Pound Sterling Price News and Forecast: GBP/USD minor dips should remain well-supported

GBP/USD Forecast: Pound sterling to stay rangebound ahead of key events

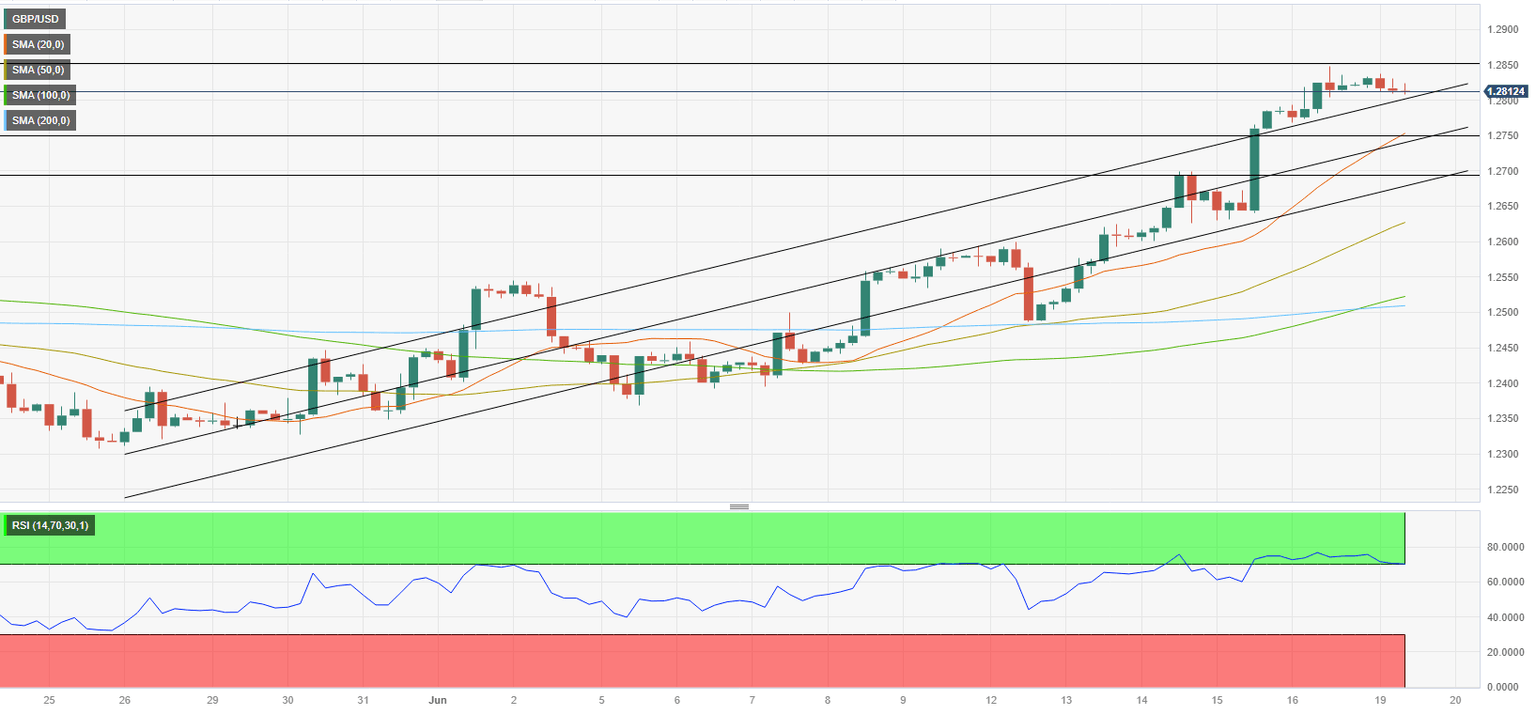

GBP/USD went into a consolidation phase above 1.2800 on Monday after having climbed to its strongest level in 14 months at 1.2850 on Friday. The pair could have a difficult time building on last week's gains in the near term, with investors moving to the sidelines ahead of this week's key macroeconomic events. Read more...

GBP/USD: Minor dips should remain well-supported – Scotiabank

Economists at Scotiabank analyze GBP outlook.

EUR/GBP to see a further fall towards support around 0.8450

Sterling gains have steadied versus the USD, with oscillator signals veering towards overbought on the intraday and daily studies. Read more...

GBP/USD: Longs stretched but acceleration to 1.30 may gather momentum depending on Wednesday’s CPI – SocGen

GBP/USD pauses after a 1.95% gain last week. Economists at Société Générale analyze GBP outlook ahead of the UK Consumer Price Index (CPI) data and the Bank of England (BoE) meeting this week. Read more...

Author

FXStreet Team

FXStreet