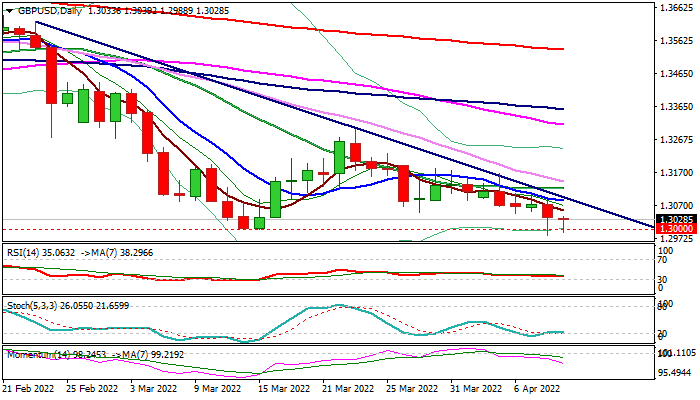

GBP/USD outlook: Bears probe again through key 1.30 support

Cable remains in a negative mode in early Monday and probed again through key 1.30 support (psychological/Mar 15 low), following last Friday’s short-lived dip to 1.2982 (the lowest since Nov 2020).

Rising US dollar keeps the pound in defensive, while weaker than expected UK Feb GDP data added pressure to the currency, threatening of a final clear break of 1.30 pivot that would risk extension towards 1.2855/ 20 zone (lows of Nov/Oct 2020 respectively). Read more...

GBP/USD moves sideways ahead of UK data dump

The Australian dollar remained under pressure after the country’s prime minister called for a new election in May. Scott Morrison will face off with Anthony Albanese, the leader of the center-left Labor Party. The campaign has focused mostly on the rising inflation in the country and defense. While Morrison is trailing in polls, analysts expect that the results will be close. The announcement came a few days after the Reserve Bank of Australia (RBA) delivered its interest rate decision. The bank now expects that rates will start rising in June. Analysts expect a 0.25% rate hike and two more later this year. Read more...

GBP/USD Forecast: Pound to extend recovery as long as 1.3000 holds

GBP/USD has staged a rebound after having declined below 1.3000 in the late Asian session on Monday. In case risk flows start to dominate the financial markets, the pair could extend its correction in the short term.

Rising US Treasury bond yields provided a boost to the greenback at the beginning of the week. The US Dollar Index (DXY), which rose more than 1% amid the Fed's aggressively hawkish stance last week, edged higher earlier in the day. With the market mood-improving modestly in the European morning, however, the DXY turned negative on the day. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD turns south toward 0.6500 as US Dollar finds fresh demand

AUD/USD hs turned south toward 0.6500 in Asian trading on Wednesday. The pair lacks bullish conviction after the PBOC left the Lona Prime Rates unchanged. Escalating Russia-Ukraine geopolitical tensions and renewed US Dollar demand keep the Aussie on the edge ahead of Fedspeak.

USD/JPY jumps back above 155.00 as risk sentiment improves

USD/JPY has regained traction, rising back above 155.00 in Wednesday's Asian session. A renewed US Dollar uptick alongside the US Treasury bond yields and an improving risk tone counter Japanese intervention threats and Russia-Ukraine tensions, allowing the pair to rebound.

Gold advances to over one-week high on rising geopolitical risks

Gold price (XAU/USD) attracts some follow-through buying for the third consecutive day on Wednesday and climbs to a one-and-half-week high, around the $2,641-2,642 region during the Asian session.

UK CPI set to rise above BoE target in October, core inflation to remain high

The UK CPI is set to rise at an annual pace of 2.2% in October after increasing by 1.7% in September, moving back above the BoE’s 2.0% target. The core CPI inflation is expected to ease slightly to 3.1% YoY in October, compared with a 3.2% reading reported in September.

How could Trump’s Treasury Secretary selection influence Bitcoin?

Bitcoin remained upbeat above $91,000 on Tuesday, with Trump’s cabinet appointments in focus and after MicroStrategy purchases being more tokens.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.