Pound Sterling Price News and Forecast GBP/USD: Investors eye Brexit headlines as next catalyst

GBP/USD plummets down to 1.3420 post-US CPI figures, amid increasing Brexit tensions

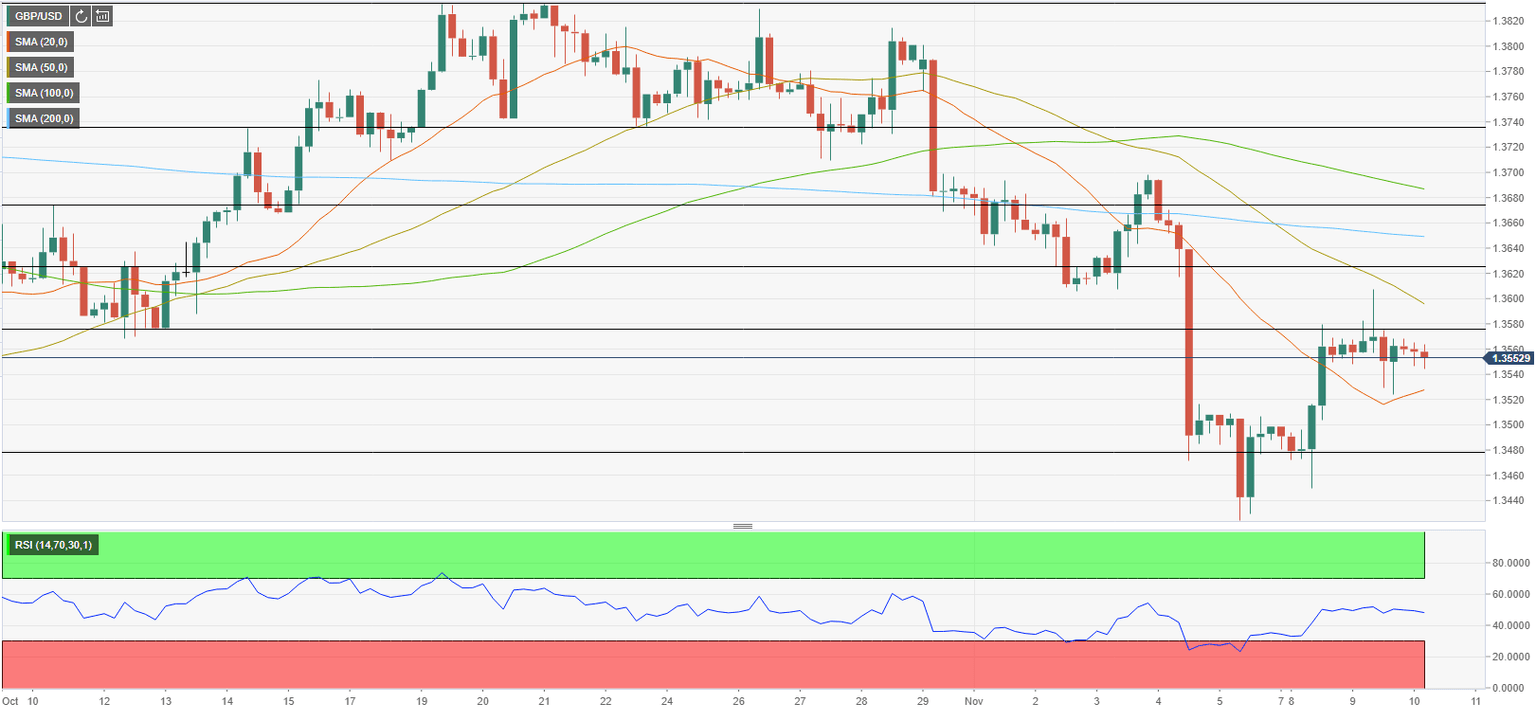

The British pound reverses this week’s gains and some more, plummeting 160 pips during the day, down almost 1%, trading at 1.3426 at the time of writing. Since the beginning of the week, the GBP/USD pair trimmed last Friday’s losses, bouncing from 1.3400 to this week’s high (November 9) at 1.3606, amid the lack of a catalyst, mainly driven by US dollar weakness. Also, lower US bond yields dragged the greenback lower, ahead of the critical US CPI release. Read more...

GBP/USD: Five scenarios for trading UK Q3 growth figures + technical levels

Will the Bank of England raise rates in December? That is a critical question for the pound, and Gross Domestic Product figures for the third quarter could provide a signal. Economists expect an increase of 1.5% after a rapid expansion of 5.5% in the second quarter. Uncertainty is elevated. Read more...

GBP/USD Forecast: Investors eye Brexit headlines as next catalyst

GBP/USD remains at the mercy of the dollar's market valuation as heightened concerns over the UK triggering Article 16 don't allow the British pound to find demand. Following Monday's decisive rebound, GBP/USD failed to reclaim 1.3600 with the greenback holding its ground against its major rivals amid the negative shift witnessed in market sentiment. Reflecting the dollar's resilience, the US Dollar Index trades in the positive territory above 94.00 in the early European session on Wednesday. Read more...

Author

FXStreet Team

FXStreet

-637721406202442378-637721740742980286.png&w=1536&q=95)