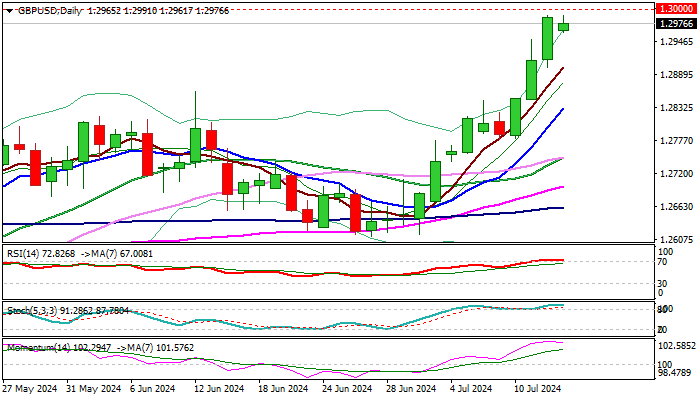

Pound Sterling holds gains near 1.3000 ahead of UK inflation data

The Pound Sterling (GBP) consolidates slightly below the psychological resistance of 1.3000 against the US Dollar (USD) in Tuesday’s London session. The GBP/USD pair struggles to extend its upside as the US Dollar gains ground after Federal Reserve (Fed) Chair Jerome Powell’s speech at the Economic Club of Washington on Monday.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, manages to hold the key support at around 104.00. Powell acknowledged that recent inflation data has added confidence that inflation is on course to return to the desired rate of 2%. Read more...

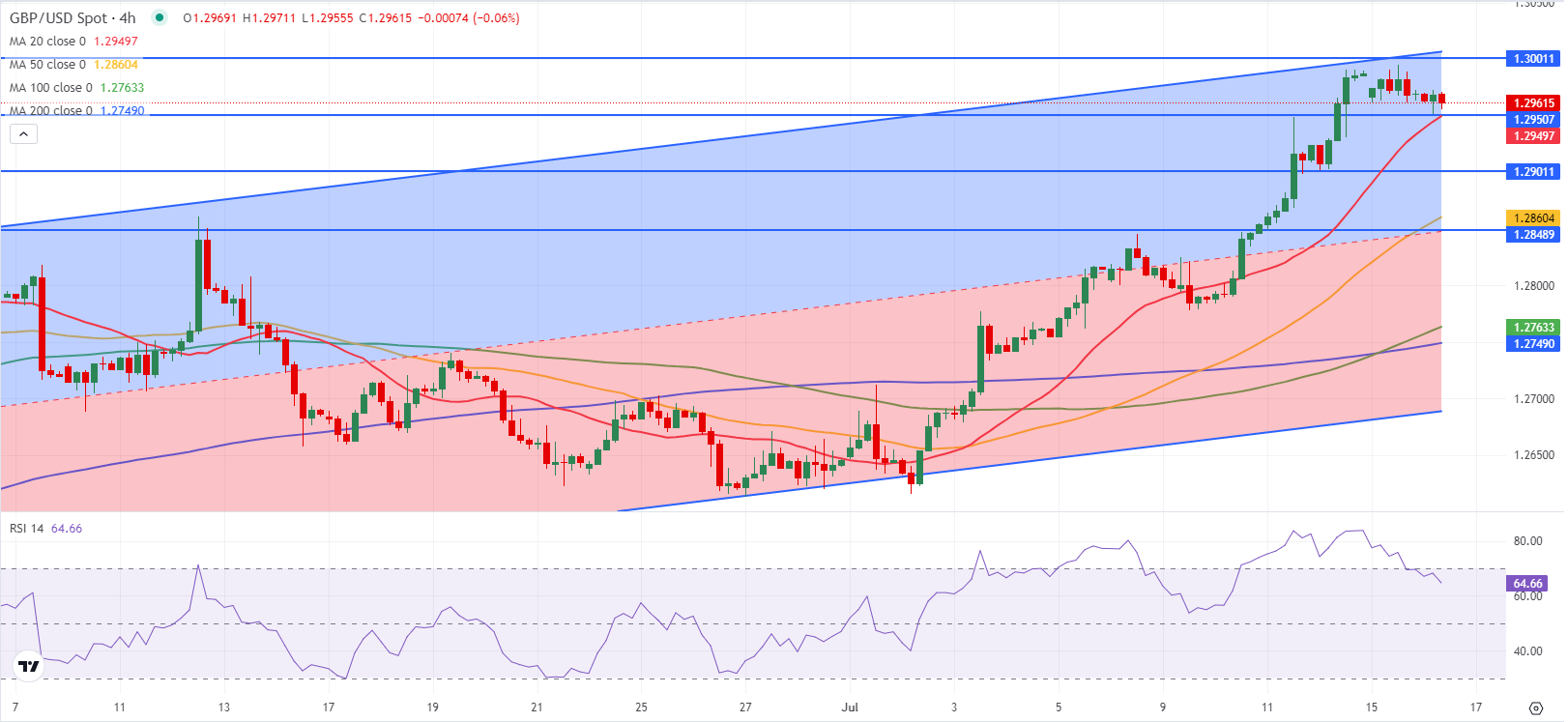

GBP/USD Forecast: Pound Sterling could struggle to gain traction ahead of key UK data

GBP/USD lost its traction after coming in within a touching distance of 1.3000 on Monday and closed the day modestly lower. The pair holds steady slightly above 1.2950 in the European session on Tuesday.

The cautious market mood helped the US Dollar (USD) find a foothold at the beginning of the week, causing GBP/USD to correct lower from the highest level it touched in nearly a year. During the American trading hours, Federal Reserve (Fed) Chairman Jerome Powell said that inflation readings in the second quarter represented further progress but repeated that he is not going to send any signals on any particular meeting. Read more...

GBP/USD outlook: Cable is holding near 1.3000 barrier ahead of Powell's speech

Cable keeps form tone on Monday and hit new yearly high, trading just ticks under psychological 1.30 barrier. The pair advanced strongly in past two weeks and bulls may start to lose traction on facing headwinds from 1.30 resistance, as daily studies are overbought, and 14-d momentum indicator is turning south at very high levels in the positive territory.

Markets also await the speech from Fed Chairman Powell, later today, expecting more signals from the central bank about the monetary policy. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD faces strong resistance around 0.6800

Further weakness saw AUD/USD retreat further and add to Monday’s decline in response to the slight advance in the US Dollar and declining prices in the commodity space.

EUR/USD: Sellers lack conviction so far

EUR/USD revisited the sub-1.0900 region before regaining balance and close Tuesday’s session with marginal gains amidst some loss of momentum in the Greenback and rising bets of an interest rate cut by the Fed in September.

Gold reaches fresh record highs above $2,460

Following a short-lasting correction in the early American session, Gold gathers bullish momentum and trades a new all-time high above $2,450. The benchmark 10-year US Treasury bond yield stays in the red near 4.2%, fuelling XAU/USD's rally.

Meme coins rally amidst Ethereum ETF approval hype, PEPE extends gains by 10%

PEPE, a meme coin built on Ethereum, and based on a popular frog-themed meme has rallied in double digits on Tuesday. As crypto market participants await the Securities & Exchange Commission’s approval of a Spot Ethereum ETF, meme coins have started recovering from their decline in the first week of July.

Despite upside surprise, Retail Sales show lost momentum

Despite lower sales at autos dealers and at gas stations, retail spending held steady in June. Excluding those categories, it was the best month since January 2023, and that means upside risk for Q2 consumer spending.