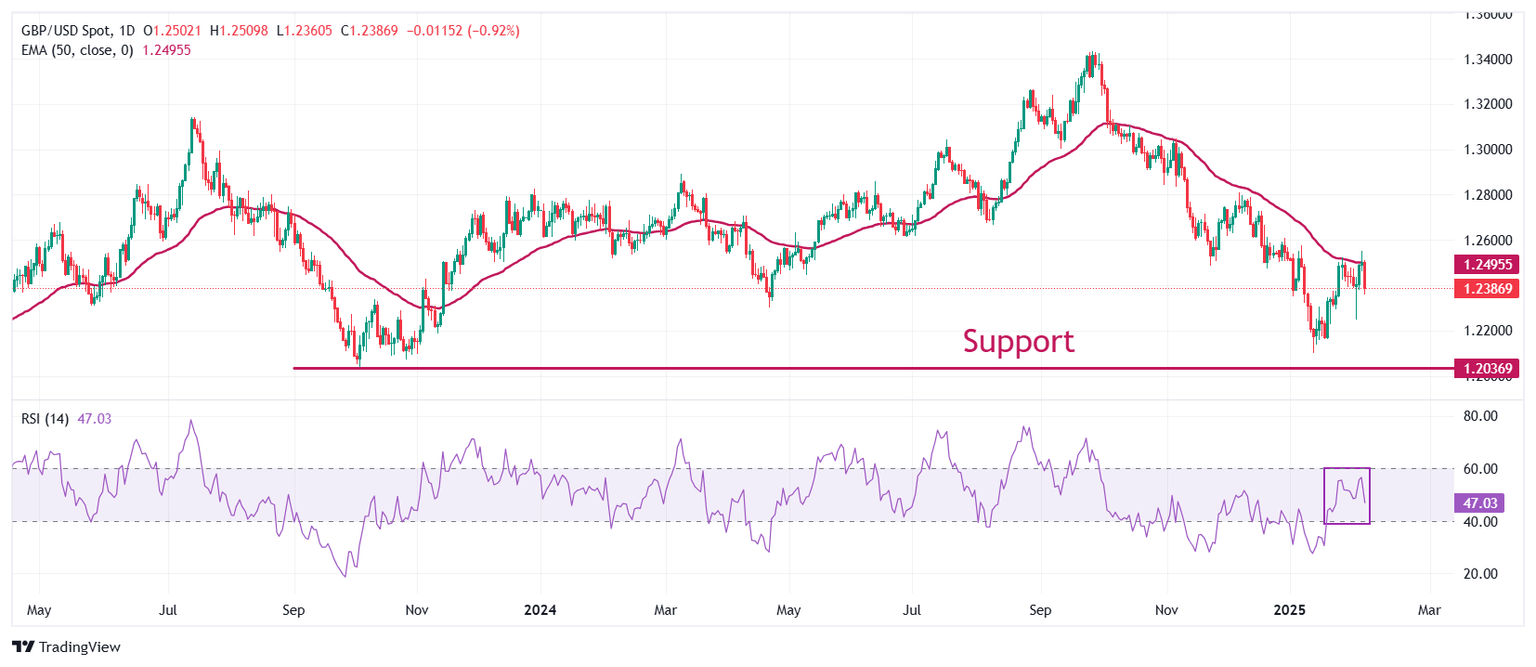

The Pound Sterling fell during Thursday’s North American session, down 0.79% after the Bank of England (BoE) reduced the Bank Rate by 25 basis points. Therefore, the GBP/USD tumbled below 1.2400 and hit a daily low of 1.2359. At the time of writing, the pair trades at 1.2405. Read More...

Pound Sterling plummets as two BoE members favor 50 bps interest rate cut

The Pound Sterling (GBP) plummets against its major peers in Thursday's North American session after the Bank of England (BoE) monetary policy meeting in which the central bank reduced interest rates by 25 basis points (bps) to 4.5%. This is the third interest rate cut by the BoE in its current policy-easing cycle, which started at the August 2024 policy meeting and the central bank was widely anticipated to do the same. Read More...

GBP/USD steadies around 1.2500, downside risks appear due to dovish mood surrounding BoE

GBP/USD halts its three-day winning streak, trading around 1.2490 during the Asian hours on Thursday. The Pound Sterling (GBP) could face downward pressure amid expectations that the Bank of England (BoE) will resume its policy-easing cycle, likely lowering interest rates by 25 basis points (bps) to 4.5% later in the day. Read More...

Author

FXStreet Team

FXStreet