Pound Sterling Price News and Forecast: GBP/USD eases from three-day high

GBP/USD Forecast: British pound could eye 1.3400 as next recovery target

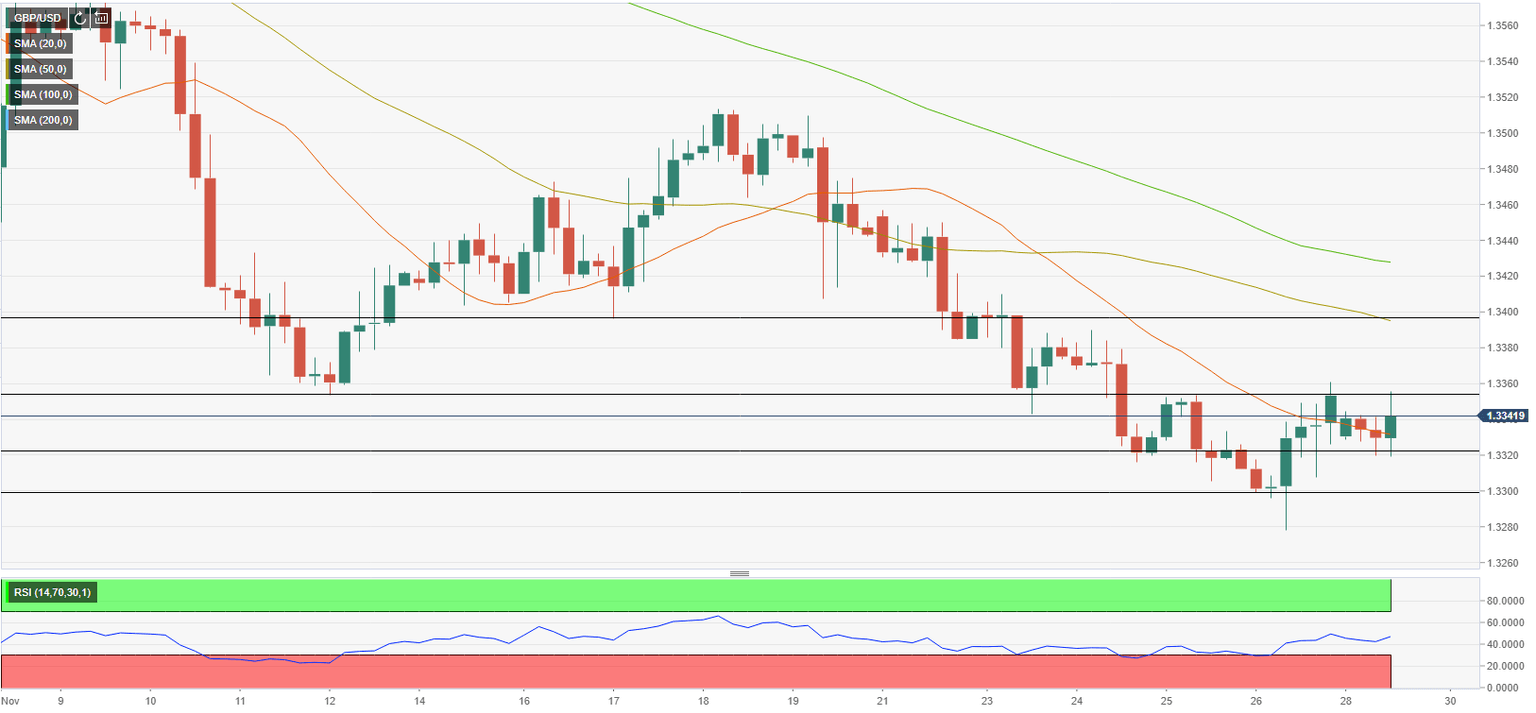

GBP/USD has recovered modestly after dipping below 1.3300 ahead of the weekend and looks to extend its technical correction toward 1.3400.

On Friday, the risk-averse market environment made it difficult for the British pound to find demand. However, the sharp decline witnessed in the US Treasury bond yields weighed on the greenback and helped GBP/USD limit its losses.

Although the dollar is staying resilient against its major rivals at the start of the week, GBP/USD continues to edge higher on improving risk sentiment. Read more...

GBP/USD eases from three-day high, upside remains capped amid Brexit woes

The GBP/USD pair climbed to a three-day high, around the 1.3360-65 region during the mid-European session, albeit lacking follow-through.

The risk-on impulse in the markets failed to assist the safe-haven US dollar to capitalize on its modest intraday gains, rather prompted some selling at higher levels. This, in turn, was seen as a key factor that provided a modest lift to the GBP/USD pair and pushed spot prices further away from the lowest level since December 2020 touched on Friday. Read more...

GBP/USD to climb toward 1.3400 on a break above 1.3360

GBP/USD seems to have set near-term bottom around 1.3300. In the view of FXStret’s Eren Sengezer, the cable could eye 1.3400 as the next recovery target.

UK doesn't think tighter rules will be needed to combat the new coronavirus variant

“On Monday, the junior UK health minister Edward Argar said that they don't expect rules to be tightened further in the next three weeks.” Read more...

Author

FXStreet Team

FXStreet