Pound Sterling Price News and Forecast: GBP/USD looks to break out of range on BOE commentary

GBP/USD Outlook: Bulls seem non-committed, remain at the mercy of USD price dynamics

The GBP/USD pair edges higher for the third successive day on Thursday, though remains below the 1.2100 mark through the Asian session. The uptick is sponsored by subdued US Dollar demand, which has been struggling to capitalize on the upbeat NFP-inspired rally to a one-month low amid the uncertainty over the Fed's rate-hike path. Fed Chair Jerome Powell Fed Chair Jerome Powell struck a balanced tone on inflation and reiterated on Tuesday that the process of disinflation was underway. This, in turn, fuels speculations that interest rates may not rise much further, exerting some pressure on the US Treasury bond yields and keeping the USD bulls on the defensive. Powell, however, acknowledged that rates might need to move higher than expected if the economy remained strong. Raed more ...

GBP/USD Forecast: Pound Sterling looks to break out of range on BOE commentary

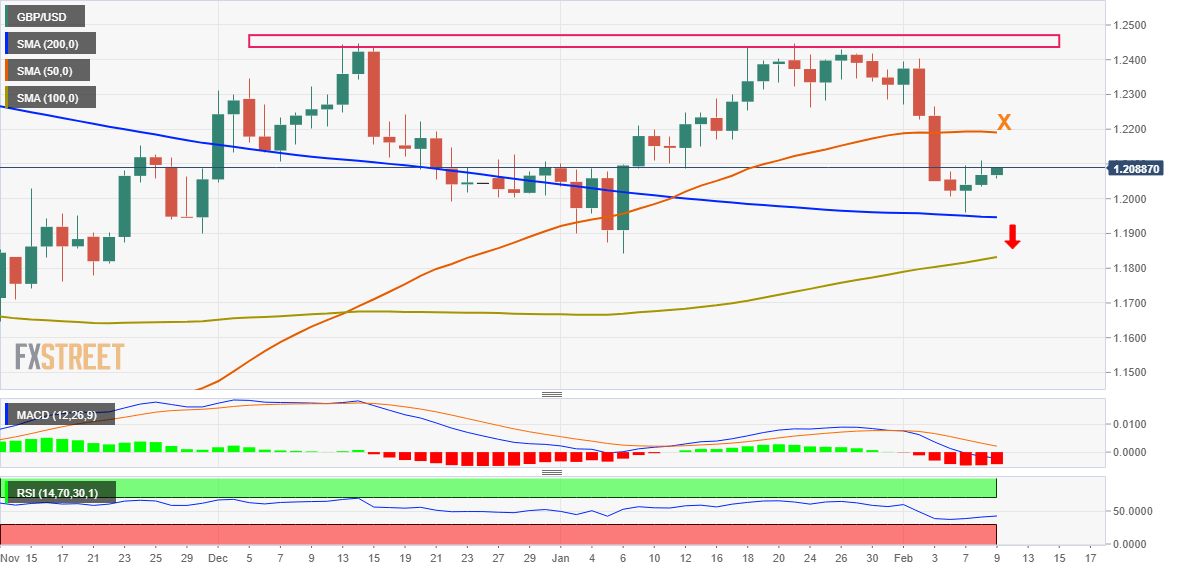

GBP/USD has been struggling to make a decisive move in either direction and moving horizontally at around 1.2100 in the second half of the week. The near-term technical outlook fails to offer a clear directional bias and investors will pay close attention to comments from Bank of England (BOE) policymakers during the policy hearing at the UK Treasury Select Committee.

Following its decision to hike the policy rate by 50 basis points as expected last week, the BOE announced that it lowered its one-year inflation projection to 3.01% from 5.2% in November's forecast. Although BOE Governor Bailey noted that inflation risks were more skewed to the upside than any time in the Monetary Policy Committee's history, Pound Sterling has been struggling to find demand since the BOE event. Read more...

GBP/USD rallies to fresh weekly high, eyes mid-1.2100s amid notable USD supply

The GBP/USD pair builds in this week's bounce from the vicinity of mid-1.1900s, representing the very important 200-day SMA and gains traction for the third successive day on Thursday. The buying interest picks up pace during the first half of the European session and lifts spot prices to a fresh weekly high, around the 1.2135 region in the last hour.

The US Dollar struggles to capitalize on its post-NFP rally and retreats sharply from a one-month top, which, in turn, pushes the GBP/USD pair higher. The uncertainty over the Fed's rate-hike path exerts some downward pressure on the US Treasury bond yields. This, along with a goodish recovery in the global risk sentiment, is seen undermining the safe-haven buck. Read more...

Author

FXStreet Team

FXStreet