Pound Sterling Price News and Forecast: GBP/USD in a third week of declines? Delta, data and dollar

GBP/USD outlook: Bulls regain traction but more evidence needed to signal reversal

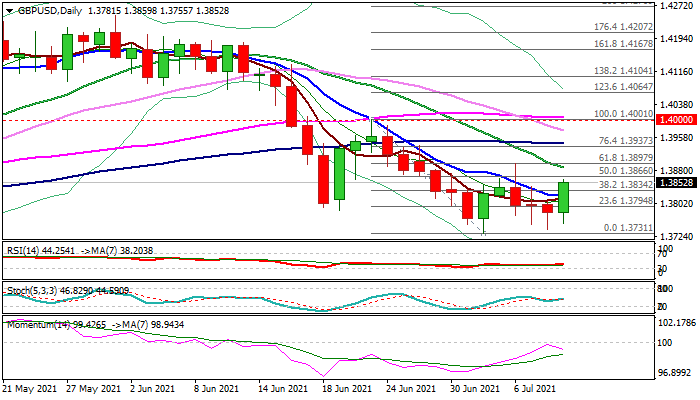

Cable regained traction on Friday after negative tone prevailed during this week, with three-day drop ending with a hammer candle that generated initial bullish signal. Fresh advance nearly fully reversed losses of this week but needs lift above pivotal barriers at 1.3887/97 (falling 20DMA / Fibo 61.8% of 1.4001/1.3731 bear-leg) to confirm reversal signal and open way for stronger recovery. Formation of bullish engulfing today would add to positive tone, but stall of 19-d momentum rally on approach to centreline and subsequent descend, warn that recovery may run out of steam. Read more...

GBP/USD Weekly Forecast: A third week of declines? Delta, data and dollar strength promise action

GBP/USD has failed to take advantage of the upcoming UK reopening. Inflation data on both sides of the pond, UK jobs and US retail sales predict major movement ahead. Mid-July's daily chart shows bears remain in the lead. The FX Poll is pointing to a gradual upward move. King Dollar reigned supreme, almost regardless of bond yields and some Fed caution. Top-tier US consumer data and Britain's jobs report are now eyed – alongside growing fears of the Delta variant on both sides of the pond. Read more...

GBP/USD quickly erodes 50-pips, turns south towards 1.3800

GBP/USD rises for the first time in four trading days. Risk recovery offsets poor UK data, Brexit, covid woes. DXY weakness boosts the cable but London fix weighs. GBP/USD runs into fresh supply into the London fix on Friday, quickly giving away nearly 50-pips to turn back towards the 1.3800 level. Read more...

Author

FXStreet Team

FXStreet

-637614343319302440-637614467686421145.png&w=1536&q=95)