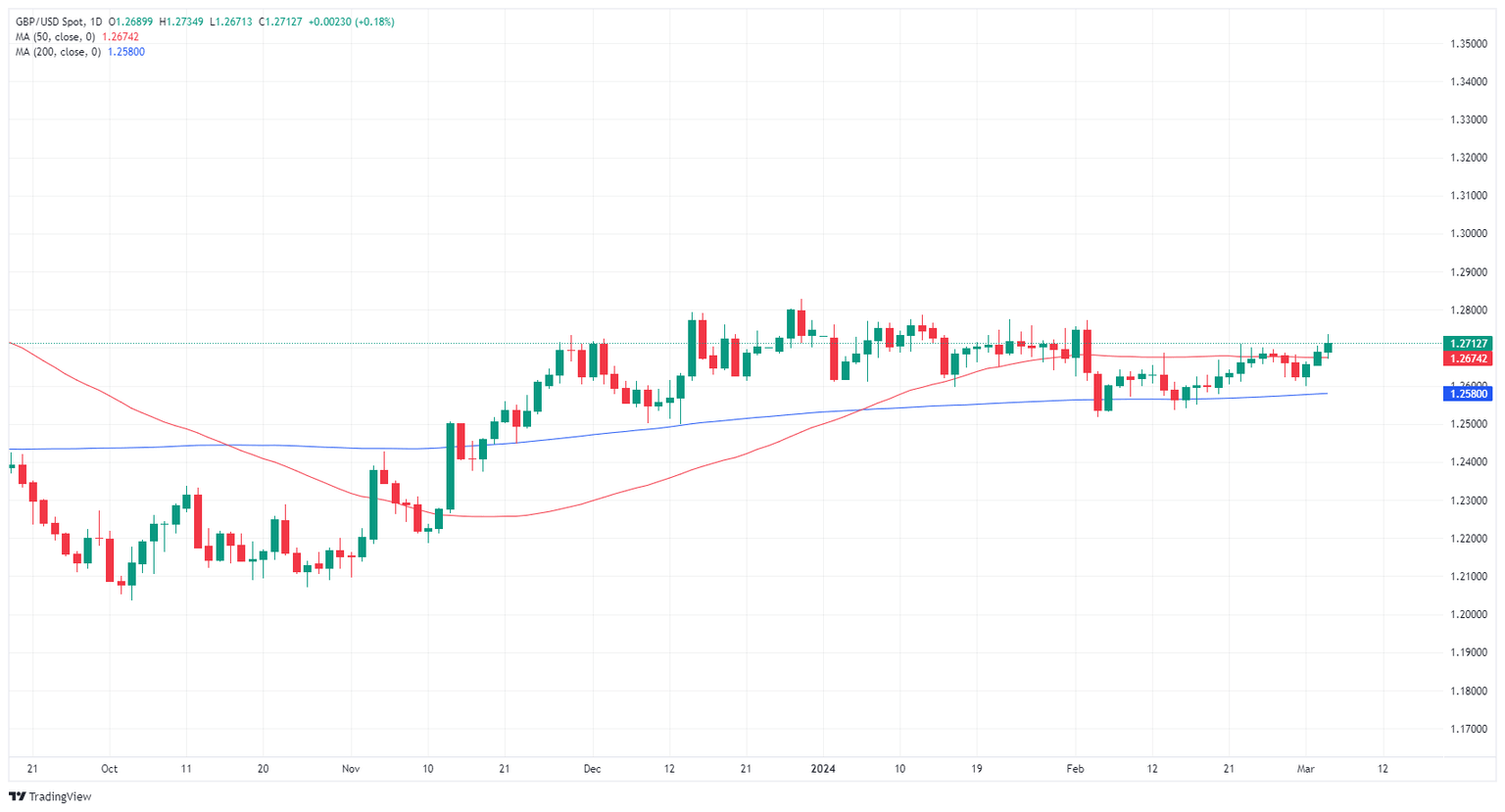

GBP/USD finds higher ground on Tuesday, steps over 1.2700

GBP/USD gained ground on Tuesday, marking in an intraday high of 1.2735 after the US ISM Services Purchasing Managers Index (PMI) and Factory Orders both missed expectations. The

US Dollar (USD) softened on reaction, but market sentiment is hanging in the midrange as markets gear up for two showings from Federal Reserve (Fed)

Chairman Jerome Powell this week.

Read More...

Pound Sterling rises ahead of UK’s Spring budget, Fed Powell's testimony

The Pound Sterling (GBP) advances to the crucial resistance of 1.2700 in Tuesday’s early New York session. The GBP/USD pair gains ahead of the United Kingdom’s Spring budget, to be outlined by Chancellor Jeremy Hunt on Wednesday. The scope of fiscal measures will be a balancing act for Jeremy Hunt as the UK economy faces a stubborn inflation

outlook and deteriorating growth forecasts. “We’ve always said we would only cut taxes in a way that’s responsible and prudent,” Hunt said on Sunday, according to BBC

News.

Read More...

GBP/USD Price Analysis: The potential upside barrier is seen at the 1.2700-1.2710 zone

The GBP/USD pair snaps the two-day winning streak during the early European session on Tuesday. The major pair edges lower amid the modest recovery of the US Dollar (USD). February’s labor market report this week will be a closely watched event. At press time, GBP/USD is trading at 1.2685, down 0.03% on the day.

Read More...

-638452135391948396.png&w=1536&q=95)