British Pound gains ground as UK inflation rises

The British pound has edged higher after UK inflation rose unexpectedly in December. In the European session, GBP/USD is trading at 1.2694, up 0.47%. UK inflation has a tendency to surprise the markets and that happened again on Wednesday as December CPI ticked upwards to 4.0% y/y, up from 3.9% in November and above the consensus estimate of 3.8%. The main driver of the upswing was higher alcohol and tobacco prices. Monthly, CPI rose 0.4%, up from -0.2% in November and higher than the consensus estimate of 0.2%.

Core CPI remained unchanged at 5.1% y/y, above the consensus estimate of 4.9%. Monthly, the core rate surged 0.6%, compared to -0.3% in November and above the consensus estimate of 0.4%. For the Bank of England, the rise in inflation is a nasty surprise, in particular the sharp rise in monthly core CPI. Still, one disappointing inflation report will not lead to the Bank of England changing its monetary policy. Read more...

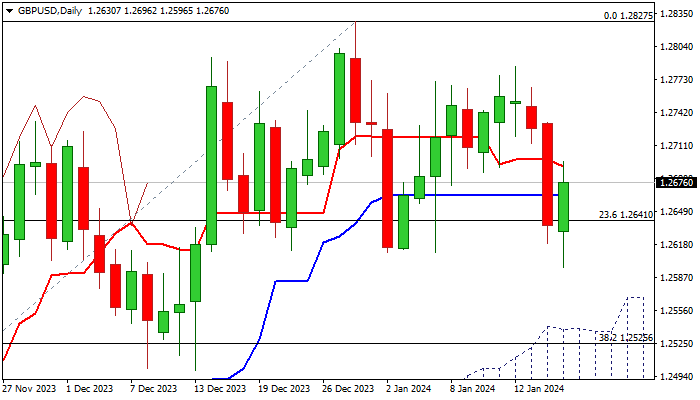

GBP/USD outlook: Cable jumped around 0.4% in European trading on Wednesday

Cable jumped around 0.4% in European trading on Wednesday, lifted by above forecast UK December inflation data, which soured the sentiment about rate cut, pushing percentage of bets for rate cut by May significantly lower. Fresh gains move the price from dangerous zone after the price retested the floor of larger range at 1.2600 zone, which extends into fifth consecutive week.

Although the price action moved into range’s mid-point, there is still notable lack of clearer direction signals, as negative momentum on daily chart is strengthening, but moving averages are mixed and rising and thickening daily cloud continues to underpin. Read more...

Pound Sterling soars on surprisingly sticky UK Inflation data

The Pound Sterling (GBP) delivers a stalwart recovery on Wednesday after the release of the surprisingly stubborn United Kingdom consumer price inflation data for December. The GBP/USD pair recovers losses as hopes of an early rate cut by the Bank of England (BoE) have waned amid higher price pressures. The Consumer Price Index (CPI) came in higher than expected amid a significant rise in Oil prices and slightly higher service inflation.

Still-high inflation in the UK means that BoE policymakers have more room to maintain interest rates at the current 5.25% for a longer period. BoE policymakers have been warning that it is too early to discuss interest rate cuts as price pressures are far above the required rate of 2%. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays pressured toward 1.0800 amid fresh US Dollar demand

EUR/USD is posting small losses, directed toward 1.0800 in Friday’s European trading. The pair is undermined by a renewed US Dollar buying and investors'' caution ahead of German parliamnet's Upper House vote on the spending plan, Trump and Fed-speak.

GBP/USD holds losses below 1.2950 on sustained US Dollar strength

GBP/USD keeps the red below 1.2950 in the early European session on Friday. Resurgent US Dollar demand amid cautious Fed and economic uncertinaties remain a drag on the pair, despite the BoE's hawkish hold decision. The focus shifts to the Fedspeak and US President Trump's Oval address.

Gold price hangs near multi-day low on stronger USD; bears lack conviction amid trade jitters

Gold price continues losing ground for the second straight day on Friday, though it managed to rebound slightly from the $3,020 area during the early European session. The Federal Reserve's forecast for only two 25 basis points (bps) rate cuts by the end of this year assists the US Dollar in gaining positive traction for the third successive day

Bitcoin, Ethereum and Ripple stabilize as SEC Crypto Task Force prepares for First roundtable discussion

Bitcoin price hovers around $84,500 on Friday after recovering nearly 3% so far this week. Ethereum and Ripple find support around their key levels, suggesting a recovery on their cards.

Tariff wars are stories that usually end badly

In a 1933 article on national self-sufficiency1, British economist John Maynard Keynes advised “those who seek to disembarrass a country from its entanglements” to be “very slow and wary” and illustrated his point with the following image: “It should not be a matter of tearing up roots but of slowly training a plant to grow in a different direction”.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.