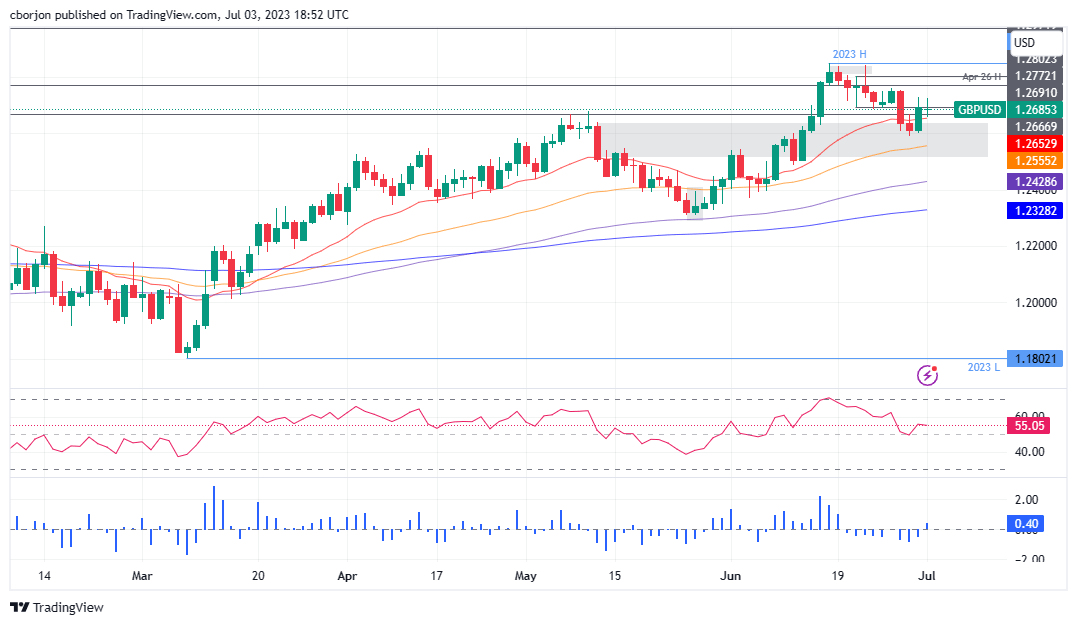

GBP/USD holds steady as US PMI slows, UK data sparks recessionary talks

GBP/USD stayed firm at the beginning of the year’s second half, at around the 1.2690s area; post-data release in the United States (US) showed manufacturing activity slowed down. Meanwhile, UK data portrayed a slight improvement but remained in recessionary territory. At the time of writing, the GBP/USD is trading at 1.2690, almost unchanged.

Read More...

Pound Sterling turns choppy as investors await key PMI figures

The Pound Sterling (GBP) is demonstrating a non-directional performance above the crucial support of 1.2660 as United Kingdom's global Manufacturing PMI numbers (June) have outperformed expectations. The economic data jumped to 46.5 versus the expectations and the former release of 46.2. The GBP/USD pair broadly looks well-supported as inflationary pressures in the Britain region are struck above 8.5% and showing no signs of easing despite the restrictive monetary policy.

Read More...

GBP/USD oscillates in a narrow range around 1.2700, remains below 200-hour SMA

The GBP/USD pair struggles to gain any meaningful traction on the first day of a new week and oscillates in a narrow trading band, around the 1.2700 mark through the Asian session. Spot prices, meanwhile, remain below Friday's swing high and so far, have been struggling to make it through the 200-hour Simple Moving Average (SMA).

Read More...