GBP/USD Price Analysis: Keeps break of 200-day EMA above 1.2600

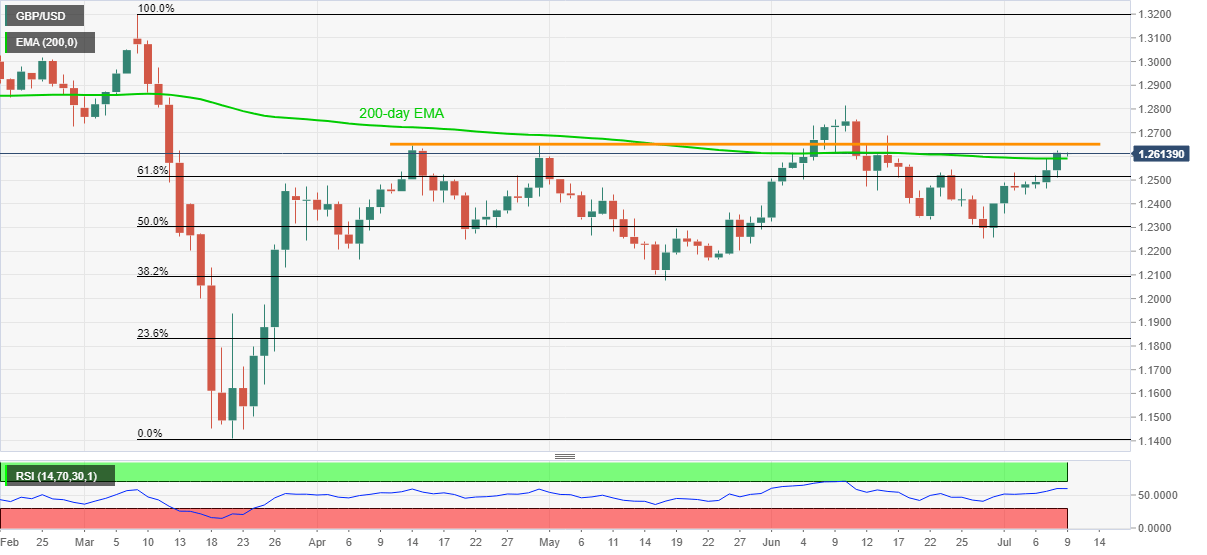

GBP/USD remains on the front foot around 1.2613 during the early Asian session on Thursday. In doing so, the Cable keeps the previous day’s break above 200-day EMA. As a result, the bulls are targeting a horizontal area comprising multiple highs marked since April 14.

Other than the 1.2645/55 immediate resistance region, the early-June top of 1.2730 and 1.2800 round-figure may act as buffers ahead of the June 10 peak of 1.2813.

It’s worth mentioning that the pair’s rise past-1.2813 could aim for 1.3000 psychological magnet before refreshing the yearly top beyond 1.3200. Meanwhile, a daily close below 200-day EMA level of 1.2590 could drag the quote to 61.8% of Fibonacci retracement of March month’s fall near 1.2515.

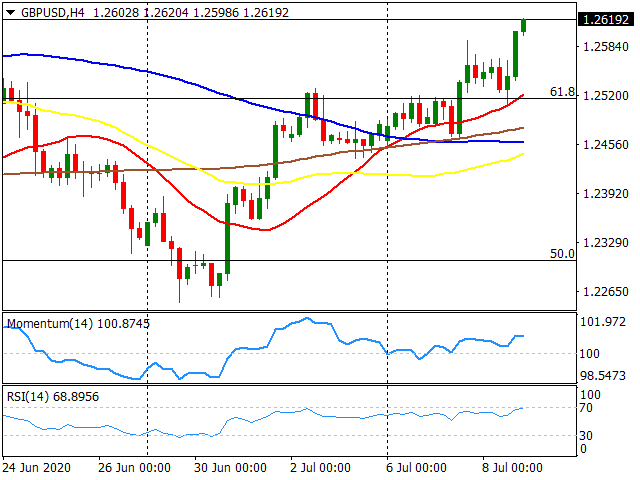

GBP/USD Forecast: Extends gains above 1.2600, ignoring Brexit talks

The GBP/USD pair surged to 1.2591 its highest in four weeks, finishing the US session in the 1.2550 area. The pound surged on the dollar’s broad weakness and despite the lack of progress in Brexit talks. The American dollar, on the other hand, remained on the back foot against most of its major rivals. The UK published Halifax House Prices, which printed at -0.1% in June, better than anticipated. In the Brexit front, UK’s David Frost and EU’s Barnier have resumed trade talks in London. News on that front could be out during the first hours of Asian trading. This Wednesday, the UK will publish the RICS Housing Price Balance for June.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD struggles to lure buyers; focus remains on FOMC meeting

AUD/USD trades with a positive bias for the second straight day, albeit it lacks bullish conviction and remains close to the YTD low touched last week. China's economic woes, US-China trade war fears and the RBA's dovish shift continue to act as a headwind for the Aussie.

Ripple's XRP could rally to $4.75 as RLUSD set to officially launch on Tuesday

Ripple confirmed in a press release on Monday that its RLUSD stablecoin will officially launch on Tuesday across exchanges, including MoonPay, Uphold, CoinMENA, Bitso and ArchaxEx.

USD/JPY drops back below 154.00 ahead of US Retail Sales data

USD/JPY sees fresh selling and gives up 154.00 in the Asian session on Tuesday. The Japanese Yen seems to draw support from Japanese commnetary and a softer risk tone. A broad US Dollar weakness also undermine the pair ahead of the US November Retail Sales report.

Gold price stuck in a range around $2,650 as traders await Fed decision

Gold price extends its sideways consolidative price move during the Asian session on Tuesday as traders await the highly anticipated FOMC policy decision before placing directional bets. In the meantime, bets for a less dovish Fed, elevated US bond yields and a positive risk tone should cap the XAU/USD.

Five fundamentals for the week: Fed dominates the last full and busy trading week of the year Premium

Christmas is coming – but there's a high likelihood of wild price action before the holiday season begins. Central banks take center stage, and there is enough data to keep traders busy outside these critical decisions.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.