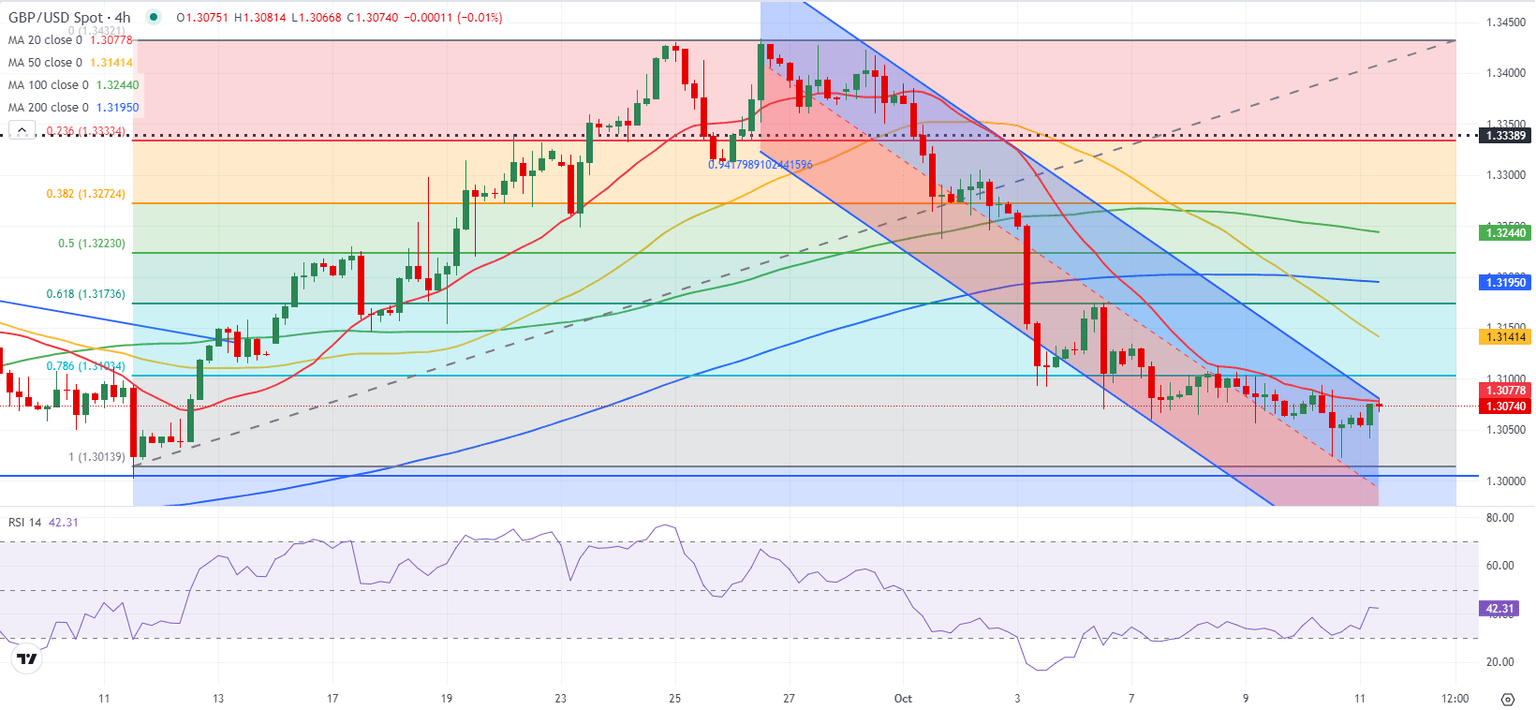

Pound Sterling Price News and Forecast: GBP/USD managed to erase a portion of its daily losses

GBP/USD Forecast: Sellers could move aside if Pound Sterling rises above 1.3100

GBP/USD clings to small daily gains early Friday after closing marginally lower on Thursday. The pair could extend its recovery if it manages to flip 1.3100 into support.

After coming in within a touching distance of 1.3000 in the early American session on Thursday, GBP/USD managed to erase a portion of its daily losses as the mixed macroeconomic data release from the US limited the US Dollar's (USD) strength. Read more...

GBP/USD heads towards $1.3000, as UK economy suffers from the ‘August effect’

The UK economy returned to growth in August, it expanded 0.2% on a monthly and 3-month-on-month basis. This means that unless the growth bounced back sharply last month, the UK economy most likely moderated in Q3 compared to the 0.5% growth rate in Q2. Delving into the details of the report reveals that all main sectors of the economy expanded last month, however, service growth was meagre at just 0.1%, while production and construction were robust, expanding by 0.5% and 0.4% respectively.

The picture is one of slowing growth in the UK, compared to the first half of this year. Some sectors that had an especially strong month included accountancy, retail and manufacturing. Although oil production was weaker. Service growth, which is usually been the mainstay of British growth, barely budged in August. Read more...

Author

FXStreet Team

FXStreet