GBP/USD Price Forecast: Hovers below nine-day EMA near 1.2500

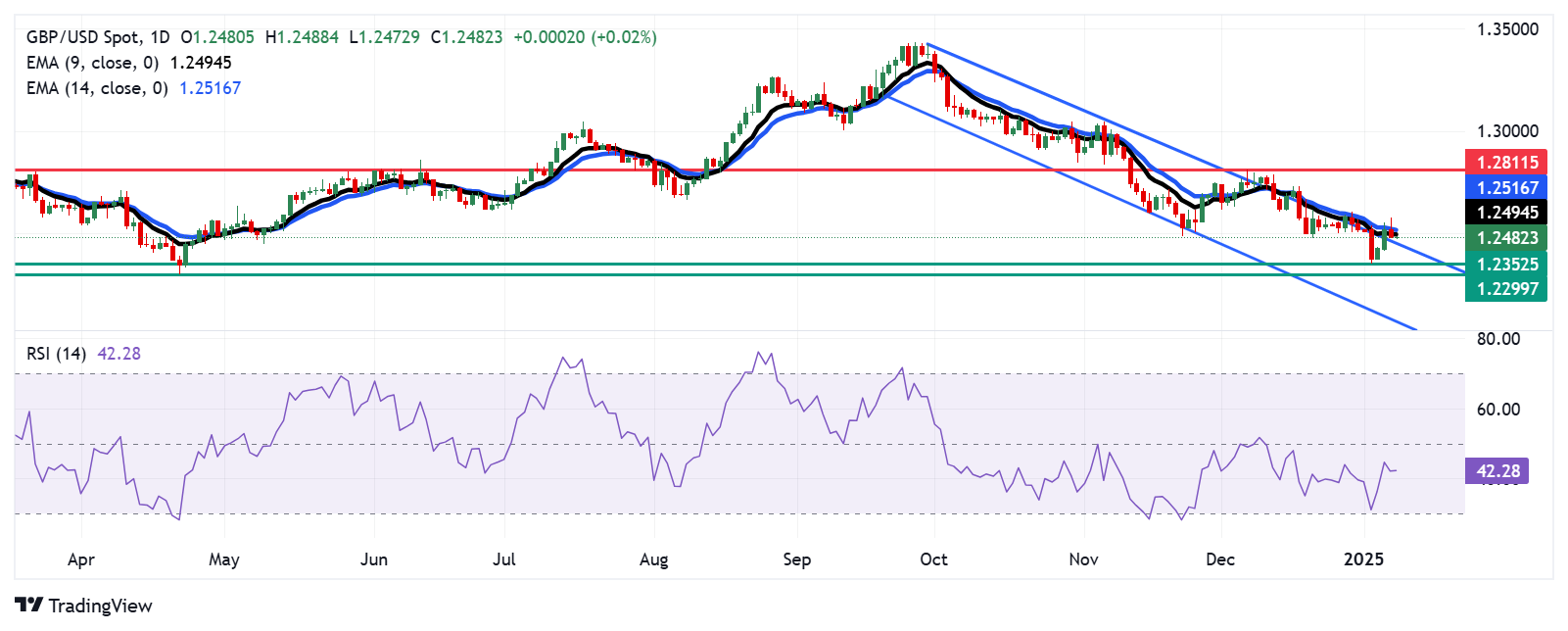

The GBP/USD pair maintains its position after registering losses in the previous session, hovering around 1.2480 during Wednesday's Asian hours. Technical analysis on the daily chart points to a weakening bearish trend, as the pair is trading above the upper boundary of a descending channel pattern.

Despite this, the 14-day Relative Strength Index (RSI) remains below the 50 level, signaling continued bearish pressure. Furthermore, the pair is positioned below both the nine- and 14-day Exponential Moving Averages (EMAs), indicating weak short-term price momentum. A clear breakout above these EMAs could signal a shift from a bearish to a bullish outlook. Read more...

GBP/USD snaps two-day win streak as risk appetite stumbles

GBP/USD caught a mild bid early on Tuesday before turning south once again and shedding roughly one-third of one percent to end the day on the low side of the 1.2500 handle. Cable bidders continue to struggle to find reasons to hit the bids as a technical recovery falters after a tepid two-day bull run from 9-month lows near 1.2350.

It’s been a wobbly start to the new year on the Pound Sterling charts after ending 2024 with a three-month losing streak, and bidding momentum is hobbled near medium-term lows with a light data docket on the cards for Cable traders. UK Like-For-Like Retail Sales surged to 3.1% for the year ended in December, but GBP flows were unable to overcome a fresh bout of risk aversion after US Purchasing Managers Index (PMI) activity and business costs survey results shredded near-term hopes for continued rate cuts from the Federal Reserve (Fed) in early 2025. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD loses momentum to near 1.0300 ahead of Eurozone Retail Sales release

The EUR/USD pair trades in negative territory for the third consecutive day around 1.0310 during the early European session on Thursday. The downbeat German November Factory Orders and the expectation of aggressive rate cuts by the European Central Bank this year weigh on the Euro against the Greenback.

GBP/USD trades near 1.2350 after rebounding from nine-month lows

The GBP/USD pair remains under pressure for the third consecutive session, hovering near 1.2360 during Thursday's Asian trading hours. Technical analysis of the daily chart highlights a prevailing bearish bias, with the pair falling back to the descending channel pattern.

Gold price sticks to modest intraday losses amid bullish USD; downside seems limited

Gold price snaps a two-day winning to a multi-week top amid the Fed’s hawkish stance. Retreating US bond yields undermine the USD and lend some support to the XAU/USD pair. Traders look to Fed speakers for some impetus ahead of the US NFP report on Friday.

BNB poised for a decline on negative Funding Rate

BNB price hovers around $696.40 on Thursday after declining 4.58% in the previous two days. BNB’s momentum indicators hint for a further decline as its Relative Strength Index and Moving Average Convergence Divergence show bearish signals.

Bitcoin edges below $96,000, wiping over leveraged traders

Bitcoin's price continues to edge lower, trading below the $96,000 level on Wednesday after declining more than 5% the previous day. The recent price decline has triggered a wave of liquidations across the crypto market, resulting in $694.11 million in total liquidations in the last 24 hours.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.