Pound Sterling Price News and Forecast: GBP/USD keeps bounce off four-month low

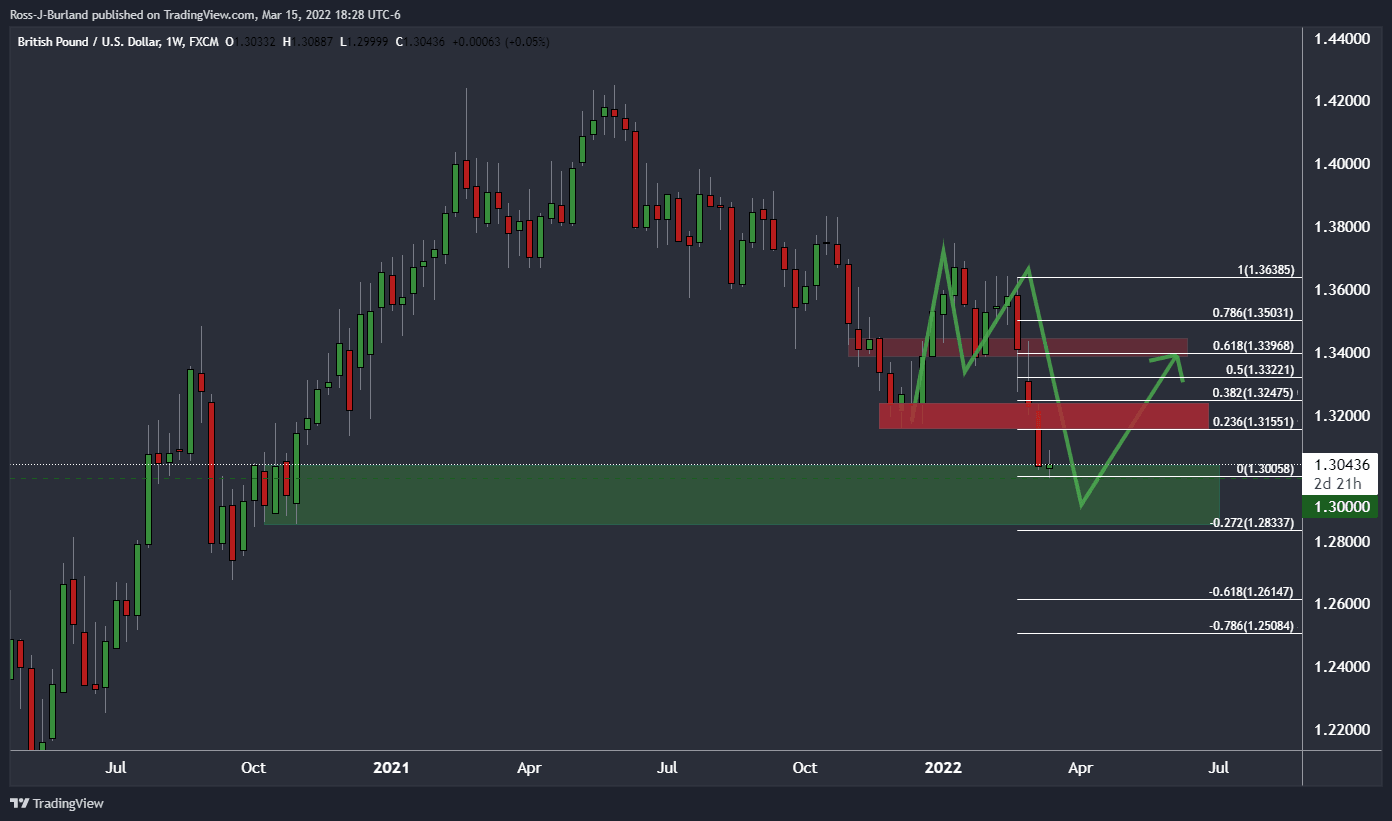

GBP/USD Price Analysis: GBP/USD bears on the prowl, 1.30 vulnerable

GBP/USD is stalling in the sell-off as the price moves into what could be deemed as a solid longer-term demand area. However, there is room to go with 1.2850 in focus for the days and weeks ahead. In the meantime, there are prospects of a bullish correction as per the daily chart.

GBP/USD keeps bounce off four-month low around mid-1.3000s ahead of Fed

GBP/USD treads water around 1.3040-50 amid anxious market conditions during Wednesday’s Asian session. The cable pair snapped a three-day downtrend to bounce off the lowest levels since November 2021 following the upbeat UK jobs report. Also on the positive side was the US dollar’s retreat amid pre-Fed caution.

Author

FXStreet Team

FXStreet