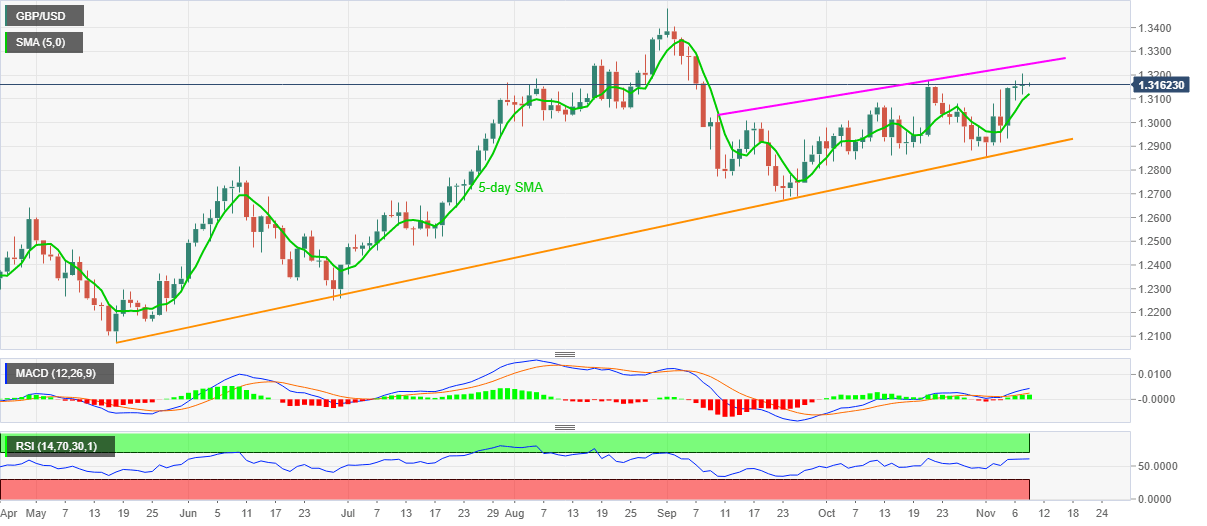

GBP/USD Price Analysis: Bulls struggle near two-month top, 5-day SMA offers immediate support

GBP/USD recedes to 1.3160 during the initial hour of Tuesday’s Asian session. The pair refreshed the two-month peak on Monday but failed to stay positive beyond 1.3200.

However, bullish signals from the MACD joins strong RSI, not near the overbought region, favor the GBP/USD buyers to keep the optimism while targeting a resistance line stretched from September 10, at 1.3246 now. In doing so, a clear break above the recent high of 1.3208 becomes necessary.

While the quote is likely to post another U-turn from the mid-1.3200 area, any further upside can be challenged by the August 18 high near 1.3270, a break of which could challenge the yearly top surrounding 1.3485.

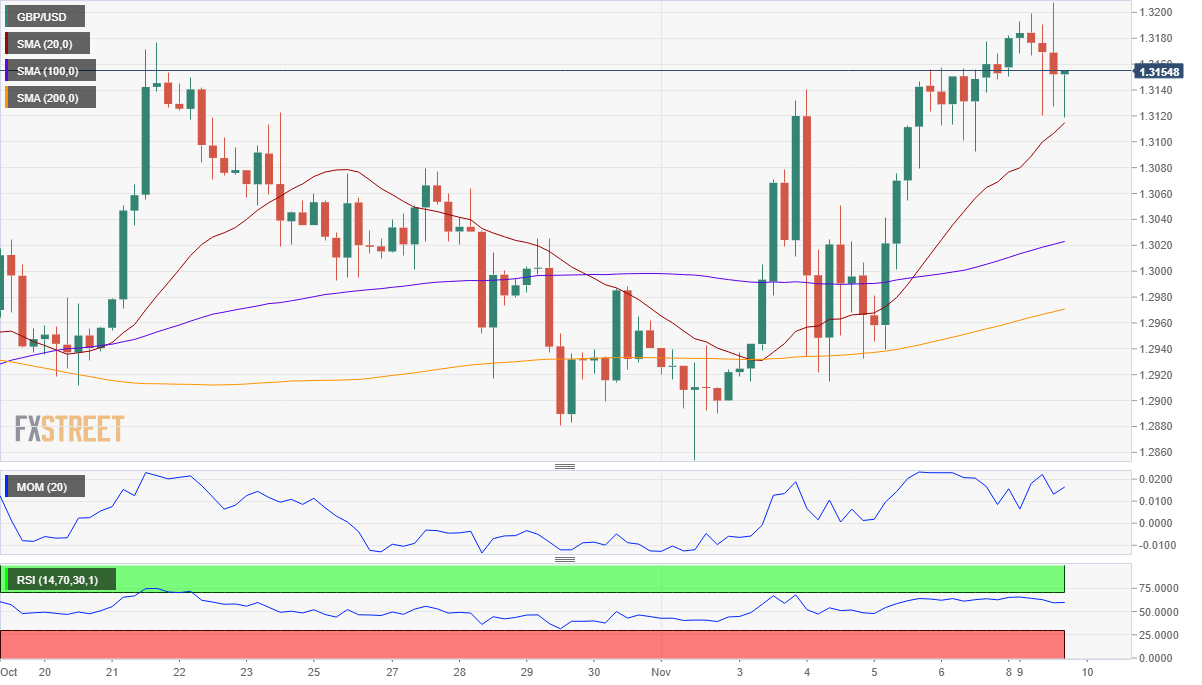

GBP/USD Forecast: Brexit returns to the limelight

The GBP/USD pair is ending the first day of the week unchanged around 1.3150, after reaching a fresh two-month high of 1.3207. The British Pound found eased as speculative interest rushed into the greenback on positive coronavirus vaccine news, but its slump was limited by encouraging Brexit headlines. UK Finance Minister Rishi Sunak said that significant progress was made in Brexit talks while announcing a plan to provide stability to the financial sector in the post-Brexit era. Meanwhile, EU's chief Brexit negotiator Michel Barnier said they are redoubling their efforts to reach an agreement on the future EU-UK partnership.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds lower ground below 0.6350 after dismal Australian data

AUD/USD keeps its offered tone intact below 0.6350 in Wednesday's Asian trading, undermined by below forecasts Australian Constuction Output and monthly CPI data. The data fan more RBA rate cut expectations. Risk-off flows and renewed US Dollar demand also add to the weight on the Aussie.

USD/JPY: Rebound gathers steam to near 149.50

USD/JPY is extending the rebound to near 149.50 in Asian trading on Wednesday. The pair tracks the upswing in the US Dollar and the US Treasury bond yields, fuelled by the US House passage of the Republican Budget plan, advancing Trump's tax plans.

Gold buyers jump back amid tariff uncertainty

Gold price struggles to build on Tuesday’s rebound in the Asian session on Wednesday. Gold buyers try their luck as safe-haven flows return on US President Donald Trump’s tariff uncertainty and weak US economic prospects.

Strategy stock dips as Bitcoin price crashes below $90K, sparking concerns of forced liquidation

Strategy witnessed an 11% stock decline on Tuesday, stirred by Bitcoin's market's plunge below $90,000 and fueling speculations of a forced liquidation for the company.

Five fundamentals for the week: Fallout from German vote, Fed's favorite figure stand out Premium

Statements, not facts, are set to dominate the last week of February. Further fallout from Germany's elections and new comments from Trump on trade may overshadow most figures –but not the Fed's favorite inflation figure.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.