Pound Sterling Price News and Forecast: GBP/USD edges lower after China may suspend 125% tariff on US imports

GBP/USD breaks below 1.3300 as US Dollar appreciates on a potential US-China trade deal

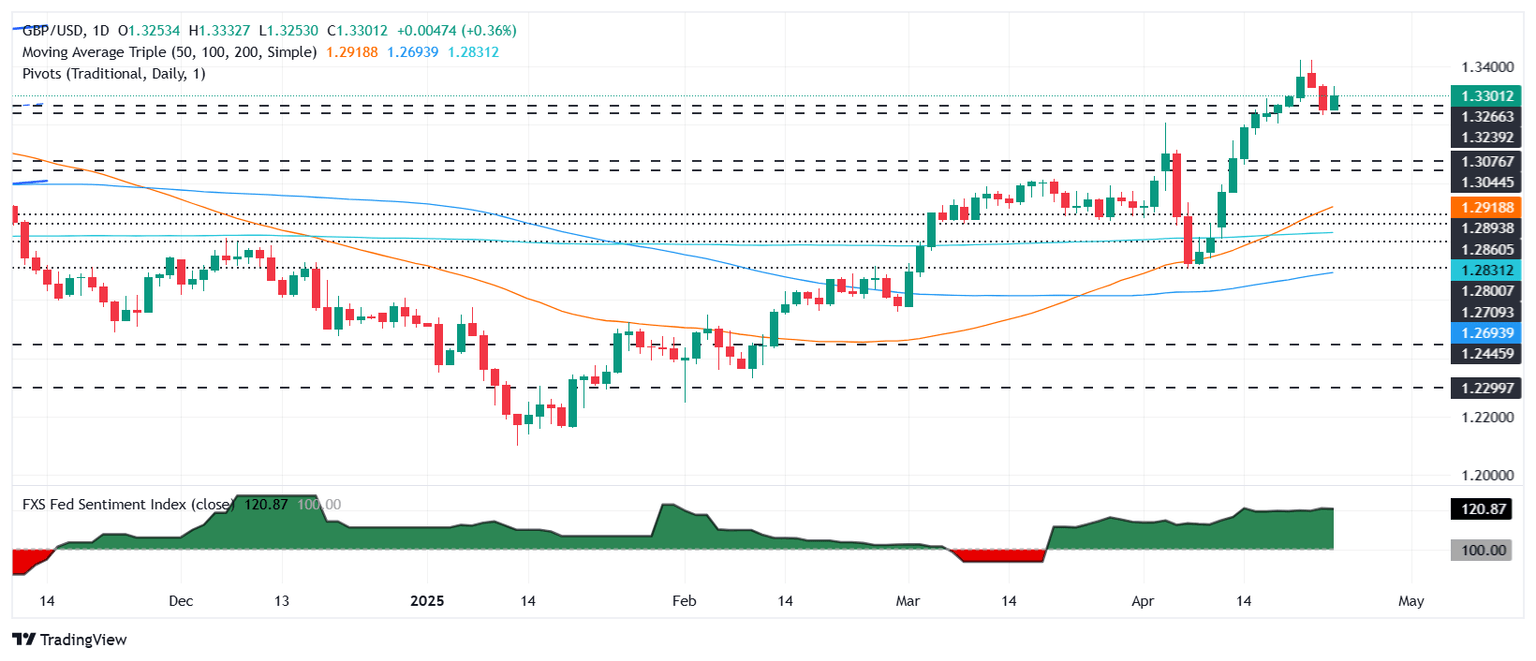

GBP/USD is retracing its recent gains, hovering around 1.3290 during Friday’s Asian session. The pullback comes as the US Dollar (USD) strengthens, bolstered by a Bloomberg report suggesting China may suspend its 125% tariff on select US imports, including medical equipment, ethane, and aircraft leasing.

Sources familiar with the matter noted that officials are particularly evaluating a waiver on tariffs for plane leases. China's Ministry of Finance and the General Administration of Customs have yet to comment. Further supporting the Greenback is optimism surrounding US trade negotiations. Reuters reports progress in preliminary talks with key Asian allies, including South Korea and Japan. Read more...

GBP/USD weakens to near 1.3300 ahead of UK Retail Sales release

The GBP/USD pair attracts some sellers to around 1.3310 during the early Asian session on Friday, pressured by the renewed US Dollar (USD) demand. The UK Retail Sales data for March will be the highlight later on Friday.

The Greenback edges higher amid the optimism about a US trade deal announcement, which acts as a headwind for the major pair for the time being. UK Finance Minister Rachel Reeves said on Thursday she was confident Britain could reach a trade deal with the US. Read more...

GBP/USD rebounds past 1.3300 as US-China tensions rattle US Dollar

The Pound Sterling recovered some ground versus the US Dollar on Thursday as market participants grew pessimistic about de-escalating the US-China trade war. Beijing is pressuring Washington to eliminate tariffs and has denied talks. At the time of writing, the GBP/USD trades above 1.3300 and gains 0.55%.

Price action remains dominated by the Greenback, which tumbled 0.32% as depicted by the US Dollar Index (DXY), which tracks the buck’s performance against a basket of peers. The DXY is at 99.45 after hitting a daily peak of 99.84. Read more...

Author

FXStreet Team

FXStreet