Pound Sterling Price News and Forecast: GBP/USD is being dragged lower by weakness in the euro on Monday

GBP/USD hits fresh session lows, eyes test of 1.3650 as euro slides

GBP/USD is being dragged lower by weakness in the euro on Monday. Versus the US dollar, sterling and the euro have a positive correlation, which is unsurprisingly really given that geographical proximity and trade interdependence of the UK and EU (i.e. economic weakness in one seeps into the other).

Cable currently trades at lows of the day in the 1.3650s and EUR/USD continues to press lower, having only very briefly managed to surpass the 1.3700 level during the early part of the European morning. At present, the pair trades lower by about 0.1% or just over 15 pips on the day, but if the current downtrend in EUR/USD persists, the pair is likely to drop further.

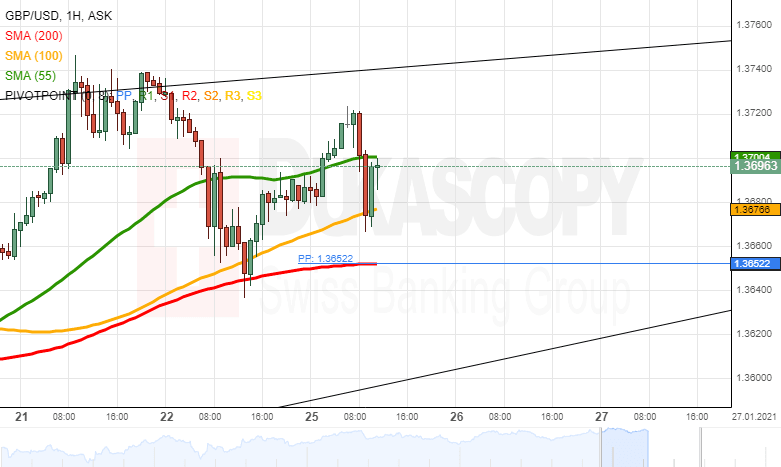

GBP/USD analysis: Follows rising wedge pattern

GBP/USD

The GBP/USD exchange rate continues to follow the rising wedge pattern.

From a theoretical perspective, it is likely that the currency pair could re-test the lower pattern line circa 1.3600. If the given pattern holds, a reversal north could occur.

Meanwhile, note that the exchange rate could gain support from the 200-hour SMA and the weekly PP near 1.3650. Thus, the rate could re-test the upper pattern line. If the predetermined pattern holds, a breakout north could occur.

Author

FXStreet Team

FXStreet