Pound Sterling Price News and Forecast: GBP/USD ignores overbought conditions after UK data

GBP/USD Forecast: Pound Sterling ignores overbought conditions after UK data

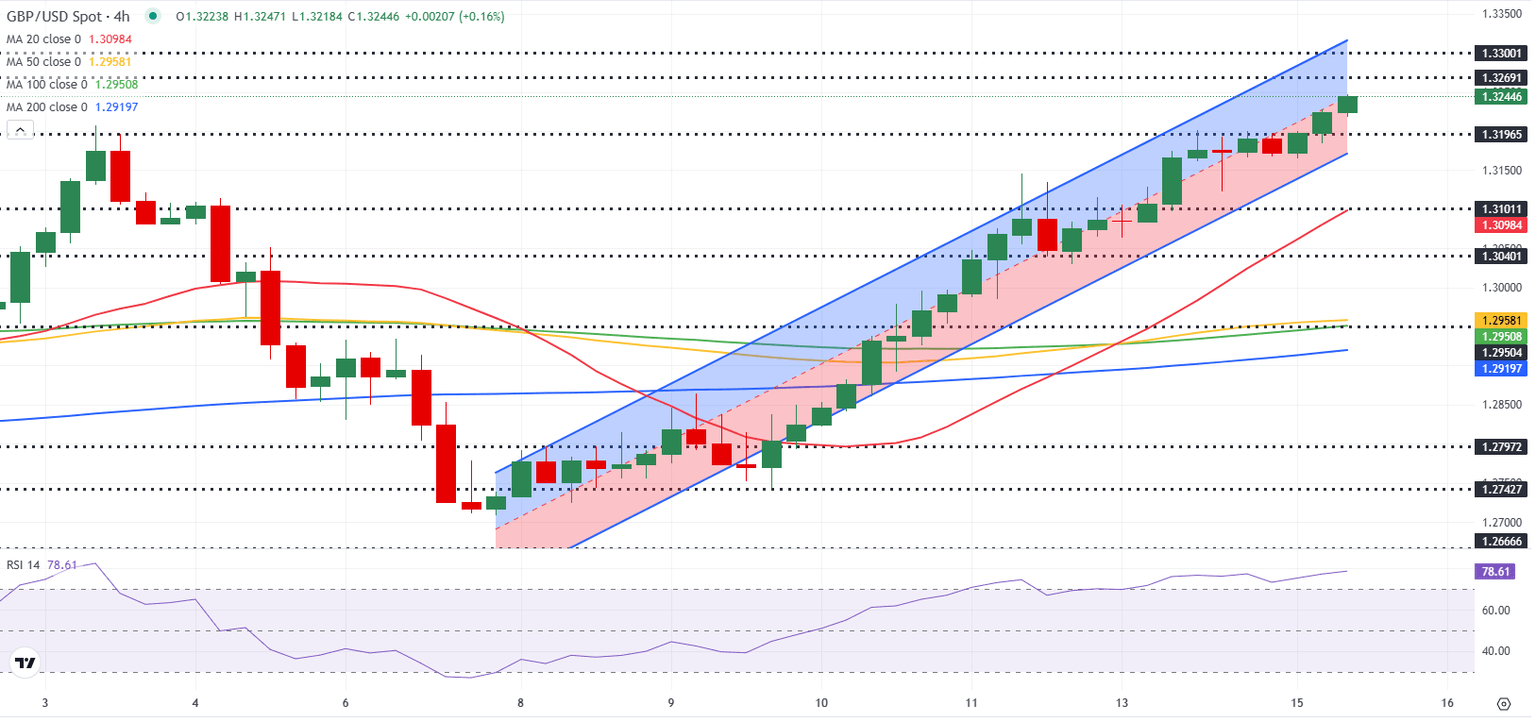

GBP/USD preserves its bullish momentum after posting gains for five consecutive days and trades at a fresh 2025-high near 1.3250 on Tuesday. The pair's technical picture points to overbought conditions.

Pound Sterling gathered strength on Tuesday following the UK employment data. In the three months to February, the ILO Unemployment Rate held steady at 4.4%, the Office for National Statistics (ONS) reported. Further details of the publication showed that job vacancies fell below their pre-pandemic levels for the first time in nearly four years. Read more...

GBP/USD outlook: Bulls test again 1.3200 barrier, eye UK data for fresh signals

Cable remains well supported at the start of the week and extends steep ascend into fifth consecutive day.

Bulls crack 1.3200 barrier again (following last attempt and false break higher on April 3) but is likely to face headwinds at this zone again as daily indicators are entering overbought zone and traders may pull the break ahead of release of UK labor data (Tuesday) and Inflation report (Wednesday) which provide fresh signals. Read more...

Author

FXStreet Team

FXStreet