Pound Sterling Price News and Forecast: GBP/USD gains momentum around 1.2688 amid the weaker USD on Thursday

GBP/USD extends its upside above 1.2680 on weaker US Dollar

The GBP/USD pair extends its upside near 1.2688 on Thursday during the early Asian session. The uptick of the major pair is supported by the weaker Greenback after the release of softer US CPI inflation data. Later in the day, the US Building Permits, Housing Starts, the weekly Initial Jobless Claims, the Philly Fed Manufacturing Index, and Industrial Production will be released. Also, the Federal Reserve’s (Fed) Barr, Harker, Mester, and Bostic are set to speak on Thursday.

Inflation in the United States eased slightly in April. The Consumer Price Index (CPI) rose 3.4% on a yearly basis in April, compared to an increase of 3.5% in March, according to the US Bureau of Labor Statistics (BLS) on Wednesday. The annual core CPI inflation eased to 3.6% YoY in April from 3.8% in the previous reading. Both figures came in line with the estimation. On a monthly basis, the CPI and the core CPI both rose 0.3% MoM in April. The softer inflation data raised the odds for a Federal Reserve (Fed) rate cut in 2024, which drag the US Dollar (USD) lower and create a tailwind for the GBP/USD pair. Read more...

GBP/USD Price Analysis: Peaks at five-week high, fails to challenge 1.2700

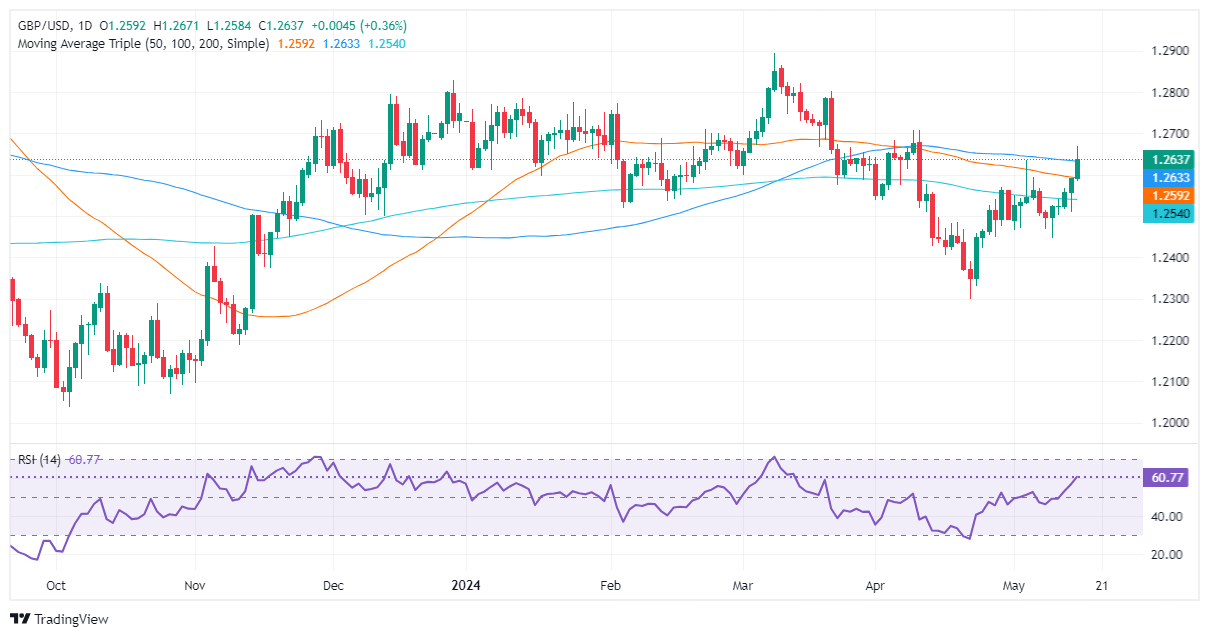

The Pound Sterling advanced some 0.30% and hit a five-week high of 1.2670 following the release of the US Consumer Price Index (CPI). The data was mostly aligned with estimates, showing a continuation of the disinflation process, which weighed on the Greenback. The GBP/USD trades at 1.2641 at the time of writing.

The GBP/USD remains neutral to upward bias and hit a weekly high at 1.2670 following a soft US inflation report. However, the pair has retreated toward the 100-day moving average (DMA) at 1.2632, seen as the next key technical level that, once surpassed, could pave the way for further gains. Read more...

Author

FXStreet Team

FXStreet