Pound Sterling Price News and Forecast GBP/USD: Nonfarm Payrolls and the virus curve set to stir sterling

GBP/USD trims losses as the US dollar pulls back, remains in the range

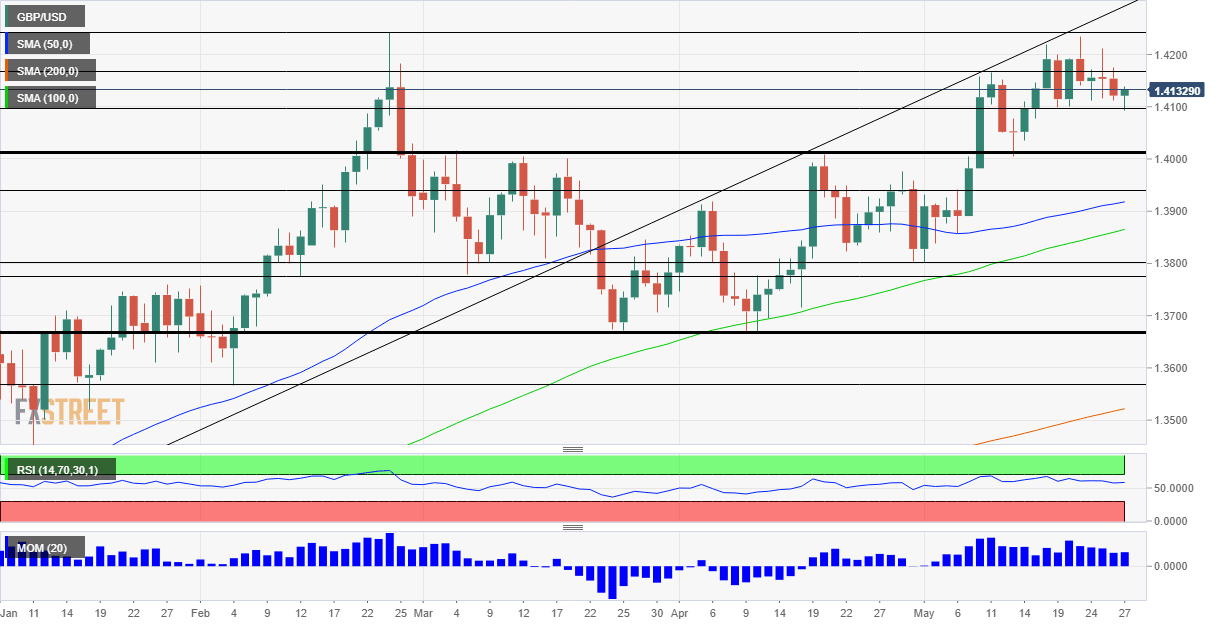

The GBP/USD bottomed before the release of US data at 1.4135 amid a rally of the US dollar across the board. Afterward, the greenback lost strength favoring a rebound in cable back above 1.4150. The intraday bias still points to the downside in GBP/USD but the bearish pressure eased significantly. The economic data from the US came in mostly above expectations. The US dollar at first extended gains and later pulled back, amid a decline in US yields. Read more...

GBP/USD Weekly Forecast: Nonfarm Payrolls and the virus curve set to stir sterling

GBP/USD has been unable to take advantage of dollar weakness due to rising UK covid cases. Early June's daily chart is painting a mixed picture for the currency pair. The FX Poll is pointing to losses on all timeframes. The Fed has downed the dollar – but sterling has also suffered from its own issues. As the page turns on June, cable is at a crossroads, and the all-important US jobs reports may serve as a tiebreaker. UK covid developments and other events are also in play. Read more...

GBP/USD drops to mid-1.4100s ahead of the key US inflation data

A broad-based USD strength prompted selling around GBP/USD on the last day of the week. The upbeat UK economic outlook, BoE Vlieghe’s hawkish comments might help limit losses. The market focus remains on the Fed’s preferred inflation gauge, Biden’s budget proposal. The intraday USD buying picked up pace during the mid-European session and dragged the GBP/USD pair to fresh daily lows, around the 1.4155-50 region. Read more...

Author

FXStreet Team

FXStreet